- Joined

- May 25, 2013

- Posts

- 1,795

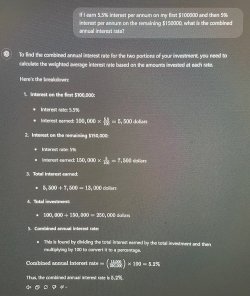

Looks like there's a key difference here: Rabo needs you to increase the balance while UBank only to deposit (and you can even lower the balance overall and still get the high %).The link has reference to the following "Premium Saving" account.