Wow, I wish I could say I had the same experience. It’s now 8 days and counting. Even my initial transfer to XE was an overnight thing, unlike the 2 hour it takes you. Don’t know if it’s the bank, (I am with CBA). I got the message from XE the following day saying they have sent the funds, since then it’s been a waiting game.Hi Rohit, I was surprised by your recent posts as my experience is I send to XE and approx 2 hours later they have received the money and approx 2 hours later have sent it and then AMEX US sends an email the next day "We've received your payment" You're all set, but give us 24 - 36 hours for you payment to appear online.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Strategy to obtain US Amex

- Thread starter ithongy

- Start date

- Featured

From my experience with Citigold the transfer is never fee free with the cost built into the inferior exchange rate which might be worthwhile for small transfers - the benefit being the transfer is instantaneous .

I believe this should be true for hsbc premier as well .

oh definitely, for paying off a US amex i've found the intermediary fees can be up to $20USD when using FX platforms, so for larger sums it makes sense to use an FX, but if you are like me I don't use the AMEX for my daily purchases (i use my Qantas cc which the i think points are more valuable to me). $20 usd of say $100 monthly spend is like 20% fee. But in saying that my citibank fx rate is generally only around 0.01 worse than FX "market" rates. So for me the cut off for using my banks global transfer is around $2000usd. Anything more it would be better to use an FX platform... ymmvI agree, there's no such thing as a free lunch. Either it's "free" but you pay for it with an exchange rate away from the market or pay a monthly service fee but get a "market" FX rate. If you're transferring quite a bit, then paying a monthly fee should work out to an overall saving - depending on how much you need to transfer. Otherwise for simplicity, use your bank's (ie Citi/HSBC) global transfer function. Might not be worth the minimal saving for time invested to get it.

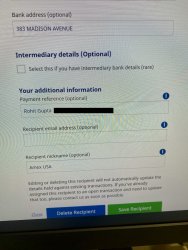

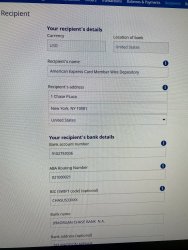

This is the ‘Recipient’ info on my XE account. Would appreciate if someone who uses them regularly can take and look and advise if this looks ok or I need to change something. In one of the images, I have blocked the card number next to my name.

Attachments

PointsLife1

Member

- Joined

- Jan 30, 2020

- Posts

- 196

All the best mate, did Amex confirm you had filled out the correct information? Very stressful for you.Wow, I wish I could say I had the same experience. It’s now 8 days and counting. Even my initial transfer to XE was an overnight thing, unlike the 2 hour it takes you. Don’t know if it’s the bank, (I am with CBA). I got the message from XE the following day saying they have sent the funds, since then it’s been a waiting game.

I would've said "FFC for futher credit Rohit Gupta xx_xcardxx_x" under payment reference. Everything else seems okThis is the ‘Recipient’ info on my XE account. Would appreciate if someone who uses them regularly can take and look and advise if this looks ok or I need to change something. In one of the images, I have blocked the card number next to my name.

PointsLife1

Member

- Joined

- Jan 30, 2020

- Posts

- 196

It looks exactly like mineThis is the ‘Recipient’ info on my XE account. Would appreciate if someone who uses them regularly can take and look and advise if this looks ok or I need to change something. In one of the images, I have blocked the card number next to my name.

Thanks, will amend that.I would've said "FFC for futher credit Rohit Gupta xx_xcardxx_x" under payment reference. Everything else seems ok

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,563

Has anyone used Citigold`s service similar to HSBC Premier to open an account and credit card in the US?

Is it as easy as HSBC?

Is it as easy as HSBC?

Don't bother if you're in Australia. YMMV. I'm located in SYD - I went to Citi's "Wealth Management" branch in Pitt St. A dude who was sitting at the front desk walked up to the door and wasn't prepared to open up the doors he spoke through the cracks and told me that I couldn't make an appointment and to try to call the main number. No Thanks. Moved all my money out of Citi US as soon as I set up with HSBC US. I'm not a Packer but expected better treatment than this.

I've had a Citi US checking account (and Credit Card) which I've had open for years which I opened up at the branch. They wouldn't let me open up a new one remotely - had to go back to the US to do so.

There is talk HSBC is looking to exit the US so if you can use the Premier service, do it now before that option is closed off.

I've had a Citi US checking account (and Credit Card) which I've had open for years which I opened up at the branch. They wouldn't let me open up a new one remotely - had to go back to the US to do so.

