BelindaJK101

Junior Member

- Joined

- Jun 25, 2023

- Posts

- 14

Hi  can anyone recommend some good policies that cover ‘reconsider your need to travel’ areas for long trips (like months?) Thanks

can anyone recommend some good policies that cover ‘reconsider your need to travel’ areas for long trips (like months?) Thanks

Is 'months' more than two? If so then your main issue will be to get a travel insurance policy, (which is what I think you are asking about) to cover more than 60 days.Hican anyone recommend some good policies that cover ‘reconsider your need to travel’ areas for long trips (like months?) Thanks

Any insurer will cover longer trips, out to 365 days plus.Is 'months' more than two? If so then your main issue will be to get a travel insurance policy, (which is what I think you are asking about) to cover more than 60 days.

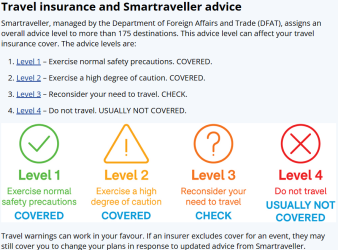

I don’t think most policies have a prohibition on 'reconsider your need to travel' but certainly do for 'do not travel'.

They will issue a yearly policy, but I’ve often seen restrictions on individual trips more than 60 days. But you’ve seen full year away from Home policies?Any insurer will cover longer trips, out to 365 days plus.

As I say, single trip policies are the default for most and probably account for 80-90% if policies issued. You can insure any length of trip.They will issue a yearly policy, but I’ve often seen restrictions on individual trips more than 60 days. But you’ve seen full year away from Home policies?

Together with what @Happy Dude wrote, I've learned something, so thanks.You can insure any length of trip.

In fact, there is no insurer I’m aware of that doesn’t issue single trip insurance, while many do not sell annual cover.

Thanks @RooFlyer quite a few I’ve come across cover for 6 months. It’s for our son’s gap year tripIs 'months' more than two? If so then your main issue will be to get a travel insurance policy, (which is what I think you are asking about) to cover more than 60 days.

I don’t think most policies have a prohibition on 'reconsider your need to travel' but certainly do for 'do not travel'.

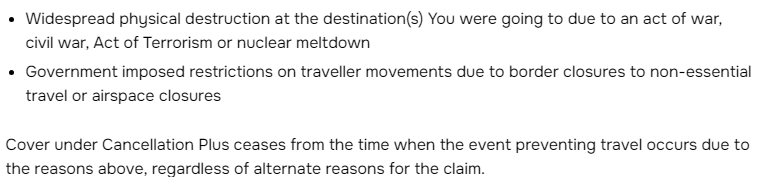

Huh? If a policy doesn't cover "reconsider your need to travel" it won't matter when you bought it. It'll be the classification when you enter the country that matters most regarding coverage.You need to read the PDS as some policies will not cover you if taken out after an area is designated reconsider your need to travel by government.

Huh? If a policy doesn't cover "reconsider your need to travel" it won't matter when you bought it. It'll be the classification when you enter the country that matters most regarding coverage.

I wasn’t aware policies excluded ‘reconsider your need to travel’? I thought it was only ‘don not travel’?

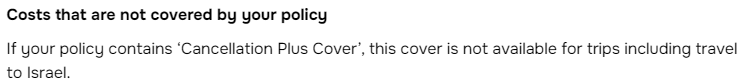

Yes Amex is a good example, SCTI and Covermore are others, but each policy is different (and sometimes even different for different destinations with the same warning) so pays to read through all criteria before deciding where to go.The way I read the QF Amex policy is they do cover reconsider, but they will cover cancellation for reconsider and do not travel if declared after you purchase, with a set of caveats.

AFF Supporters can remove this and all advertisements

Did any not, however?AFF looked into the conditions of various travel insurance policies in 2021. The context was looking into which insurers covered COVID-19, and things may have changed since then, but our research at the time found that Cover-More, Medibank and Qantas covered "reconsider your need to travel" destinations.

International COVID-19 Travel Insurance Guide for Australians

There's a growing number of international travel insurance options for Australians. Photo: Nils Nedel on Unsplash. Given the risks involved withwww.australianfrequentflyer.com.au