I haven't had a chance to read all the results because I was genuinely blown away by the fact that Qantas is offering all cabin crew working under QCCA, direct employment under Qantas, along with big pay rises to cabin crew that work for QD/QCCA/MAM/Altara.

The QF wages gap is $60 million pa

https://investor.qantas.com/DownloadFile.axd?file=/Report/ComNews/20240829/02845250.pdf

That’s how much less they were paying at least short haul cabin crew

And more to come with QFi & JQ forced to the table too

As well

Here’s the key points

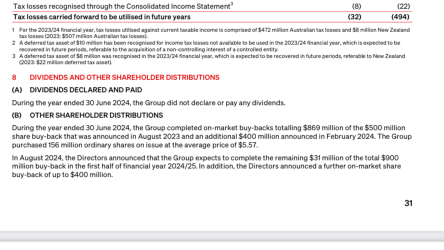

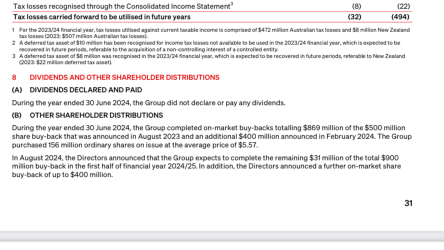

Tax losses are nearly exhausted. Churn this amount of revenue and you’ll be paying income tax

Currently no dividends (taxed as income) but plenty of share buybacks (taxed as capital gains so 50% discounts etc)

RRIA

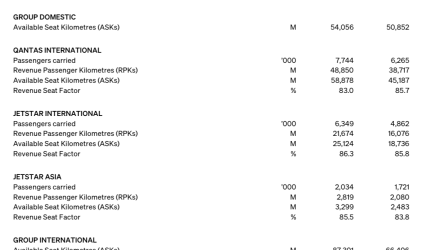

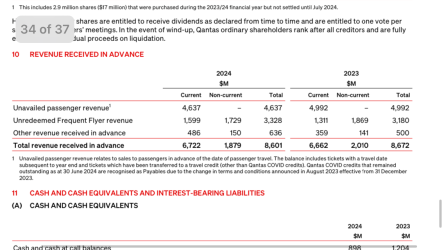

Well this looks complicated but is hiding two problems in plain sight

1. Current FF Revenue continues to blow higher - the positive is the non-current liability has been cutback

What they describe as member engagement might well be people cashing in their long terms points earns for CR or CR+ and making a bolt for the exit door

And then there was the COVID credits

AND the Customer Remediation project

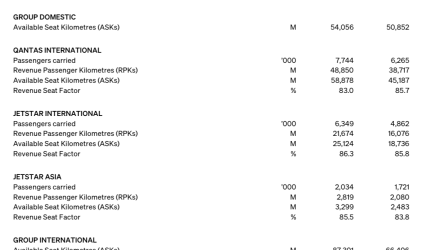

2. Forward PAX revenue is $300 million LESS than the same time last year - QF Dom hardly scored a PAX uplift (3.5%) and forward projections suggest a 2% lower PAX Volumes

QFi can’t keep charging those 2023 Rugby

World Cup fares so while PAX international volumes are actually buoyant the overall “money in the door” isn’t.