There is talk HSBC is looking to exit the US so if you can use the Premier service, do it now before that option is closed off.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,563

Don't bother if you're in Australia. YMMV. I'm located in SYD - I went to Citi's "Wealth Management" branch in Pitt St. A dude who was sitting at the front desk walked up to the door and wasn't prepared to open up the doors he spoke through the cracks and told me that I couldn't make an appointment and to try to call the main number. No Thanks. Moved all my money out of Citi US as soon as I set up with HSBC US. I'm not a Packer but expected better treatment than this.

I've had a Citi US checking account (and Credit Card) which I've had open for years which I opened up at the branch. They wouldn't let me open up a new one remotely - had to go back to the US to do so.

There is talk HSBC is looking to exit the US so if you can use the Premier service, do it now before that option is closed off.

Thanks . I used to be citigold some years ago and didn’t see any benefit apart from invites to seminars .

I have qualified for premier and should have my US account open soon . But If hsbc is going to exit the US that would mean all accounts would be closed right ?

I will ask the consultant about the same when they call me regarding the form completion today .

They wouldn't know - assuming they'll be the last to know. I would imagine if the rumour is right, HSBC will just sell it to someone else. They're unlikely to close it down - its profitable I think - just sub-scale. I think they have a limited geographic presence where they originally had ambitions to be a big national player in the US.

A sale would mean existing accounts "should" be grandfathered. May need to have a change of address to FL to avoid them getting shut down.

A sale would mean existing accounts "should" be grandfathered. May need to have a change of address to FL to avoid them getting shut down.

Last edited:

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,563

possibly open us hsbc transaction thru video call:International Banking - New to USA - HSBC Bank USA

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,563

Don't bother if you're in Australia. YMMV. I'm located in SYD - I went to Citi's "Wealth Management" branch in Pitt St. A dude who was sitting at the front desk walked up to the door and wasn't prepared to open up the doors he spoke through the cracks and told me that I couldn't make an appointment and to try to call the main number. No Thanks. Moved all my money out of Citi US as soon as I set up with HSBC US. I'm not a Packer but expected better treatment than this.

I've had a Citi US checking account (and Credit Card) which I've had open for years which I opened up at the branch. They wouldn't let me open up a new one remotely - had to go back to the US to do so.

There is talk HSBC is looking to exit the US so if you can use the Premier service, do it now before that option is closed off.

Spoke to citigold . Said they definitely can’t assist with opening an account in the US .

Update on my attempt to pay off the statement through XE. I am happy to advise that the funds have finally hit the account after 10 days. I still do not know what caused the delay, although XE seem to think it was because of the maiden transfer. They say future transfers should post within 2 business days.

The other interesting thing I noted was that the $20 fee wasn't taken by the intermediary bank, so the full amount was credited. Not sure if they simply waived this cos of the delay or if there is another reason.

I am happy, but more like relieved.

The other interesting thing I noted was that the $20 fee wasn't taken by the intermediary bank, so the full amount was credited. Not sure if they simply waived this cos of the delay or if there is another reason.

I am happy, but more like relieved.

Update on my attempt to pay off the statement through XE. I am happy to advise that the funds have finally hit the account after 10 days. I still do not know what caused the delay, although XE seem to think it was because of the maiden transfer. They say future transfers should post within 2 business days.

The other interesting thing I noted was that the $20 fee wasn't taken by the intermediary bank, so the full amount was credited. Not sure if they simply waived this cos of the delay or if there is another reason.

I am happy, but more like relieved.

You are the second person who said the $20 fee wasn't deducted from the transfer, I imagine it must have been processed manually and the manual process don't include the charge $20 part in the procedure.

marki

Suspended

- Joined

- Feb 11, 2010

- Posts

- 3,529

- Qantas

- Platinum 1

- Virgin

- Gold

- Oneworld

- Emerald

- SkyTeam

- Elite

- Star Alliance

- Silver

Hi, So Newbie like me who holds an Australian AMEX what is the best way to obtain an AMEX card in the US? Do I use the official moving countries on the website and get myself alike card in the US under my US forwarding address? I currently have an Australian Card AMEX registered to a US forwarding address very successfully and I am able to use it for US Apple purchases and BEST BUY, and even iTunes app store purchases even funds purchase. I have used this facility for Walmart purchases and US Amazon purchases. Even Amazon Credit and Amazon Plus subscription which included all the videos and watched it in Australia via VPN. I, of course, apologise for the totally newbie question.

Last edited:

marki

Suspended

- Joined

- Feb 11, 2010

- Posts

- 3,529

- Qantas

- Platinum 1

- Virgin

- Gold

- Oneworld

- Emerald

- SkyTeam

- Elite

- Star Alliance

- Silver

Become an American Express Platinum Cardmember.As an Australian, you can also apply to Amex UK for a Platinum ICC. The card is denominated in US Dollars, GBP or Euro, and carries a $450USD membership fee. But the good part is that it gets you Amex UK's partner benefits, so you get SPG/Marriott Gold, Hilton Gold, Shangri-La Jade, Radisson Gold, plus the usuals - and with Shangri-La Jade, you can also immediately match to SQ KrisFlyer Silver with an immediate upgrade to KrisFlyer Gold after three SQ or SilkAir flights in four months.

