You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wise debit card

- Thread starter neils2004

- Start date

albatross710

Established Member

- Joined

- May 15, 2004

- Posts

- 3,797

The cash limit is a big drawback. It depends on where you are travelling. Modern countries Japan, Singapore where everything is paywave the cash doesn't mater. Philippines, Vietnam it is more critical.I was responding to another general question about getting a Wise account. For someone who just wants to get cash from an ATM OS, there are easy / better options IMHO.

But I am a fanboy for Wise just for clarity and immediateness of transaction amounts. Spend JPY400 on a coffee and it's immediately visible as a JPY400 drawdown on the JPY balance. I also spin up a virtual card for each trip for in country Grab app, train trips etc etc. Upon completion of the journey I cancel that virtual card and any registrations I made with it are useless.

Another favourite I have is for those "free" subscriptions which require a card to activate them with the idea that you will forget the auto-renewal. I use a virtual card for the registration and then freeze the virtual card. I can then choose to pay again when they prompt me instead of navigating the tortuous path to cancelling a subscription.

VPS

Senior Member

- Joined

- Apr 2, 2011

- Posts

- 9,361

- Qantas

- LT Gold

- Virgin

- Gold

Yes - that is one reason I love WiseThe cash limit is a big drawback. It depends on where you are travelling. Modern countries Japan, Singapore where everything is paywave the cash doesn't mater. Philippines, Vietnam it is more critical.

But I am a fanboy for Wise just for clarity and immediateness of transaction amounts. Spend JPY400 on a coffee and it's immediately visible as a JPY400 drawdown on the JPY balance. I also spin up a virtual card for each trip for in country Grab app, train trips etc etc. Upon completion of the journey I cancel that virtual card and any registrations I made with it are useless.

Another favourite I have is for those "free" subscriptions which require a card to activate them with the idea that you will forget the auto-renewal. I use a virtual card for the registration and then freeze the virtual card. I can then choose to pay again when they prompt me instead of navigating the tortuous path to cancelling a subscription.

The virtual cards for travelling are great

Subscriptions where they won't let you cancel online and you have to call - nope just cancel the virtual card

I too have alternatives for taking cash out but transferring money around is so easy

- Joined

- May 4, 2013

- Posts

- 164

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

I found the Wise card to be useful for buying fuel sometimes in UK. Many petrol stations are unattended after hours. Normal Australian cards didn't work with chip and pin. They'd require chip and signature. Tap and go was hard limited to £50 per transaction. At many petrol stations, their system requests pre-authorization of £90, meaning that wouldn't work either. I think that UK's limit for tap and pay is being increases, plus, if you use your phone instead of a card, the limit now doesn't apply either. But that's only useful as long as your phone is working.

clifford

Established Member

- Joined

- Jul 6, 2004

- Posts

- 3,588

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

My wife and I have become a little wary of Wise.

I've been with Wise for a year or two (UK based) and my wife has just set up an account (AU based). We've sent a few AUD/GBP to each other just to check that everything was set up OK and all was working.

On a couple of occasions Wise would not complete the processing of the transaction until additional "verification" was entered into the app. For example, my wife was forced to enter the details of her employment status (including $$$) before it would complete the transaction.

Fair enough, many might say, but if this info is required why not do it when the account is being set up? No one would want to have to go through this nonsense in the middle to making a critical payment...

I'm not sure if the work experience kids they have to do the programming are really up to it.

I've been with Wise for a year or two (UK based) and my wife has just set up an account (AU based). We've sent a few AUD/GBP to each other just to check that everything was set up OK and all was working.

On a couple of occasions Wise would not complete the processing of the transaction until additional "verification" was entered into the app. For example, my wife was forced to enter the details of her employment status (including $$$) before it would complete the transaction.

Fair enough, many might say, but if this info is required why not do it when the account is being set up? No one would want to have to go through this nonsense in the middle to making a critical payment...

I'm not sure if the work experience kids they have to do the programming are really up to it.

markis10

Veteran Member

- Joined

- Nov 25, 2004

- Posts

- 31,122

- Qantas

- LT Gold

- Virgin

- Red

- Oneworld

- Sapphire

KYC requirements kick in at certain transaction levels, ING and others are no different, and they purposely don’t start when you open an account, presumably to reduce the need to do one with only active customers. It’s Austrac, not wise playing here,

Previously ING bugged me on a frequent basis, and didn’t recognise super KYC as sufficient for transaction accounts, one having a lot more in the super anyway, grrr

Previously ING bugged me on a frequent basis, and didn’t recognise super KYC as sufficient for transaction accounts, one having a lot more in the super anyway, grrr

- Joined

- Dec 18, 2020

- Posts

- 453

- Virgin

- Platinum

- Oneworld

- Sapphire

- Star Alliance

- Gold

My wife has had the same issue that @clifford describes.KYC requirements kick in at certain transaction levels, ……

I have had a Wise account for many years and make transactions measured in thousands of dollars due to having UK credit cards and interests and US amex but living in Australia

At my suggestion, my wife set up an account when we travelled recently. As it turned out she had no cause to use it. But has used it lately to keep a specific work related event separate from her other (normal) bank accounts. Her transactions are measured in tens of dollars and multiple have been suspended due to verification checks. Based on the utter stupidity of the reasoning behind these suspensions (referring to a person’s name in the ‘Description/Reference’ box of a transaction as a possible ‘ocean going vessel’ and asking for owner & country of registration details, I can only assume that it is an extremely (!) poorly written algorithm catching more than intended

For people like me, it’s a tech issue that i can understand and tolerate with the patience to persist - for people like my wife who just wants technology to work as intended it is wildly frustrating and immensely annoying. I can’t imagine her patience lasting much longer.

