Has anyone used the 'correct info' (or similar) feature (which is really a statutory right) on their credit reports to try and force the credit reporting agencies to mark accounts closed sooner?

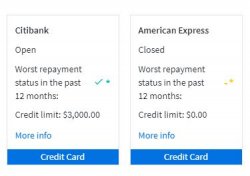

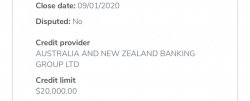

I'm finding that it's currently taking months for closed accounts to be marked as closed - which is significantly slowing down the ability to churn. I'm currently down to just one credit card, which doesn't earn points with a $1k limit. So I'm rather anxious for the closed accounts to be marked as closed so I can apply for a couple of new ones.

I know that Experian don't make it easy - requiring a whole stack of documents by post (which is no doubt very deliberate). However, I've just noticed that Illion (Dun & Bradstreet) via the free NAB credit report interface has a painless process. I've given it a go for my two closed accounts and will report back. However, I'm interested in any other experiences.

I'm finding that it's currently taking months for closed accounts to be marked as closed - which is significantly slowing down the ability to churn. I'm currently down to just one credit card, which doesn't earn points with a $1k limit. So I'm rather anxious for the closed accounts to be marked as closed so I can apply for a couple of new ones.

I know that Experian don't make it easy - requiring a whole stack of documents by post (which is no doubt very deliberate). However, I've just noticed that Illion (Dun & Bradstreet) via the free NAB credit report interface has a painless process. I've given it a go for my two closed accounts and will report back. However, I'm interested in any other experiences.