I absolutely understand how it works. The card issuer beats the cost of a fraudulent transaction unless they find a way to pass the cost on to someone else (the merchant).

And the thing is that a fraudulent transaction is the easiest chargeback of all to prove, and so it is passed back to the merchant, or if the merchant can't be made accountable, the merchants bank.

The OP was annoyed with the card issuer for two reasons: One - it took 3/4 of an hour to get through to customer service, and Two, they let through 3 high value transactions, but now require him to authenticate low value transactions. I found that pretty clear. <redacted>

Read the rules: https://www.visa.com.au/content/dam/VCOM/download/about-visa/visa-rules-public.pdf

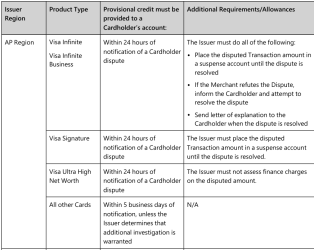

4.1.13.1: In the AP Region, Canada Region, CEMEA Region, LAC Region, US Region: An Issuer must provide provisional credit for the amount of a dispute or an unauthorized Transaction (as applicable) to a Cardholder’s account, as follows:

That means the OP should get their provisional credit within 5 business days.

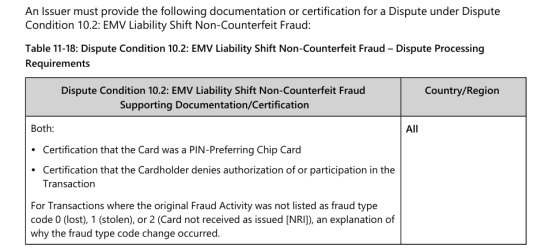

11.7.3.5 Dispute Condition 10.2: EMV Liability Shift Non-Counterfeit Fraud – Dispute Processing Requirements

Or

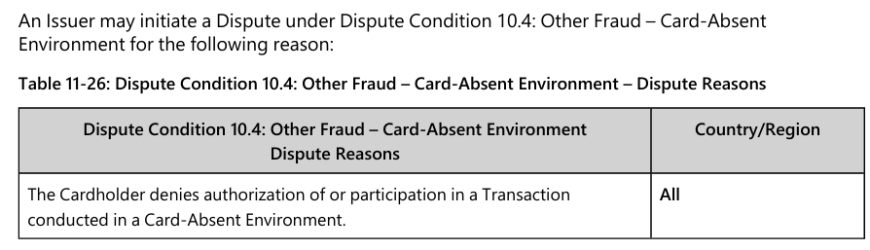

11.7.5.1 Dispute Condition 10.4: Other Fraud – Card-Absent Environment – Dispute Reasons

All HSBC has to do is provide the customer's certification that they didn't authorise the charge. This fraud was clearly either card not present, or someone is using saved credentials.

Please read the rules and explain how HSBC will end out of pocket?

Last edited by a moderator: