You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Strategy to obtain US Amex

- Thread starter ithongy

- Start date

- Featured

djchuckles

Established Member

- Joined

- Jun 22, 2011

- Posts

- 1,040

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

Global Transfer (now called Global Card Relationship)

When do I get the free Hilton night certificate after opening account?

It takes around 2-plus months. You will receive an email notification when it lands. It will also show in your HHonors account

pyramidforce

Member

- Joined

- Jan 19, 2023

- Posts

- 293

Does pulling direct from Wise still work for new Wise accounts that may or may not be in your name?1) Not sure - but i’ve never needed one

2) You’ll probably pay slightly more in fees withdrawing Wise to HSBC. Any reason why you’re not pulling the Autopay in from Wise directly and cutting HSBC out of the loop? I don’t use autopay, but I do do an ACH pull via Amex straight from Wise

3) 8-10 weeks apparently - still waiting on mine

4) Not 100% needed ongoing - but useful to have (and often needed for future new card applications)

- Joined

- Dec 17, 2010

- Posts

- 670

my understanding the new Wise accounts can not directly ACH from them - all you can do is do a test payment and see if it works - you can’t ACH transfer into our out of them but a direct payment may be seen differently and workDoes pulling direct from Wise still work for new Wise accounts that may or may not be in your name?

djchuckles

Established Member

- Joined

- Jun 22, 2011

- Posts

- 1,040

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

Ah yes I remember reading something along those lines - have had my Wise account over 10 years so guess I’m lucky

- Joined

- Dec 17, 2010

- Posts

- 670

10 years - wow - were you a user in the first early daysAh yes I remember reading something along those lines - have had my Wise account over 10 years so guess I’m lucky

djchuckles

Established Member

- Joined

- Jun 22, 2011

- Posts

- 1,040

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

- Joined

- Feb 23, 2015

- Posts

- 6,241

- Qantas

- Platinum 1

- Virgin

- Platinum

- Star Alliance

- Gold

US MR to QR Avios 20% transfer bonus live until end of March.

Worth noting that 30% transfer bonuses generally come around once per year on Amex and Chase, so only worth it if you're looking to book in the near future.US MR to QR Avios 20% transfer bonus live until end of March.

djchuckles

Established Member

- Joined

- Jun 22, 2011

- Posts

- 1,040

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

Thanks - waiting for something decent from HSBC, otherwise I’ll continue to hold them there

- Joined

- Dec 17, 2010

- Posts

- 670

Uber $75 credit arrived overnight - ok to attach to Uber AU account ?

djchuckles

Established Member

- Joined

- Jun 22, 2011

- Posts

- 1,040

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

Mine too. And yes it’ll convert to AUD.Uber $75 credit arrived overnight - ok to attach to Uber AU account ?

Attachments

djchuckles

Established Member

- Joined

- Jun 22, 2011

- Posts

- 1,040

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

- Joined

- Dec 17, 2010

- Posts

- 670

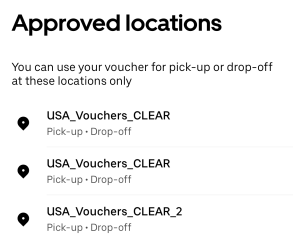

Is that only for using with the Clear locations - feel can use anywhere maybe wrong

djchuckles

Established Member

- Joined

- Jun 22, 2011

- Posts

- 1,040

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

Just tried in a dummy booking and eats order and says can’t be usedIs that only for using with the Clear locations - feel can use anywhere maybe wrong

djchuckles

Established Member

- Joined

- Jun 22, 2011

- Posts

- 1,040

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

Yeah they seem to have changed it. I won’t be in US before August so it’ll go to waste

kpc

Senior Member

- Joined

- Mar 11, 2003

- Posts

- 8,373

- Qantas

- Platinum

- Virgin

- Silver

As a newly minted Amex Hilton Aspire card holder, and as a Sydneysider (don't go to USA very often, if at all), where / how can I best make the most of the benefits below. Many thanks in advance!

