You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Strategy to obtain US Amex

- Thread starter ithongy

- Start date

- Featured

It’s a very good option for US Amex holders and even better for UK Amex holders to convert their MR points to AU Amex MR. They’ll get a nice big boost and then can transfer them to Krisflyer at 1:1, at least until April. For us to benefit, we’ll have to find a country with a coughper currency but still 1:1 transfer rates.

I managed to get a USA SPG Amex, calling the global transfer line to get it approved after applying online.

On my next trip to the USA, I will try and get a credit card with BOA or Citibank or both.

When you do the global transfer, can you request for any card that offering in US? Or only limited number of cards you can choose from? Or there are any requirements to meet for certain cards? Thanks

You can apply for any card, as long as you meet the requirements for it.

Do u mean the income requirements? Seems US AMEX don’t publish the requirements on this. Or I may missed sth.

got it, thanksYeah income and credit rating.

For global transfer, they should look at your account history in the other country for the first card.

ithongy

Member

- Joined

- Mar 3, 2009

- Posts

- 264

It depends on $USD/£GBP is against $AUD. As of 23/11/2018 AUS$1 = USD$0.72 = GBP£0.56. Depending what Amex cards you hold in Australia, I believe Australia MR points are still the way to go uptill April 2019.

In the past AU MR converts 2:1 SPG points where as USA MR converts 3:1

USD$1 gets 1x MR points requires USD$60k spend to convert to 20K SPG points

AUD$1 gets 1X MR points requires AUD$40k spend to convert to 20K SPG points

USD$1 gets 2X MR points requires USD$30k spend to convert to 20K SPG points

AUD$1 gets 2X MR points requires AUD$40k spend to convert to 20K SPG points

USD$1 gets 3MR points requires USD$20k spend to convert to 20K SPG points

AUD$1 gets 3MR points requires AUD$13,333 spend to convert to 20K SPG points.

So think about exchange rates as well & multipliers on Amex cards to converts to Airlines or hotel points.

In the past AU MR converts 2:1 SPG points where as USA MR converts 3:1

USD$1 gets 1x MR points requires USD$60k spend to convert to 20K SPG points

AUD$1 gets 1X MR points requires AUD$40k spend to convert to 20K SPG points

USD$1 gets 2X MR points requires USD$30k spend to convert to 20K SPG points

AUD$1 gets 2X MR points requires AUD$40k spend to convert to 20K SPG points

USD$1 gets 3MR points requires USD$20k spend to convert to 20K SPG points

AUD$1 gets 3MR points requires AUD$13,333 spend to convert to 20K SPG points.

So think about exchange rates as well & multipliers on Amex cards to converts to Airlines or hotel points.

It’s a very good option for US Amex holders and even better for UK Amex holders to convert their MR points to AU Amex MR. They’ll get a nice big boost and then can transfer them to Krisflyer at 1:1, at least until April. For us to benefit, we’ll have to find a country with a coughper currency but still 1:1 transfer rates.

I managed to get a USA SPG Amex, calling the global transfer line to get it approved after applying online.

On my next trip to the USA, I will try and get a credit card with BOA or Citibank or both.

It depends on $USD/£GBP is against $AUD. As of 23/11/2018 AUS$1 = USD$0.72 = GBP£0.56. Depending what Amex cards you hold in Australia, I believe Australia MR points are still the way to go uptill April 2019.

In the past AU MR converts 2:1 SPG points where as USA MR converts 3:1

USD$1 gets 1x MR points requires USD$60k spend to convert to 20K SPG points

AUD$1 gets 1X MR points requires AUD$40k spend to convert to 20K SPG points

USD$1 gets 2X MR points requires USD$30k spend to convert to 20K SPG points

AUD$1 gets 2X MR points requires AUD$40k spend to convert to 20K SPG points

USD$1 gets 3MR points requires USD$20k spend to convert to 20K SPG points

AUD$1 gets 3MR points requires AUD$13,333 spend to convert to 20K SPG points.

So think about exchange rates as well & multipliers on Amex cards to converts to Airlines or hotel points.

Yes, I am well aware.

I’m talking about Krisflyer points where Australia has a superior rate at the moment before it turns to cough next April.

Much like the SPG rate before.

I've been reading this thread with much interest. I'm considering migrating my Australian Platinum Charge card in the first instance to the US version. Are there any data points on how close the Amex FX rates are to spot? I've held a Citi US MC for some time and don't check anymore as I'm satisfied they're close enough and don't have a currency conversion fee.

I understand that foreign MC/Visa cost significantly more for merchants to accept. What's the story with Amex? I'm assuming some US Amex cards waive the FX fee but make it up by earning a higher merchant fee. I'd hate to change my affairs in this way only to have to change it back as merchants start surcharging US issued cards more.

I understand that foreign MC/Visa cost significantly more for merchants to accept. What's the story with Amex? I'm assuming some US Amex cards waive the FX fee but make it up by earning a higher merchant fee. I'd hate to change my affairs in this way only to have to change it back as merchants start surcharging US issued cards more.

