Thanks for starting the thread

@ksthommo, have been waiting for this offer to come up again and share with others.

I'm also glad to

refer other members of AFF for what is probably my favourite amex. After signing up using a referral link ourselves late last year, Mrs Excel and I have now held this card four times between us. For ongoing spend and the sheer quantity of points from the sign up bonus, it's a fantastic way to get a chunk closer to the redemption you have in mind!

As others have mentioned, you'll earn

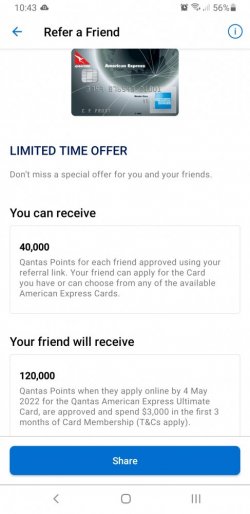

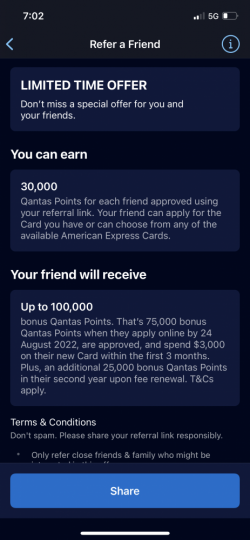

110,000 qantas points when you spend $3,000 in the first 3 months when

using a referral link. The bonus for the referrer has grown to 40k, so you'll be generously helping us (or another AFF'er whose link you choose) to get closer to a redemption target as well (rather than sending commission to a third party site).

110k is about as high as the referral bonus on this card gets (there have been 120k offers, and cashback offers in the past) but given the expiry of this offer is

9 March 2022 it may be one of the biggest referral offers you'll see over the next month or so.

This card has a large $450 annual fee, but this is offset by a $450 qantas travel credit and regular Amex cashback promotions. Be sure to subscribe to the

amex statement credits thread here on AFF for discussion of these opportunities.

You'll also get two entries to the international amex lounge in either sydney or melbourne, a complimentary qantas wine membership, and two qantas lounge passes

after your first spend on air travel with Qantas (eg flights, domestic or ex-AU flight redemptions, etc).

Some other important notes/tips:

- The card has a $65,000 minimum income and $3,000 minimum credit limit. In recent experience, the selection of a limit is towards the end of your application, after the credit check is done. Note that the limit of your account is shared with credit reporting bodies once the account is open.

- As always, you need to have not held an amex in the last 18 months to be eligible for the bonus.

- The card has a 44 day interest free period. Paying off the balance in full each will help you to avoid the high interest rate that is common to awards cards.

- In my experience, Amex usually award bonus points as soon as you hit the spend criteria, even in the first month. If you are aiming to time your bonus to hit points club or points club plus in a particular membership month, keep this in mind.

- Amex regularly offer bonus points for adding supplementary/additional cardholders (eg. for your spouse). It could be worth holding off for one of these if you're going to apply for a bonus points for a family member.

- In the past, Qantas have offered extra bonus points for people who haven't held a points-earning-card in a certain period of time. It's worth checking their cards website to see if there's a current offer, as you could end up with tens of thousands of new points, even if applying for the card via a referral link.

Mrs Excel and I have held this card four times between us, and signed up using a referral link late last year. We'd be tremendously grateful if anyone

used our referral link and helped us towards escaping fortress WA when the time comes! If our link becomes maxxed out (Amex awards a maximum of 200k points to referrers each year - but we haven't had any referrals yet at the time of posting), we'll ask a mod to remove it to ensure the points are not wasted!