The best part is that you don't need to do any funky stuff to build credit or anything, they ask Amex Australia for their assessment of your creditworthiness and go from there.

Apply now. The Platinum International Currency Card

Important Information before you apply:

International Currency Card products are only available to existing American Express customers with more than six months of membership. Product and country of residence restrictions apply. You and any Supplementary Cardmembers must be over 18 years of age. American Express International Currency Cards are serviced in English. Please note, ICC cards are not offered to residents of the USA, Singapore, the European Union (UK exempt) and some other excluded countries. Visit your local American Express website for full details on products available in your country of residence at americanexpress.com. If you'd prefer a Card without any rewards, other features or a Cardmembership fee, an alternative option is available – the Basic Card.

Please note, ICC cards are not offered to residents of the USA, Singapore, the European Union (UK exempt) and some other excluded countries.

In order to qualify for the American Express Platinum Charge Card, you must make sure that you:

- Are an existing American Express customer with more than six months of membership, or have been referred by your Private Bank.

- Confirm that you (and any Supplementary Cardmembers) are over 18 years of age

- Have an annual income of at least US$65,000

- Please note, as an existing Cardmember, you may not be eligible for a Welcome Bonus if you currently hold or have held any other Membership Rewards® enrolled American Express Cards in the last six months.

- Your existing 15 digit American Express Card Number.

- Passport or National ID Card.

- Proof of Address (must be a utility bill or bank statement, not a mobile phone bill) and dated in the last 3 months. You will need to send a certified copy of these to us once you have completed the online application.

- The same two documents above for any Supplementary Applicants. They will also need to provide certified copies of these.

Are these cards like a US CC? Or are they treated differently because the address on them is different?

Last edited:

marki

Suspended

- Joined

- Feb 11, 2010

- Posts

- 3,529

- Qantas

- Platinum 1

- Virgin

- Gold

- Oneworld

- Emerald

- SkyTeam

- Elite

- Star Alliance

- Silver

Transferwise do that now. You can send AUD FX them into your own US holding account to pay anyone by USD transfer in the US of A. This service is free account supplied by Transferwise. All they request in return is use there FX.I notice that Amex US have a reloadable prepaid card (Serve) that seems to work like a bank account of sorts. Might it be possible to wire funds into that account then transfer to your Hilton Amex to cover payment? Assuming if you were able to open the Hilton Amex, there should be an option to open more card products.

marki

Suspended

- Joined

- Feb 11, 2010

- Posts

- 3,529

- Qantas

- Platinum 1

- Virgin

- Gold

- Oneworld

- Emerald

- SkyTeam

- Elite

- Star Alliance

- Silver

Although this has changed recently doubling of points earn and generous dollar bonus on purchases up to $725 have been very useful.It’s a game that requires patience & lots of research. With Amex devaluing their earnings (in Australia) this could be a “strategy” for others to look elsewhere to build their airline/hotel points balance. No one size fits all & is a complicated game to play. When applying for cards you need a plan as to why you are wanting this card & benefits you can use. USA has many more partners to earn points compared to Australia which can be helpful instead of pooling all your eggs into one basket.

marki

Suspended

- Joined

- Feb 11, 2010

- Posts

- 3,529

- Qantas

- Platinum 1

- Virgin

- Gold

- Oneworld

- Emerald

- SkyTeam

- Elite

- Star Alliance

- Silver

This is very interesting therefore I should be able to get the same level of card! ie Centurion without an invitation ......?When I set up some years ago, both checking and credit accounts were linked to Au address.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- stm1sydney

- encryptededdy

- larry40

- DasColonel

- RSD

- Harrison_133

- Kwong

- Jay684

- muppet

- jkbaus

- kyle

- delphiki89

- Traveller X

- dajop

- gabbrielle.shane

- andyrb

- vhojm

- BodohBordeaux

- Pete98765432

- Vekor

- coyote25

- Dmac59

- kerfuffle

- meadowfield

- #flying

- Nanachi

- BrianQQ

- Dismounted

- Nate-Dawg

- AIRwin

- flyingfan

- BP.

- cjd600

- defurax

- billmurray

- Stone

- siwotravels

- coldecol

- bcworld

- stevenaus

- SCM

- hotdogs

- Wanderlust_tim

- ABC1

- moa999

- miles_collector

- Strikes

- HirafuHeartAttack

Total: 1,185 (members: 64, guests: 1,121)