Just so you know I paid some ATO on a US Amex before the rule change on fee payable and the exchange rate was no good.

I did much better with the forex with my Citi AA credit card. Their exchange rate was pretty good to do cross payments to earn AA miles.

I did much better with the forex with my Citi AA credit card. Their exchange rate was pretty good to do cross payments to earn AA miles.

The other thing to consider is the exchange rate for any conversions from aud to usd to pay off the card unless you have a ready source of USDs.

Exchange rates can change between cards day to day. I’ve notice on my travels sometimes MC is better and sometimes VISA is. Amex I haven’t had as much experience with.

Exchange rates can change between cards day to day. I’ve notice on my travels sometimes MC is better and sometimes VISA is. Amex I haven’t had as much experience with.

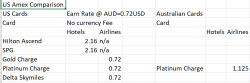

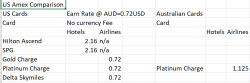

I've been doing a little more thinking about this project. I've restricted myself to only Amex US cards which have no currency fee - according to Amex's US website. I looked at primarily MR cards as I'm primarily interested in redeeming MR for Premium air travel. The Hilton and SPG cards also captured my attention as I've previously redeemed MR for Hilton and SPG points in the past - unlikely to now given the Aussie transfer rates.

I've assumed:

My thinking for MY circumstances:

I've assumed:

- US MR convert to airline points at 1:1 - found this via Googling but not directly on Amex's site as I don't have a login.

- AUD/USD cross rate is $US0.72

- Applied this cross rate to the advertised earn rate for 'regular' spend - particularly given that 'bonus' categories are restricted to US based merchants (incidentally, Citi US cards currently honour the bonus rates for overseas merchants too eg restaurants, travel, etc).

- Currency isn't an issue - I understand that it's a variable factor depending on Amex's rate on settlement and your ability to get a good deal from your FX provider and how well you manage it.

My thinking for MY circumstances:

- I might be interested in switching my Explorer post devaluation to the US SPG card if possible assuming I've understood the earn rate correctly;

- Alternatively, may look at the Hilton card depending on the eventual fate of the Macquarie Hilton card;

- with the exchange rate where it sits, unless I've misunderstood, I'd be better off (except for overseas spend at 3% currency conversion fee) with the Australian Platinum Charge card - despite the annual fee differential (US550 vs AUD1450).

The base earning rate on the charge card is not great. The 5ppd for airline spend is bloody fantastic.

The 2 Marriott ppd and 3 Hilton ppd is probably a better comparison.

A lot of the other bonus categories are US specific only for Amex cards.

The biggest killer is the foreign exchange rate though. Just because there is no FX fee, does not mean you are not paying some amount of spread, even if it’s small. For instance if it’s 0.5% and add on another 0.5% for conversion of currency to USD to pay off the card, I would apply at least a 1% cost in any of your calculations.

The 2 Marriott ppd and 3 Hilton ppd is probably a better comparison.

A lot of the other bonus categories are US specific only for Amex cards.

The biggest killer is the foreign exchange rate though. Just because there is no FX fee, does not mean you are not paying some amount of spread, even if it’s small. For instance if it’s 0.5% and add on another 0.5% for conversion of currency to USD to pay off the card, I would apply at least a 1% cost in any of your calculations.

Finale

Active Member

- Joined

- Aug 17, 2009

- Posts

- 920

I've been doing a little more thinking about this project. I've restricted myself to only Amex US cards which have no currency fee - according to Amex's US website. I looked at primarily MR cards as I'm primarily interested in redeeming MR for Premium air travel. The Hilton and SPG cards also captured my attention as I've previously redeemed MR for Hilton and SPG points in the past - unlikely to now given the Aussie transfer rates.

I've assumed:

I've put together the table below which I'd be interested in receiving some feedback on - particularly for accuracy.

- US MR convert to airline points at 1:1 - found this via Googling but not directly on Amex's site as I don't have a login.

- AUD/USD cross rate is $US0.72

- Applied this cross rate to the advertised earn rate for 'regular' spend - particularly given that 'bonus' categories are restricted to US based merchants (incidentally, Citi US cards currently honour the bonus rates for overseas merchants too eg restaurants, travel, etc).

- Currency isn't an issue - I understand that it's a variable factor depending on Amex's rate on settlement and your ability to get a good deal from your FX provider and how well you manage it.

View attachment 145412

My thinking for MY circumstances:

Interested in your feedback and corrections if I've missed something that will make this a whole lot more favourable

- I might be interested in switching my Explorer post devaluation to the US SPG card if possible assuming I've understood the earn rate correctly;

- Alternatively, may look at the Hilton card depending on the eventual fate of the Macquarie Hilton card;

- with the exchange rate where it sits, unless I've misunderstood, I'd be better off (except for overseas spend at 3% currency conversion fee) with the Australian Platinum Charge card - despite the annual fee differential (US550 vs AUD1450).

Not sure if I read the table correctly but SPG only gives 2ppd so that would be only 1.44?