Revolut is the backup plan but I don’t favour it because it doesn’t offer Sort Code & account details (and the US equivalent) like Wise does for offshore currencies

- Joined

- Nov 12, 2012

- Posts

- 29,021

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

@RooFlyer did you sort out your Wise £ account

Not yet - my UK purchaser hasn't confirmed yet, so I haven't gotten off my backside to look to do it.

albatross710

Established Member

- Joined

- May 15, 2004

- Posts

- 3,797

I have had a Wise account for many years and make transactions measured in thousands of dollars due to having UK credit cards and interests and US amex but living in Australia

My experience with Wise also made me Wise up to the risks with these platforms. I'm still with them and using it but much more aware.

Opening the business account mid 2020.

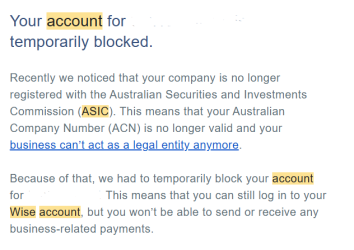

Two tears later out of the blue I received this email

So a flurry of checking and of course all of my ASIC returns are up to date, business names are active and current. My USA customer payments are immediately getting bounced. My Wise funds are locked.

Turns out that there was a mis-match or problem with how they checked my ABN to ASIC. No explanation or apology given but the account was back in operation after two weeks of email ping pong.

Definitely need to be aware of this.

Now, I rarely hold large sums on Wise, but just use it as a cost effective conduit.

- Joined

- Dec 7, 2011

- Posts

- 748

- Virgin

- Gold

- Star Alliance

- Gold

IMO, I am happy they are being cautious with the number of sophisticated scams around although the lack of an apology is unacceptable.

- Joined

- Dec 18, 2020

- Posts

- 453

- Virgin

- Platinum

- Oneworld

- Sapphire

- Star Alliance

- Gold

I understand the sentiment but from my wife’s experience (and @albatross710 it would seem) their caution is manifest in indolence and incompetence.IMO, I am happy they are being cautious with the number of sophisticated scams around although the lack of an apology is unacceptable.

This results in interruptions to personal and business financial transactions which, frankly, are unacceptable in the modern era.

They need to spend the time and money to write algorithms that actually work as intended and have human surveillance of the results. Self evidently they don’t

Ultimately, they are not protecting you or me, they are protecting themselves

clifford

Established Member

- Joined

- Jul 6, 2004

- Posts

- 3,588

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

Yes, indeed, I've had a few issues with them over the years.Ultimately, they are not protecting you or me, they are protecting themselves

They change the goalposts all the time, and just a week ago asked me to verify myself before I could receive a payment from my wife's Wise account. I've been verified several times previously (!), or how else could I have been using their services? What is this carp? They seem to assume that everone using their services is a potential criminal. I bank with several UK High Street banks and don't get this garbage.

I certainly don't trust Wise and would never leave more than a $100 float in any of my accounts with them. As far as I am concerned they are a bank of last resort, when there isn't any real viable alternative.

CMA222

Active Member

- Joined

- Oct 15, 2009

- Posts

- 928

Interesting as I, touch wood, have never had an issue in the many years I have been using Wise. I find them to be "as good as any bank" which is not setting the bar too high. I have had some very large transactions delayed a couple of days, just like the banks do for new account transfers, and that is to comply with local regulations like AUSTRAC, and to protect both them and the Customer.Yes, indeed, I've had a few issues with them over the years.

......

I certainly don't trust Wise and would never leave more than a $100 float in any of my accounts with them. As far as I am concerned they are a bank of last resort, when there isn't any real viable alternative.

They are heavily regulated (like the banks)"

Wise Australia Pty Ltd. is regulated by the Australian Securities and Investments Commission (ASIC) and holds an Australian Financial Services Licence (AFSL) and Australian Prudential Regulation Authority (APRA) authorised as an Authorised Deposit-taking Institution (ADI) limited to a provider of purchased payment facilities (“PPF licence”). Its AFSL licence number is 513764. It is also a reporting entity with the Australian Transaction Reports and Analysis Centre (AUSTRAC).

Wise Australia Investments Pty Ltd. is regulated by the Australian Securities and Investments Commission (ASIC) and holds an Australian Financial Services Licence (AFSL). Its AFSL number is 545411. Wise Australia Investments Pty Ltd is also a reporting entity with the Australian Transaction Reports and Analysis Centre (AUSTRAC).

and moving forward we are expecting the banks and other financial institutions to take responsibility for any losses we incur due to fraud, often arising from our stupidity or naivety . They need to protect themselves by being overly cautious and that involves mere mortals trying to get computers to check transactions, have recent verification with no way to understand relationships, to ultimately demonstrate the precautionary steps they have taken in the event of a loss incident. It is the price we pay for on-line convenience, in my view.

