- Joined

- Mar 29, 2015

- Posts

- 2,360

https://www.servicesaustralia.gov.a...d-income-limits-increase-from-4-november-2022

There will be a lot of applications I suspect

There will be a lot of applications I suspect

Sept 2022 figures are 456,453.Commonwealth Seniors Health Card income limits increase from 4 November 2022

There will be a lot of applications I suspect

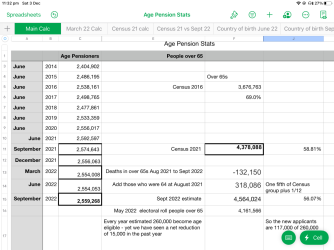

Does this include the part pension ones as well as full rate ?Sept 2022 Age pension figures have arrived...

in the past year 260,000 have become eligible yet there’s been a net reduction of 15,000 (eg deaths (about 130,000), surviving spouses getting caught on the reduced assets thresholds, others cancelled as result higher asset values or deemed income)

roughly

117,000 of 260,000 going onto age pension 45%

View attachment 309519

Search

data.gov.au

Looking at the underlying data:Does this include the part pension ones as well as full rate ?

I wonder if along with less pensioners ,there is less full rate pensioners.

I am aware many structure (as far as possible ) to receive the infamous $1.

I know in many states the Pensioner Concession Card give significant discounts

Dec 22 seniors health care cardSept 2022 figures are 456,453.

dec 22 figures will be out around end Feb 2023

There's an interesting situation that may develop at work. I have ~8 weeks long service and due for another ~4 weeks in a few months. I've heard some people say they've been forced to take some of their long service. I do not want to take ~6 weeks off work to sit in BNE apartment doing nothing. I actually fear for my health as I'd be bored and need to work.

I suspect they may offer to pay out long service but that means paying close to 50% tax which is ludicrous and not an option in my mind. I've been planning/hoping to save long service leave as a ~16 week payout almost tax free after 20 years service as I'd be retiring on 07th July in new tax year.

What are my options? I think I can take them to tribunal citing hardship? If offered to cash out long service can I contribute to superannuation? I have about $12000 available that I can contribute to superannuation each year. Contributions tax is much better option than 50% tax.

Not looking for free advice but have been checking my options in case this becomes an issue. Will check with HR first and I think we can consult ANZ free of charge for superannuation advice.

The problem is 6 year old daughter going to school. Then there's trip money for 3 people.Just a crazy thought: is renting a villa / apartment somewhere – France, Vanuatu, Azores, wherever – for a longer ~6+ weeks vacation an idea? Two or three weeks exploring the local area, sucking up the sights and culture then going for long, interesting, meandering walks followed by day trips to places further afield here or there?

Assuming the closing balance as at June 30 in the year prior was <$500,000.You can also use unused concessional limits from prior few years as well.

Hey JohnThere's an interesting situation that may develop at work. I have ~8 weeks long service and due for another ~4 weeks in a few months. I've heard some people say they've been forced to take some of their long service. I do not want to take ~6 weeks off work to sit in BNE apartment doing nothing. I actually fear for my health as I'd be bored and need to work.

I suspect they may offer to pay out long service but that means paying close to 50% tax which is ludicrous and not an option in my mind. I've been planning/hoping to save long service leave as a ~16 week payout almost tax free after 20 years service as I'd be retiring on 07th July in new tax year.

What are my options? I think I can take them to tribunal citing hardship? If offered to cash out long service can I contribute to superannuation? I have about $12000 available that I can contribute to superannuation each year. Contributions tax is much better option than 50% tax.

Not looking for free advice but have been checking my options in case this becomes an issue. Will check with HR first and I think we can consult ANZ free of charge for superannuation advice.