Mr_Orange

Senior Member

- Joined

- Jun 17, 2013

- Posts

- 5,632

Anyone have thoughts/comments about GRR?

Smaller resources companies are tricky. A new low above 64c with a turn back up would be pretty bullish though.

Anyone have thoughts/comments about GRR?

Yeah Grange, in at 0.30 out at 0.62. Held on FMG though.Grr?

I'm still angry I didn't buy them over a year agoSquare circles on Afterpay deal

price rockets

Afterpay (ASX:APT) share price up 29% after takeover & FY 2021 update

The Afterpay Ltd (ASX:APT) share price is surging higher after agreeing to be acquired by Square and releasing its FY 2021 trading update...www.fool.com.au

I'm still angry I didn't buy them over a year ago

I sold out at 140 but don’t mind ..I'm still angry I didn't buy them over a year ago

Well, at $3100 a bottle, not bad for a $7.21 buy!@Steady , FWIW, I reckon Grange is pretty sound wrt geology and ore reserves; good product and good life potential, even after 50 years!

Sometimes you refer to yourself, other times it's we. Who are you buying on behalf of, any of these investments your own wad?We went for Rubicon Water which is doing a pre IPO raising using sophisticated investors today. That came thru Bell Potter.

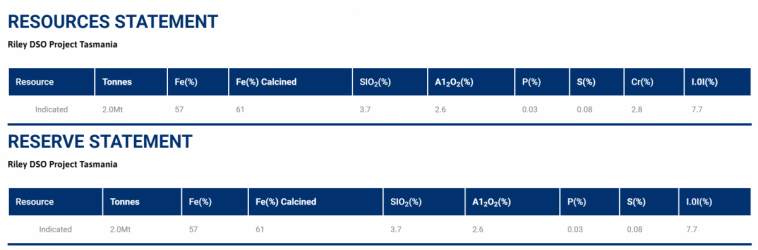

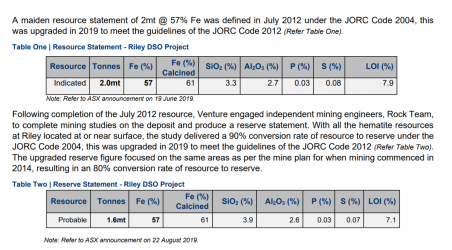

VMS just away to start shipping Iron Ore from Tasmania, but it's the tin deposit i'm more interested in that will be funded by the ore, plus the JV with CHN on a Julimar copy deposit