As per

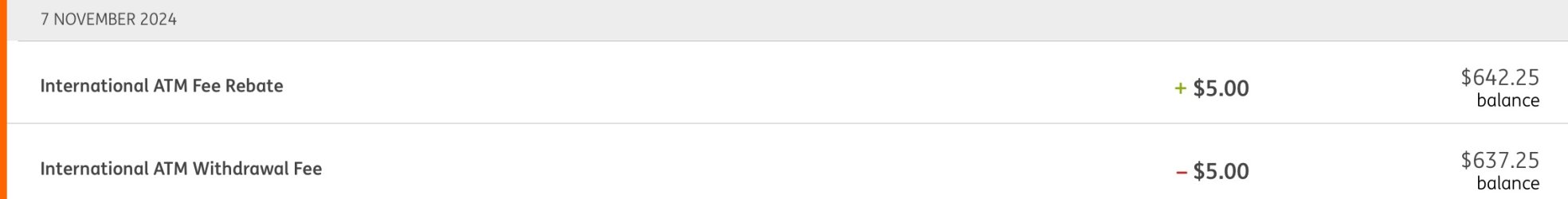

@Cynicor , ING have a fee which they rebate for up to the first 5 per month.

ATM operators may also have a fee. ING used to rebate these as well, but no more. Before this change I would get effectively 5 transactions for an ATM cash withdrawal where the ATM operator charged a fee:

- Actual Withdrawal.

- ING Fee

- ATM operator Fee

- ING Fee reversal

- ATM operator fee reversal

(Sometimes 1 & 3 would be merged to the one amount)

Now where the ATM operator Charges a fee you get effectively four transactions:

- Actual Withdrawal.

- ING Fee

- ATM operator Fee

- ING Fee reversal

(Sometimes 1 & 3 are merged to the one amount)

Note no ATM operator Fee reversal.

And if the ATM Operator does not charge a fee, three transactions:

- Actual Withdrawal.

- ING Fee

- ING Fee reversal