SeatBackForward

Senior Member

- Joined

- Jun 20, 2006

- Posts

- 5,567

- Qantas

- LT Gold

- Oneworld

- Emerald

Post automatically merged:

Full suite of announcements are available from here: Qantas Investors | Investor Centre

Qantas Loyalty

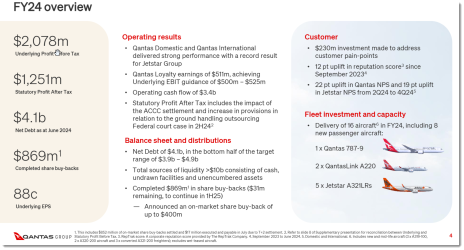

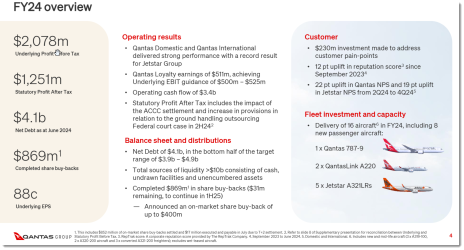

Qantas Loyalty continued to perform strongly in FY24 with a record Underlying EBIT of $511 million as it delivered major program improvements for members.

A record number of points were earned and redeemed across the year, including a record number of reward seats booked, and there was a 14 per cent increase in the number of active members compared to the previous year.

The introduction of a new flight redemption product, Classic Plus Flight Rewards, was one of the biggest expansions of the Qantas Frequent Flyer program in its history, unlocking more redemption opportunities to drive program engagement. Classic Plus was launched on international flights in April 2024 and once rolled out on the Qantas domestic network by the end of calendar year 2024, members will have had access to more than 20 million reward seats.

Qantas Loyalty continued its expansion into holiday packages by purchasing the remaining stake in online travel business TripADeal. The acquisition will drive value in the Group by combining Qantas and Jetstar’s extensive network with the growing curated tour market, as well as benefitting members. The total transaction value of TripADeal bookings has increased four-fold since 2022.

The program continues to see growth in white-label insurance and home loan products and reached more than 800 coalition partners including major new partnerships with Ticketek and Accent Group.

When you get to control both sides of a quasi-currency, how could it not be profitable?Qantas loyalty is very profitable !

I know your question is rhetorical, but it's by devaluing the program in a way that makes it unappealing for members to be retained. Lots of 'sky is falling' comments in the CR+ thread about how CR+ was going to be the thing that broke QFF. Clearly the opposite, but I'm still surprised by how strong some of those metrics are.When you get to control both sides of a quasi-currency, how could it not be profitable?

What QF have done very well is to promote the idea that by earning QFF points from everyday spend you'll get to convert them into luxurious holidays. So your average QFF member (as opposed to the like who research and participate on AFF etc) is going to look at whatever option is put forward to them to convert the points they've earnt. Have 200k points from your credit card and grocery spend over the past few years? sure use Points and Pay on a J ticket, because it feels like you're being rewarded.I know your question is rhetorical, but it's by devaluing the program in a way that makes it unappealing for members to be retained. Lots of 'sky is falling' comments in the CR+ thread about how CR+ was going to be the thing that broke QFF. Clearly the opposite, but I'm still surprised by how strong some of those metrics are.

CR+ considerations won't affect QF loyalty balance books for a few years to come. This is sort of a medium term effect (2-5years) rather than anything short term. People still have banks of points and still need to use them. There's still lots of social media talking about reward flights.I know your question is rhetorical, but it's by devaluing the program in a way that makes it unappealing for members to be retained. Lots of 'sky is falling' comments in the CR+ thread about how CR+ was going to be the thing that broke QFF. Clearly the opposite, but I'm still surprised by how strong some of those metrics are.

I completely disagree. It's already contributing to a flywheel effect.CR+ considerations won't affect QF loyalty balance books for a few years to come

Was vitally necessary to shore up the future.Reduced profit from freight, so all that conversion of passenger capacity to freight looks like it has been a waste of capital and lost opportunity for revenue.

When you get to control both sides of a quasi-currency, how could it not be profitable?

All part of their master strategy to break the shackles of the airline game and become the Qantas Frequent Flyer Bank in the financial sector.Unsurprisingly no new major capital investments announced

AFF Supporters can remove this and all advertisements

+1What QF needs is some decent competition.

QFd for Golden Triangle only. JQ for everything else

and room for both QFi and JQ eg HNL, DPS etcQF already farmed off every route it could to JQ. Some have come back. The ones left are the ones that work for mainline.