djchuckles

Established Member

- Joined

- Jun 22, 2011

- Posts

- 1,071

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

I did the same. Dump to Hilton. In fact MR AU to VS to Hilton is better than MR AU to HiltonVS frequent flyer program? It's a lot more useful not it's joined SkyTeam; I've got around 14,000 points that have gradually accumulated over years, one day I'll use them. I used to dump them into Hilton every 10k when it was 1:2, and even that wasn't a great use, but it's now 2:3 which is awful value.

I did recently purchase a £5 Virgin Train ticket for the 1,000 points/£5 discount on trains (took the 1,000 points of course), because that's a pretty good purchase price.

Post automatically merged:

Seems Chase is picking up the Apple Card from Goldman Sachs. I wonder if the benefits will change

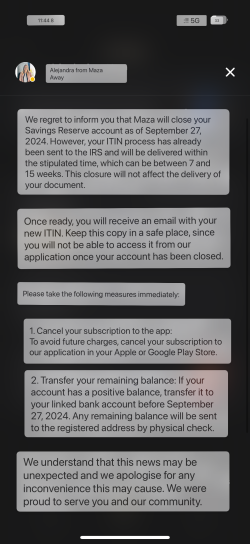

rhats interesting. They’ve also stopped their savings account partHas anyone signed up with MAZA recently ?

I’ve tried just now (US iTunes account, Maza app), US location VPN, and after tapping ‘New Account’, it asks for my US phone number.

After inputting this, it says (in Spanish) ‘we are not accepting new subscriptions at this time’

From

Strategy to obtain US Amex I assumed this was not the distinct part that requires GPS spoofing so I haven’t set that up yet (most of the apps appear a bit dodgy !)

Have they perhaps been Ozbargained/AFFed ?!