- Joined

- Feb 23, 2015

- Posts

- 6,212

- Qantas

- Platinum 1

- Virgin

- Platinum

- Star Alliance

- Gold

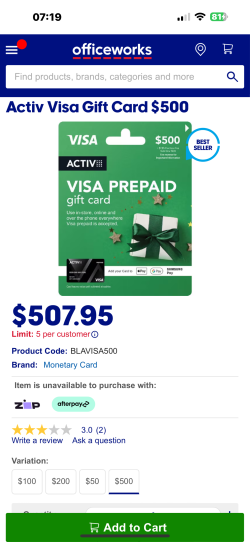

Earn 4x-10x Qantas Points on Bunnings, Woolworths, Everyday WISH and Other Gift Cards @ Qantas Marketplace

Deal: Earn 4x-10x Qantas Points on Bunnings, Woolworths, Everyday WISH and Other Gift Cards @ Qantas Marketplace, Store: Qantas, Category: Other

Anyone going to see how these code? The Offset (which codes well) comes from Marketplace

Qantas Offset your Home purchase:

Appears on statement as QANTAS LOYALTY MASCOT AU

Expanded online statement entry reads QANTAS STORE

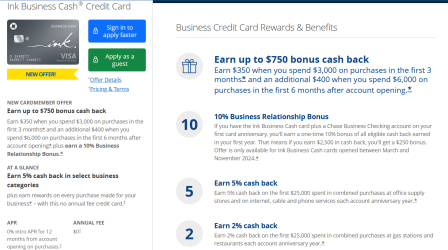

Categorised as 'Airfare' on Aspire and earned 7X - should work for airline credit