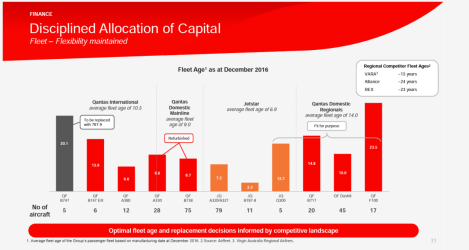

I don't dispute the calculations, other than presumably in a mature market, Qantas would be targeting 3-5% annual capacity growth.So by 2029 QF could have retired 40% of the 737 fleet (pretty much all the 2002-2006 deliveries), all the 717 fleet and got a big uplift in J seats

I agree with you - but you will notice that even many mid-size airlines smoothen their deliveries across a longer period of time for this reason. And ordinarily, the small-mid airlines usually have these 'lumps' to coincide with new aircraft that provide a step-change in economics. The 77W in 2005, 787 in 2011, A321neo in 2016 being good examples. Qantas has eschewed this.Works best in super large airlines (like the US ones) who are continually replacing all types of aircraft.

And also in airlines with single fleet types (like most of the LCCs).

It has its failings in small-mid carriers who will purchase fleet in lumps so they have a sufficient mass of aircraft of similar specs.

Other measures you could look at is $ Capex per year to depreciation (adjusting both for leases)

The capex per year to depreciation is an interesting one. Especially so in QF's case given the very large write downs they did in 2014 and then during covid.

For the purposes of this discussion, I think we're really talking about the 737 and the A330 at the core, with smaller fleets like the 717 and Q400 on the periphery. It's arguable that QF already has the replacement to the A380 in the A350-1000.If you are measuring this to determine future spend on replacement, that won't work either as the cost of replacing a fleet of Dash 8s will be much cheaper than replacing a fleet of 787s, and yet we've recorded the old Dash 8s on an equal weighting with the new 787s.