Mickey Mouse

Intern

- Joined

- May 2, 2023

- Posts

- 95

According to the ATO, paying $0 on over $9 billion of income.

AFF Supporters can remove this and all advertisements

Just because they had income, doesn't mean they were making a taxable profit.

There's a difference between 'income' and 'making money'The topic of the thread is the words of Joyce:

"As we're making money, we'll pay corporate tax"

Not

"As we're making money, we'll avoid corporate tax"

(Please don't get hung up on the use of the word "avoid". Reactions to it demonstrate where people sit on greed vs morality.)

You're right! If you're not making money then you cant fund share buy backs...There's a difference between 'income' and 'making money'

Do you have a source to the quote attributed to Uncle Alan?According to the ATO, paying $0 on over $9 billion of income.

You're right! If you're not making money then you cant fund share buy backs...

Post automatically merged:

I wonder how many billions (above ten) in income is required to start "making money"?

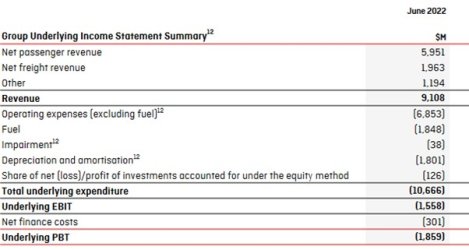

I just realised you're looking at the 2021/22 figures. I think anyone who has been alive and watched any bit of news would realise that the period July 2021 to June 2022 would be difficult for an airline. You will be sorely disappointed when they carry forward losses and don't pay tax in 2022/23 as although they made significant profit, I'm pretty sure recalling that they will have significant losses from the previous two years to offset that profit.The topic of the thread is the words of Joyce:

"As we're making money, we'll pay corporate tax"

From Qantas Group FY22 Appendix 4E and Preliminary Final Report:were they doing a buyback during 2021-2022?

The topic of the thread is the words of Joyce:

"As we're making money, we'll pay corporate tax"

Not

"As we're making money, we'll avoid corporate tax"

(Please don't get hung up on the use of the word "avoid". Reactions to it demonstrate where people sit on greed vs morality.)

I get the feeling the Team members here really need to visit a pub occasionally!The resident Qantas PR Team doesn’t make an ethical distinction but will claim unbiased, analytical presentation of “facts”.

From Qantas Group FY22 Appendix 4E and Preliminary Final Report:

"

No dividend will be paid in relation to the year ended 30 June 2022.

In August 2022, the Directors announced an on-market share buy-back of up to $400 million.

"

True, but I recall a certain female Labor Finance Minister whose name I can’t recall stated that was the case….No business pays tax based on income, though I'm sure many a government would like to institute it. The issue is that business has become so good at hiding any profit.