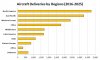

In an industry mag today they published a shocking chart.

Shocking in as much as it shows that going forward the Middle Eastern airlines influence is expected to wane. Perhaps that is why the A380 stretch/NEO discussions were suspended and talks with major US airlines seem to have been significantly ramped up.

There has been a lot of US vs Middle East arguing over whether the MEs are subsidised or not. In the last ten months or so it really seems to have dissipated. I won't speculate on why *that could be a whole series of threads on its own).

What is interesting, to me, at least is how North America is now expecting as many deliveries as China and the ME combined.

Will this be a case of "The Empire fights back"?

Possibly due to the parlous state of US carriers since 2007 which saw many cancel/abandon their options for new aircraft while some carriers/lessors went out of business.

The outcome, as the graph implies, is that they have a very large in-service fleet that is getting very old and would be maintenance heavy. A bit like Q had been with its slew of 20+ year old 747s and 767s not long ago.

A potential 'fly-in-the ointment' is that the most profitable routes for major airlines were those paired with LHR. If BREXIT (who knows) sees financial institutions shift from London to FRA (for example) then all of a sudden the aircraft required can change. Now that really can muck up your fleet planning.

A major financial report on the large international airlines (done in 2003/4) estimated that the profit from the LHR pairs due to bankers, fund managers, merchant bankers flying J or F at full fare was at times 80% or more (in one case they estimated 120%) of airline net profit.

Shocking in as much as it shows that going forward the Middle Eastern airlines influence is expected to wane. Perhaps that is why the A380 stretch/NEO discussions were suspended and talks with major US airlines seem to have been significantly ramped up.

There has been a lot of US vs Middle East arguing over whether the MEs are subsidised or not. In the last ten months or so it really seems to have dissipated. I won't speculate on why *that could be a whole series of threads on its own).

What is interesting, to me, at least is how North America is now expecting as many deliveries as China and the ME combined.

Will this be a case of "The Empire fights back"?

Possibly due to the parlous state of US carriers since 2007 which saw many cancel/abandon their options for new aircraft while some carriers/lessors went out of business.

The outcome, as the graph implies, is that they have a very large in-service fleet that is getting very old and would be maintenance heavy. A bit like Q had been with its slew of 20+ year old 747s and 767s not long ago.

A potential 'fly-in-the ointment' is that the most profitable routes for major airlines were those paired with LHR. If BREXIT (who knows) sees financial institutions shift from London to FRA (for example) then all of a sudden the aircraft required can change. Now that really can muck up your fleet planning.

A major financial report on the large international airlines (done in 2003/4) estimated that the profit from the LHR pairs due to bankers, fund managers, merchant bankers flying J or F at full fare was at times 80% or more (in one case they estimated 120%) of airline net profit.