- Joined

- Oct 13, 2013

- Posts

- 15,712

What does ExpertFlyer suggest are the current loadings?

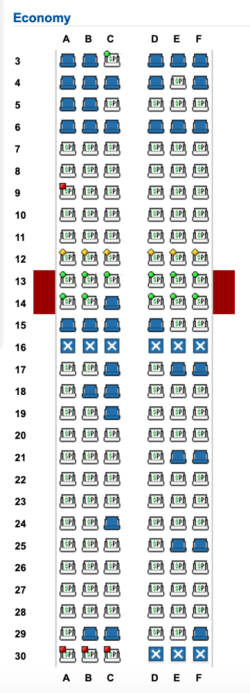

I know seat maps are no indication of loads but VA77 is blocked on the first day, on the 2nd day of CNS-HND operations it looks like below.What does ExpertFlyer suggest are the current loadings?

So it is, that's a little odd :/I know seat maps are no indication of loads but VA77 is blocked on the first day.

These appear to be low loadings. I would have thought demand would have been much higher.So it is, that's a little odd :/

The second flight out, as below for me.

Yes, absolutely.These appear to be low loadings. I would have thought demand would have been much higher.

I wouldn't be surprised if such flights are heavily sold by (Japanese) travel operators. This means they would buy a number of seats per flights. However, a seat map isn't going to be of much use as they would only allow seat selection at checkin.These appear to be low loadings. I would have thought demand would have been much higher.

Now there is a very valid possibility, a great pointI wouldn't be surprised if such flights are heavily sold by (Japanese) travel operators. This means they would buy a number of seats per flights. However, a seat map isn't going to be of much use as they would only allow seat selection at checkin.

They can give it back. They have been given 2? Extensions.

Well, yes. That would be the other option (and not the first time Virgin has pulled the pin on an idea before launch). I can’t find a reference but I’m fairly sure it was a definite no to any further extensions.

It is a Queensland Government subsidised service via the AAIF. If it wasn't for Premier Annastacia and the North Queensland Tourism stumping up the money, I'm sure we'll all agree the slot would've lapsed and put up for tender back at the end of March this year.Perhaps just hand it back. Which means they don’t have to worry about ordering a wide body, and it’s damn clear now that United has this trans pacific network well and truly tied down now. Virgin operating pacific would just be a token anyway considering the scale of the others, ie what’s the point.

Likely some ego at stake here. They know that QF will get the slot and it will just boost the margin over the fence. I thought Virgin was done playing those games with QF.

I agree. But it does give them more time to decide what they want to do with that slot and it sure could help the IPO, don't you think?It is a Queensland Government subsidised service via the AAIF. If it wasn't for Premier Annastacia and the North Queensland Tourism stumping up the money, I'm sure we'll all agree the slot would've lapsed and put up for tender back at the end of March this year.

I don't think flying to Japan has anything whatsoever to do with an IPO (which appears to be delayed).I agree. But it does give them more time to decide what they want to do with that slot and it sure could help the IPO, don't you think?

AFF Supporters can remove this and all advertisements

The second extension was already given for 737-8Max delayed deliverysurely they can get a minor extension for a factor that is outside their control (aka Boeing delay

An extension on certain basis of delay out of their contorl is very possible. even an apparant 2nd extension.I mean, surely they can get a minor extension for a factor that is outside their control (aka Boeing delay). Maybe they’re prepping the -700s to lay the groundwork to say « look we did our best but this isn’t our fault give us a couple of weeks. We’re dead set on launching this route pinky promise ».

What's the point of flying to Japan? what cos there's other airlines encompassing the space.....where could you ever fly without competition?Perhaps just hand it back. Which means they don’t have to worry about ordering a wide body, and it’s damn clear now that United has this trans pacific network well and truly tied down now. Virgin operating pacific would just be a token anyway considering the scale of the others, ie what’s the point.

Likely some ego at stake here. They know that QF will get the slot and it will just boost the margin over the fence. I thought Virgin was done playing those games with QF.

I will seriously enjoy celebrating if this IPO doesn't happen soon cause almost every other post (seems to) references an IPO whch is already rumoured. Then again, if it delayed the comments on this forum will continue.IPO 1st round tour in asia over for now.

I will seriously enjoy celebrating if this IPO doesn't happen soon cause almost every other post (seems to) references an IPO whch is already rumoured. Then again, if it delayed the comments on this forum will continue.

When is the Virgin Australia IPO?

There’s no set date for the Virgin Australia IPO yet and the company will be waiting for the right market conditions. The listing had been rumoured for June 2023, but due to the instability caused by the global banking crisis, the float could be pushed back six months or more.

Virgin Australia IPO: everything you need to know about Virgin Australia

Australia’s second-biggest airline is expected to have one of the country’s largest listings in 2023. Find out everything we know ahead of the Virgin Australia IPO.www.cityindex.com