tykissy

Junior Member

- Joined

- May 25, 2007

- Posts

- 28

Yes

Yes that’s a timely reminder, thank you…

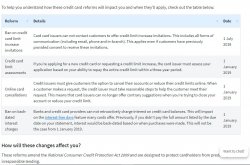

Interesting outcome from consumer protection law changes - I doubt these consequences were deliberate. One matter to be aware of when considering cancelling a card is that you may loose any accumulated points unless you can transfer them into the target airline program. BTW has anyone posted here about which airlines have expiry dates on points in their FF programs? I have been reluctant to transfer credit card points into FF programs because of the risk of expiry but if they no longer expire, I may as well do the transfers. Ta, Peter.

Yes that’s a timely reminder, thank you…