1) Up to $400 in Hilton resort statement credits: During each calendar year, you'll receive up to $400 (up to $200 semi-annually) in statement credits for eligible purchases at eligible Hilton resorts. That $400 can be used on dining, activities, spa treatments, room rates and taxes.

Which properties in Asia-Pacific count as eligible Hilton resorts that I get these credits, and spending on what counts?

2) Up to $200 in annual airline fee credits each calendar year: Receive up to $50 in statement credits each calendar quarter for airfare purchases on flights purchased directly from the airline or through AmexTravel.com.

If I pay for an airfare say on the Qantas or Virgin Australian website, will I qualify for this statement credit?

3) Up to $100 Hilton on-property credit: When you book at least a two-night paid stay at participating Waldorf Astoria or Conrad properties through hiltonhonorsaspirecard.com (or over the phone at 855-292-5757), you'll receive a credit of up to $100 for incidentals during your stay.

Any in particular in the Asia Pacific region?

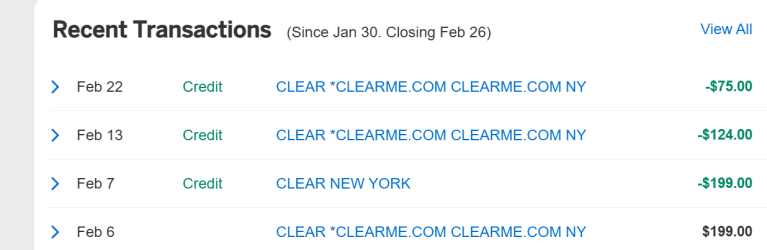

4) Clear Plus membership: Receive up to $199 in statement credits per year when you sign up for a Clear Plus membership and pay with your Hilton Aspire card.

Any benefit for an Aussie with Clear Plus membership?

5) Rental car elite status: Receive complimentary National Car Rental Emerald Club Executive status after enrollment in the Emerald Club program (terms apply).

Self explanatory, I guess

6) Cellphone protection*: Card members can be reimbursed for repairing or replacing a damaged or stolen device for a maximum of $800 per claim when the wireless bill for the specific cellphone line is paid using the Hilton Aspire card. There is a limit of two approved claims within a 12-month period, and each claim has a $50 deductible.

Probably won't use / claim.

1) Up to $400 in Hilton resort statement credits: During each calendar year, you'll receive up to $400 (up to $200 semi-annually) in statement credits for eligible purchases at eligible Hilton resorts. That $400 can be used on dining, activities, spa treatments, room rates and taxes.

Which properties in Asia-Pacific count as eligible Hilton resorts that I get these credits, and spending on what counts?

2) Up to $200 in annual airline fee credits each calendar year: Receive up to $50 in statement credits each calendar quarter for airfare purchases on flights purchased directly from the airline or through AmexTravel.com.

If I pay for an airfare say on the Qantas or Virgin Australian website, will I qualify for this statement credit?

3) Up to $100 Hilton on-property credit: When you book at least a two-night paid stay at participating Waldorf Astoria or Conrad properties through hiltonhonorsaspirecard.com (or over the phone at 855-292-5757), you'll receive a credit of up to $100 for incidentals during your stay.

Any in particular in the Asia Pacific region?

4) Clear Plus membership: Receive up to $199 in statement credits per year when you sign up for a Clear Plus membership and pay with your Hilton Aspire card.

Any benefit for an Aussie with Clear Plus membership?

5) Rental car elite status: Receive complimentary National Car Rental Emerald Club Executive status after enrollment in the Emerald Club program (terms apply).

Self explanatory, I guess

6) Cellphone protection*: Card members can be reimbursed for repairing or replacing a damaged or stolen device for a maximum of $800 per claim when the wireless bill for the specific cellphone line is paid using the Hilton Aspire card. There is a limit of two approved claims within a 12-month period, and each claim has a $50 deductible.