Hilton Aspire card has become my new favorite card. $450 per year but comes with $250 airlines credit (almost useless if not in the US), $250 resort credit, 1 weekend night cer, Priority pass and also Diamond status. 14x at Hilton, 7x at airlines & car rental & US restaurants, 3x for the rest. I don't spend that much on this card though but used those benefits.

Thanks for the pick up on the SPG card. Thought it was 3 points on the “luxury” version but Durant appear to be. Looks like Hilton might be better esp to get to diamond if you don’t have the Macquarie card or Centurion. I value Hilton points at less than SPG unless staying at a very expensive property (like Conrad Maldives) since usually need so many more points for a reward. At 1.44 SPG it’s not exciting but certainly better than AUS MR conversion depending on the Amex exchange rate and cost of managing USD payments.

I've been doing a little more thinking about this project. I've restricted myself to only Amex US cards which have no currency fee - according to Amex's US website. I looked at primarily MR cards as I'm primarily interested in redeeming MR for Premium air travel. The Hilton and SPG cards also captured my attention as I've previously redeemed MR for Hilton and SPG points in the past - unlikely to now given the Aussie transfer rates.

I've assumed:

I've put together the table below which I'd be interested in receiving some feedback on - particularly for accuracy.

- US MR convert to airline points at 1:1 - found this via Googling but not directly on Amex's site as I don't have a login.

- AUD/USD cross rate is $US0.72

- Applied this cross rate to the advertised earn rate for 'regular' spend - particularly given that 'bonus' categories are restricted to US based merchants (incidentally, Citi US cards currently honour the bonus rates for overseas merchants too eg restaurants, travel, etc).

- Currency isn't an issue - I understand that it's a variable factor depending on Amex's rate on settlement and your ability to get a good deal from your FX provider and how well you manage it.

View attachment 145412

My thinking for MY circumstances:

Interested in your feedback and corrections if I've missed something that will make this a whole lot more favourable

- I might be interested in switching my Explorer post devaluation to the US SPG card if possible assuming I've understood the earn rate correctly;

- Alternatively, may look at the Hilton card depending on the eventual fate of the Macquarie Hilton card;

- with the exchange rate where it sits, unless I've misunderstood, I'd be better off (except for overseas spend at 3% currency conversion fee) with the Australian Platinum Charge card - despite the annual fee differential (US550 vs AUD1450).

Don't forget to add another USD$175 if your Ms/Mr need a supp card.

Finale

Active Member

- Joined

- Aug 17, 2009

- Posts

- 920

In case anybody is interested about FX. I paid AUD on Amex Platinum and Citi Prestige on the same day and appeared to settle on the same day as well.

Amex - 0.7278

Citi - 0.7275

I forgot to record the midmarket rate at the time of paying but looking at the history on XE, it was around 0.7236-0.7246.

Citi (Mastercard) used the rate on the transaction date, not settlement date. For Amex, I have no idea.

It's not 100% accurate since I don't know the date Amex used but from these numbers, Amex is just a bit higher than Mastercard and both are around 0.4-0.5% higher than midmarket rate.

Amex - 0.7278

Citi - 0.7275

I forgot to record the midmarket rate at the time of paying but looking at the history on XE, it was around 0.7236-0.7246.

Citi (Mastercard) used the rate on the transaction date, not settlement date. For Amex, I have no idea.

It's not 100% accurate since I don't know the date Amex used but from these numbers, Amex is just a bit higher than Mastercard and both are around 0.4-0.5% higher than midmarket rate.

ithongy

Member

- Joined

- Mar 3, 2009

- Posts

- 264

Dam they are raising the business Amex Plat Charge Card to USD$595.

American Express Business Platinum Raises Annual Fee to $595, Adds $200 Dell Credit, WeWork Benefit and More - Doctor Of Credit

American Express Business Platinum Raises Annual Fee to $595, Adds $200 Dell Credit, WeWork Benefit and More - Doctor Of Credit

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Recent Posts

-

1Cover - requiring pre-payment / going hard on pre-existing conditions?

- Latest: Flyfrequently

-

-

Oneworld Classic Flight Reward Discussion - The Definitive Thread

- Latest: MEL_Traveller

Currently Active Users

- Spacetravel

- mapnz

- Flyfrequently

- Pete98765432

- equus

- jepi

- mikedesign

- SYD

- BriarFlyer

- billmurray

- Sbv72

- ronaldh

- ThatMrBlake

- astrosly

- torks

- cove

- aplmac

- mattr00

- Scr77

- anat0l

- MarkB123

- Chrism13

- REM

- Warragul

- MEL_Traveller

- Layslow

- tgh

- mt4789

- pshict

- jellybelly

- Deno

- Rich

- markis10

- Bundy Bear

- kelvedon

- gty222

- ghinx

- madrooster

- Grrr

- MattA

- Flechette1866

- mannej

- jase05

- axkhanna1

- NoName

- bernardblack

- meljfk

- Hilius

- cranky

- muppet

Total: 464 (members: 79, guests: 385)