Firstly before you apply via the AMEX GT route you need to have a U.S. phone number and address set up if you have not already done so. Easiest thing to do is if you have any friends or relatives living in the U.S. use their address, otherwise open a MyUS account to get a address that way. YMMV if your card seamlessly gets delivered to your MyUS account, sometimes it may get lost especially if you go for the lower tier cards, so you may need to provide tracking details to them so they can find your package, or just wait 10 days and get AMEX to send the card directly to you in Australia.Hi all.

Avid wanna-be 'travel hacker' here from Newcastle.

I run Ecommerce businesses and I've had Amex Platinum Charge Card for 2 years & Amex Platinum Reserve Credit Card for 1 year, and only recently ventured into the world of hotel/airline status & loyalty programs since travel has started opening up again. I read about 15 pages back in this insanely long thread but thought I'd just make this post asking for some help from a newbies perspective about the US Amex cards because it would help out other possibly overwhelmed people in a similar position to me to compile a summary of strategies now after these 183 pages.

I have Gold Hilton status and Gold Marriott status (both complimentary with the personal Amex Platinum Charge Card) & I see that Amex offers in the US several Hilton Amex and Marriott Amex hotel branded credit cards (Aspire, Surpass, Bevy, Brilliant) with awesome point sign up bonuses which I want to take advantage of to get a nice 1-2 weeks of free hotel stay. I understand that these offers are "available to US Residents" as in Terms & Conditions, but how do us Aussies living in Australia go about getting these cards?

Cheers,

Tim

P.S. I greatly, greatly appreciate any help offered

You can get a phone number using free TextNow but you gotta use it every couple of weeks or you lose your number, or you can just pay the annual fee.

The next tricky part is verifying your address, which usually requires a 3 way chat with AMEX and a local U.S. bank if you have an existing checking account with them. If you don't you may need to upload some other statement proving your address. I think citibank AU allows you to update to a U.S residential address.

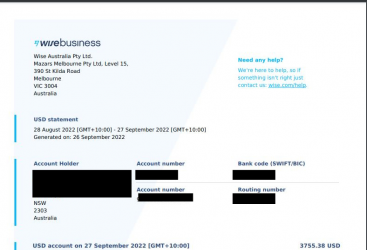

Besides you passport, this is what is minimum required to start your US AMEX journey...