SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 11,728

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

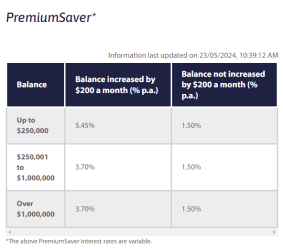

5.6% is 0.5% better than current. So 100k balance will be better off.Yes indeed. I rang them yesterday too, they have released all this information on the internet promoting their new spin and conveniently leave out the interest rate per tier. That’s what everyone needs to know.

Tier 1 $0-$100,000 will probably be 5.6% (including bonus)

Tier 2 will be less than tier 1

Then over $250,000 will be the base rate which is useless.

Anyone with balance over $100,000 will get worse off.

I’ve already moved some of my money to Rabo @5.7% for 4 months. I did that last night.

I’ll still wait for official info before doing anything radical.