CaptJCool

Established Member

- Joined

- May 31, 2012

- Posts

- 4,604

For clarification, I gather you mean superannuation pension as distinct to Government Age Pension ?Most folks have not realized that there are many retired folks who rely on franking credits to supplement their pensions. They will be hoping their children can help them if they lose this money and that affects the next generation who are probably in an age range of 40 to 65. This cascading problem has not been thought out too well. I think of this as a mean thought bubble and needs to be fought off sooner rather than later.

I do note super is considered accounting income for determining eligibility to Govt Age Pension (less some concessions for example public servants where 10% of the super stream isn’t included (until Jan 2016, it was 50%))

While I’m supportive of capital from super not being taxed. Like we don’t tax withdrawals from a bank account, it is pretty generous all the same to have super including the ongoing earnings completely taken off the table for tax purposes. So for those on tax-free super AND tax-free dividend streams wow what a great wicket !

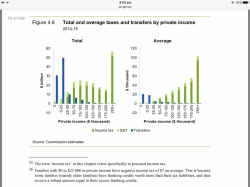

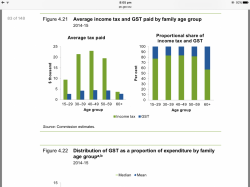

Franking credits were designed to avoid double taxation not create zero taxation. In the tax system, most credits and offsets are non-refundable. Franking credits were made refundable when super income was still taxed and the excess was small. It was only in 2006, that the excesses started to be significant. Until today.

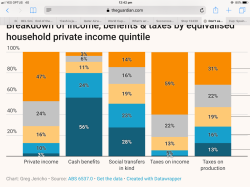

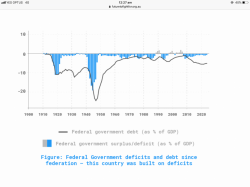

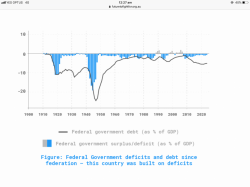

What Australia won’t discuss is the the spending beyond what you earn. It’s cslled progressive taxation for a reason, you got more you share with those in need, and because we got a pile of people who need. Most legitimately but some dubiously and the more who ask for govt money, the more cash needed.

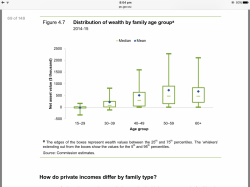

One solution is to raise taxes on capital gains instead of income. Especially to tackle obscene profits on founders shareholdings and property subdivisions. Another is what’s proposed by the govt where the biggest spenders of free govt money are also the smallest contributors. Ah, you might say, but that’s the progressive tax system at work. And when you’re no longer working, you’re no longer earning anywhere near as much income. The charts prove that as your wealth holdings go backwards ....