albatross710

Established Member

- Joined

- May 15, 2004

- Posts

- 3,799

Over the past week I've started looking at my travel insurance needs for 2018. Have completely read three policies this week and each one leaving me with the thought that it doesn't suit me.

Question for those that have Annual Travel Insurance policies, what is your process for choosing a policy?

My 2017 travel year included 11 work trips to Asia. One 11 hour delayed luggage, one low cost medical visit to a Philippines hospital, a few 2-3 hour delays.

My travel insurance wish list:

Reimbursement/re-accommodation in times of natural disaster.

Travel Cancellation prior to departure.

Medical cost/evacuation:

Other insurance considerations:

What I discovered:

Westpac Black travel insurance

Excludes claims caused by flood and atmospheric conditions.

$500 spend not always triggered for reward bookings or some domestic travel.

Budget Direct policy

Has some weird exclusions which ruled me out due to family relations.

Alliance multi-trip policy

Ruled this out because of the property depreciation rules. Excludes ziplines & wakeboarding.

So for those with annual policies, how do you choose?

Alby

Question for those that have Annual Travel Insurance policies, what is your process for choosing a policy?

My 2017 travel year included 11 work trips to Asia. One 11 hour delayed luggage, one low cost medical visit to a Philippines hospital, a few 2-3 hour delays.

My travel insurance wish list:

Reimbursement/re-accommodation in times of natural disaster.

Travel Cancellation prior to departure.

Medical cost/evacuation:

Other insurance considerations:

- Flight & airline problems usually seem to be covered by the airline, so not as critical in the insurance.

- Lost luggage seems to be becoming rarer.

- 6 -8 hour Flight delays I'm happy to wear the cost of airport food if needed.

- Sport aviation, wakeboarding & ziplines, maybe I'll do this in 2018 travels.

What I discovered:

Westpac Black travel insurance

Excludes claims caused by flood and atmospheric conditions.

$500 spend not always triggered for reward bookings or some domestic travel.

Budget Direct policy

Has some weird exclusions which ruled me out due to family relations.

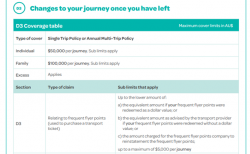

Alliance multi-trip policy

Ruled this out because of the property depreciation rules. Excludes ziplines & wakeboarding.

So for those with annual policies, how do you choose?

Alby