- Joined

- Oct 4, 2013

- Posts

- 960

- Qantas

- Silver Club

I doubt it (nor would others) because they’re still on the hook to cover us if we get back alive.

So long as you're conscious within a month of return!Qantas Health said:To resume the Policy Holder will need to call Us within one month of the date of return to Australia.

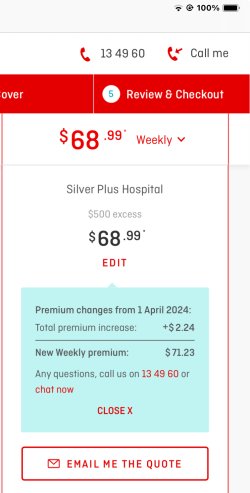

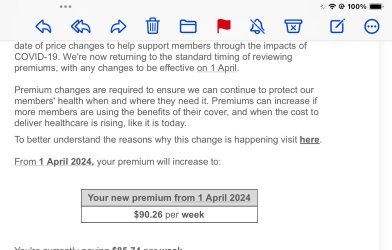

In the case of an overseas travel suspension, resumption of your Policy will be backdated to the date of return to Australia, with the applicable arrears requiring payment.