- Joined

- Nov 12, 2012

- Posts

- 31,128

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

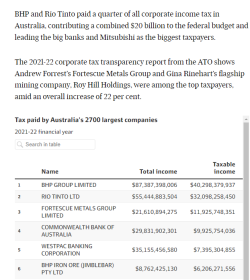

According to the ATO, paying $0 on over $9 billion of income.

As much as I dislike this mob, that's fair enough.

As others have said, they pay tax on that part of the profit which is taxable, (nothing to do with income) under the ATO rules (which are about an encyclopedia in size if printed out). BUT - if a company makes a loss in any year, or consecutive years, rather than the tax-man paying it 'negative tax', the company 'stores it' - called accumulated losses. When the company returns to taxable profit, it can off-set the accumulated loss against it. When the accumulated loss is exhausted (may take some years), and if the company is still making a taxable profit, it then re-commences to pay tax on it (subject to any other lurks - Kerry Packer refers).

The reason Qantas instigated a buy-back rather than pay dividends was, as well as the intention to increase the share price (this didn't work, of course - exactly the reverse), because the dividends would have been unfranked in the hands of shareholders (as the company hadn't paid tax, due to the accumulated losses) and therefore the dividends would have been subject to tax in the shareholders' hands. Of course why the company didn't retain the profit to go to capex and reduce debt, probably goes to the increasing share price thing