SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 13,935

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

That’s not quite right either. If you look closely, where the Sale fares are selling out you can still get CR+ at the ”Saver” fare bucket and there’s a lot more of those seats which obfuscates how many CR+ are being bought. I’d imagine a lot More than you might think.It's relatively easy to understand.

When an airline has a sale on cash fares, the cheapest sale fares often completely sell out, and very quickly on popular dates.

What Qantas has done with CR+ is to allow you to purchase airfares from the cheapest buckets using points. They have not sold out, pretty much on any route for any period despite being available for many weeks now.

Imagine, hypothetically, that Qantas set the CR+ redemption levels at 2c/pt for Y and 4c/pt for J. Do you think we'd have any CR+ fare buckets left? No — they would have gone in minutes.

The market has spoken. They are not buying at this price, at least in any significant quantities.

That suggests we're back at square one — everyone is still chasing the elusive classic awards and frustration with the system will continue to grow.

Another way to put it. Qantas allows you to buy any seat with P+P. Did that reduce the frustration with the Qantas points ecosystem? Not one bit.

C+ may be going down the same path.

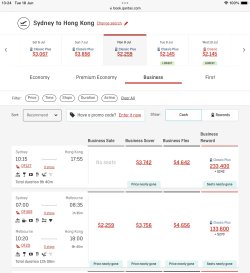

For example, random date. SYD-HKG direct, Sale fare exhausted but CR+ still available for ”Saver” J. But Sale fare via MEL still available, along with cheaper CR+.