Each to their own.

A near universal experience with banks these days is that they're fine until you get caught up in their fraud/risk crosshairs. Then they become a nightmare to deal with.

Search for any bank name and 'account closure' on Google, and you'll find tales of woe and misery from people who have experienced shut downs with no explanation, no ability to appeal, money held up for months/years, etc etc.

Wise is probably a little more sensitive than most banks because it deals with so many cross-border transactions, so it is dealing with a lot more compliance issues than your typical domestic bank.

Search for any bank name and 'account closure' on Google, and you'll find tales of woe and misery from people who have experienced shut downs with no explanation, no ability to appeal, money held up for months/years, etc etc.

Wise is probably a little more sensitive than most banks because it deals with so many cross-border transactions, so it is dealing with a lot more compliance issues than your typical domestic bank.

OT but I'd really like to know more about your comment on petrol station prepayments, that while au issued cards don't work, using that same card on say Google Wallet does work (£50 limited)? That would avoid a big hassle, I wonder if it's the same in USA.I found the Wise card to be useful for buying fuel sometimes in UK. Many petrol stations are unattended after hours. Normal Australian cards didn't work with chip and pin. They'd require chip and signature. Tap and go was hard limited to £50 per transaction. At many petrol stations, their system requests pre-authorization of £90, meaning that wouldn't work either. I think that UK's limit for tap and pay is being increases, plus, if you use your phone instead of a card, the limit now doesn't apply either. But that's only useful as long as your phone is working.

- Joined

- May 4, 2013

- Posts

- 164

- Qantas

- Gold

- Virgin

- Red

- Oneworld

- Sapphire

It was explained to me a few years ago that there's a difference in how the PIN is validated in the Australian banking system vs UK / EU. I don't remember what the difference was, as that was a few years ago. But my understanding is that the way it's stored in Google Wallet / Apple Pay is the same worldwide. Based on that, I suspect that if people in the USA are able to do that with their locally issued cards, it would likely work there, too. But I've never been to the USA, so I don't really know.OT but I'd really like to know more about your comment on petrol station prepayments, that while au issued cards don't work, using that same card on say Google Wallet does work (£50 limited)? That would avoid a big hassle, I wonder if it's the same in USA.

Pete98765432

Member

- Joined

- Apr 3, 2013

- Posts

- 304

- Qantas

- Platinum

- Virgin

- Red

That’s right, it’s the difference between offline and online PIN verification. UK and much of EU use offline verification where the PIN is stored on the card chip. Australia (and US) use online verification where the PIN is verified against the issuing bank’s records. That’s why we can change PIN online but in the UK you have to do it in branch or ATM. Wise use offline verification, therefore it works at the petrol pump in UK & EU.It was explained to me a few years ago that there's a difference in how the PIN is validated in the Australian banking system vs UK / EU. I don't remember what the difference was, as that was a few years ago. But my understanding is that the way it's stored in Google Wallet / Apple Pay is the same worldwide. Based on that, I suspect that if people in the USA are able to do that with their locally issued cards, it would likely work there, too. But I've never been to the USA, so I don't really know.

- Joined

- Nov 12, 2012

- Posts

- 29,021

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

Thanks that’s interesting to know. I wonder if also have something to do with the fact that my NAB credit card, when I tap it onto a EFTPOS machine, it requires a pin but if I use it as stored on my Apple Watch it never does.That’s right, it’s the difference between offline and online PIN verification. UK and much of EU use offline verification where the PIN is stored on the card chip. Australia (and US) use online verification where the PIN is verified against the issuing bank’s records. That’s why we can change PIN online but in the UK you have to do it in branch or ATM. Wise use offline verification, therefore it works at the petrol pump in UK & EU.

So au card in Google Wallet might work at UK petrol stations but not at US "gas" stations?That’s right, it’s the difference between offline and online PIN verification. UK and much of EU use offline verification where the PIN is stored on the card chip. Australia (and US) use online verification where the PIN is verified against the issuing bank’s records. That’s why we can change PIN online but in the UK you have to do it in branch or ATM. Wise use offline verification, therefore it works at the petrol pump in UK & EU.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- dairyfloss

- markis10

- Auer_Rods

- Strikes

- jbmarshall90

- deka2

- WrenchHammerMcTool

- Oscarq

- Brissy1

- dsdavidc

- ellen10

- Chris1985

- asterix

- jc123

- sidereal

- n7of9

- kpc

- SYD

- utaussiefan

- Cottman

- There'sOnlyOneJimmy

- Saab34

- Beachy55

- texter

- Franky

- Ikara

- bawbag

- Flyfrequently

- Quickstatus

- Steady

- desafinado74

- NinnyPoo

- BJReplay

- redwoodw

- AuSammy

- georgie23

- twinaisle

- GarrettM

- US_Amex

- scotty_mel

- L2.

- Kerrodt

Total: 746 (members: 51, guests: 695)