Probably won't use / claim.

djchuckles

Established Member

- Joined

- Jun 22, 2011

- Posts

- 1,040

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

1) I believe Surfers Paradise and one of the NZ Hilton’s codes as a resort - but don’t take my word as gospelAs a newly minted Amex Hilton Aspire card holder, and as a Sydneysider (don't go to USA very often, if at all), where / how can I best make the most of the benefits below. Many thanks in advance!

1) Up to $400 in Hilton resort statement credits: During each calendar year, you'll receive up to $400 (up to $200 semi-annually) in statement credits for eligible purchases at eligible Hilton resorts. That $400 can be used on dining, activities, spa treatments, room rates and taxes.

Which properties in Asia-Pacific count as eligible Hilton resorts that I get these credits, and spending on what counts?

2) Up to $200 in annual airline fee credits each calendar year: Receive up to $50 in statement credits each calendar quarter for airfare purchases on flights purchased directly from the airline or through AmexTravel.com.

If I pay for an airfare say on the Qantas or Virgin Australian website, will I qualify for this statement credit?

3) Up to $100 Hilton on-property credit: When you book at least a two-night paid stay at participating Waldorf Astoria or Conrad properties through hiltonhonorsaspirecard.com (or over the phone at 855-292-5757), you'll receive a credit of up to $100 for incidentals during your stay.

Any in particular in the Asia Pacific region?

4) Clear Plus membership: Receive up to $199 in statement credits per year when you sign up for a Clear Plus membership and pay with your Hilton Aspire card.

Any benefit for an Aussie with Clear Plus membership?

5) Rental car elite status: Receive complimentary National Car Rental Emerald Club Executive status after enrollment in the Emerald Club program (terms apply).

Self explanatory, I guess

6) Cellphone protection*: Card members can be reimbursed for repairing or replacing a damaged or stolen device for a maximum of $800 per claim when the wireless bill for the specific cellphone line is paid using the Hilton Aspire card. There is a limit of two approved claims within a 12-month period, and each claim has a $50 deductible.

Probably won't use / claim.

2) Qantas is fine - and I assume Virgin too - but you can also buy from Qantas Marketplace, so I just buy a $100 Apple Gift Card every quarter if I’m not flying that period.

3) Didn’t actually know about this one - but you’ll have no options in Aus - though you’ll find some Conrads in APAC (and possibly some WAs)

4) Did this - got the credit, got the $75 Uber voucher which turned out to be useless outside of US. But Clear in itself is a complete waste of time - in the limited places you can use it, you’ll probably spend longer in the Clear queue!

5) Never bothered with this as I’m Pres Circle Hertz and on the occasional time I use a rental i book with them.

6) I have this with my AU cards (actually this seems more in depth than the screen cover i have here) - i figured you’d probably run into issues being outside of US if/when you claim (or proving you pay the monthly cost with the cad) so haven’t bothered. That said $800 wouldn’t replace an iPhone 16 Pro

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- jase05

- jc123

- kookaburra75

- GrahamBRI

- Flyfrequently

- Chrism13

- JackMiles

- I love to travel

- Larko1

- Blackadder

- BriarFlyer

- Cruise Luxury

- Virgin Bart

- Aeryn

- smiliemonster

- angusburns

- SBD

- markis10

- DeanCorp

- Daver6

- JessicaTam

- Jimmy89

- kevrosmith

- Houghton27

- Foz

- papeto

- redbigot

- Khisanth

- tim84

- knightfall88

- jb747

- Stacycrow

- Robliversage

- Nic

- wentworthmeister

- sihyonkim

- BrianQQ

- Rug

- Pete98765432

- craigmikej

- mrs.dr.ron

- eting

- mccaffd

- HealthyPotato

- SYD

- NoName

- billmurray

- JB001

- luxury-lizard

- offshore171

Total: 1,128 (members: 69, guests: 1,059)