MelbFlyer

Active Member

- Joined

- Jun 20, 2022

- Posts

- 839

- Qantas

- Silver

- Oneworld

- Ruby

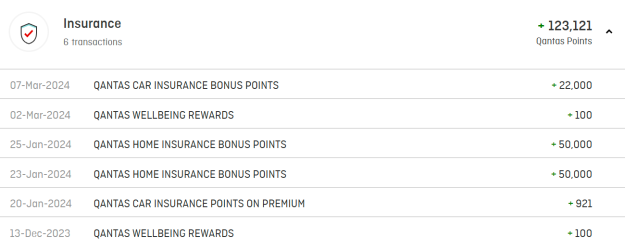

Still looking at changing over to Qantas Car Insurance as it is cheaper than my current insurer and many others - but my current policy isn't up until the end of May.

I'm also not going to change policies early as my current policy is around 60% the price of any new ones now. If the offer was for say, 100k bonus points then maybe I'd consider ending it early, but for up to 20k it's not worth it.

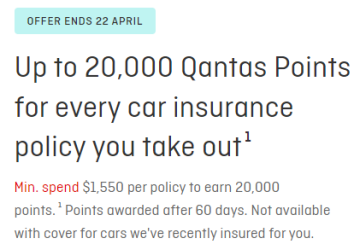

I can see that the current offer is up to 20k points and ends on 22/04.

I assume that if I sign-up before 22/04 and have my policy start at the end of May (with the charge to then be made then), that I'd still be eligible for up to 20k points considering I signed up before the promo ended even despite the service not being active until EOM May?

I would then obviously turn off / call up to request to turn off auto-renew etc.

I'm also not going to change policies early as my current policy is around 60% the price of any new ones now. If the offer was for say, 100k bonus points then maybe I'd consider ending it early, but for up to 20k it's not worth it.

I can see that the current offer is up to 20k points and ends on 22/04.

I assume that if I sign-up before 22/04 and have my policy start at the end of May (with the charge to then be made then), that I'd still be eligible for up to 20k points considering I signed up before the promo ended even despite the service not being active until EOM May?

I would then obviously turn off / call up to request to turn off auto-renew etc.