Has anyone used Citi global account for receiving OS funds? It looks like the exchange rate with CIti is worse by more than 0.5%, so should still be cheaper with the approx 0.5% TW fee?

I just had a quick look at the rates on USD1000 and the TW rate inclusive of fees is still about $8 ahead. Citi website shows a currency spread that citibank uses in a traditional banking way.

A couple of observations might interest some people

Citibank can hold 10 currencies with 10 bank details ie can accept deposit in ten countries

Transferwise can hold 50 currencies with 4 countries of bank.

If you wanted to accept deposits in Hong Kong, Canada , Japan then Citi is the option

If you wanted a good exchange rate into Philippine Peso, Indian rupee then transferWise is the way to go

So for me with TW, I am accepting USD deposits in USA, converting some to AUD and for my contractors in Ph & India, I can convert the money for them at a better rate and send as their local currency than which their receiving banks do if they were to receive it as USD. Also saves me on one conversion of everything coming into AUD first.

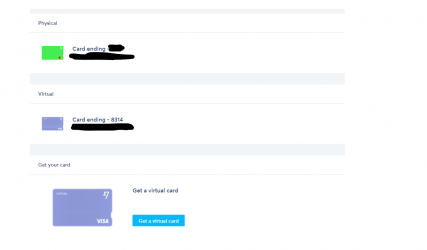

Choosing the right card will make life easy.

Alby