You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AFF Member Stock Discussion

- Thread starter samh004

- Start date

Newbie question, regarding shares: what's short and long

Mr_Orange

Senior Member

- Joined

- Jun 17, 2013

- Posts

- 5,813

Newbie question, regarding shares: what's short and long

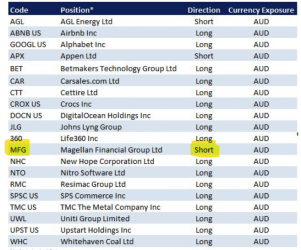

A short position is one where you believe the stock price will decrease.

A long position is one where you believe the stock price will increase.

Most people only hold long positions.

Short positions can be traded as @cove has said or by using derivatives such as a CFD (Contract for Difference) or Futures.

There are also ETFs that allow you to trade more generalised short positions such as ASX:BEAR. This is an inverted product in that the price goes up when the market goes down so if you are bearish about the market you buy a long position in BEAR.

Last edited:

Mr_Orange

Senior Member

- Joined

- Jun 17, 2013

- Posts

- 5,813

You need a tried and tested strategy for short term trading otherwise the market will eat your capital in no time. Long term or short term though you need to get yourself into a mental space where you can take a loss and move on when a trade doesn't work out. It's harder than you think.Thank you. Going to start looking into shares. Not sure for long term gain or short term buy and sell. I think the later is harder huh?

Buzzard

Senior Member

- Joined

- Jan 22, 2013

- Posts

- 6,997

For long term, not short term / trading, you can do a lot worse than investigate investing in an LIC such as AFI or Argo, or having a look at the various Vanguard ETF options. You may also want to consider some international exposure with Vanguard, after all Australia is such a small player on the world stage. I'm not giving you financial advice simply suggesting where you might head for more research.Thank you. Going to start looking into shares. Not sure for long term gain or short term buy and sell. I think the later is harder huh?

Gladstone Tim

Member

- Joined

- Feb 8, 2021

- Posts

- 217

My father was a serious long-term investor so I have a general understanding. However, it is 35+ years ago since I lived at home. Where would you suggest one gains up-to-date understanding? I am keen to invest as a hobby as well as make a profit where possible, as I plan my not-too-distant retirement.

Buzzard

Senior Member

- Joined

- Jan 22, 2013

- Posts

- 6,997

A good place to start would be read some books. I would highly recommend Noel Whittaker, he knows what he's talking about. Check out his website too.My father was a serious long-term investor so I have a general understanding. However, it is 35+ years ago since I lived at home. Where would you suggest one gains up-to-date understanding? I am keen to invest as a hobby as well as make a profit where possible, as I plan my not-too-distant retirement.

I would avoid Motley Fool like the plague, or the virus.

Some people play the game and are more traders than investors. If you're an investor I would suggest quality and consider 5 to 10 years as a minimum to hold for. If you panic and sell in a downturn, and there will be one, you will lock in your loss.

Gladstone Tim

Member

- Joined

- Feb 8, 2021

- Posts

- 217

A good place to start would be read some books. I would highly recommend Noel Whittaker, he knows what he's talking about. Check out his website too.

I would avoid Motley Fool like the plague, or the virus.

Some people play the game and are more traders than investors. If you're an investor I would suggest quality and consider 5 to 10 years as a minimum to hold for. If you panic and sell in a downturn, and there will be one, you will lock in your loss.

Thank you.

TheRealTMA

Senior Member

- Joined

- Jul 13, 2012

- Posts

- 8,340

- Qantas

- Platinum

Subscribe to a couple of investment newsletters, particularly the more conservative ones, or not, depending on your risk profile.My father was a serious long-term investor so I have a general understanding. However, it is 35+ years ago since I lived at home. Where would you suggest one gains up-to-date understanding? I am keen to invest as a hobby as well as make a profit where possible, as I plan my not-too-distant retirement.

Join an online share portal, maybe one of the banks or other.

Use the excellent Microsoft Excel Share functions to do what ifs for a while and see which newsletters or advisors have a track record over a 6-12 month period.

look for long term investments in shares with good franked dividends.

Don’t overreact to market trends or newspaper articles.

Don’t believe all you read on AFF. A number of members are sophisticated investors with long term plans.

Mr_Orange

Senior Member

- Joined

- Jun 17, 2013

- Posts

- 5,813

The best thing you can do is to learn to read a chart and understand what it is telling you.

Don't even read them.

Don't believe anything you read about a particular stock. The news is there to get you, the retail investor, to do what the professionals want you to do so that they can make more money at your expense.

Don’t overreact to market trends or newspaper articles.

Don't even read them.

Don’t believe all you read on AFF.

Don't believe anything you read about a particular stock. The news is there to get you, the retail investor, to do what the professionals want you to do so that they can make more money at your expense.

Ok here is some non financial advice......

Start investing in yourself by getting your home mortgage to zero (or close to zero if you want to do a re-draw). Keep your property fully insured.

Next you can concentrate on getting your superannuation into great shape as it is tax advantaged.

Once you have done this you can get into investing in shares and funds outside of superannuation.

These are purely our thoughts and not financial advice.

Start investing in yourself by getting your home mortgage to zero (or close to zero if you want to do a re-draw). Keep your property fully insured.

Next you can concentrate on getting your superannuation into great shape as it is tax advantaged.

Once you have done this you can get into investing in shares and funds outside of superannuation.

These are purely our thoughts and not financial advice.

Gladstone Tim

Member

- Joined

- Feb 8, 2021

- Posts

- 217

Ok here is some non financial advice......

Start investing in yourself by getting your home mortgage to zero (or close to zero if you want to do a re-draw). Keep your property fully insured.

Next you can concentrate on getting your superannuation into great shape as it is tax advantaged.

Once you have done this you can get into investing in shares and funds outside of superannuation.

These are purely our thoughts and not financial advice.

Thanks, Cove. Pretty much have those aspects in place. Home mortgage can be at zero if a redrawble account, just reducing by the amount of the originally scheduled payment each month. Seeing the financial advisor again in January so will also get his advice re shares.

I second advice on the books. Head to Goondoon St, they had I think a couple Noel Whittaker's books. I've also borrowed Motivated Money by Peter Thornhill and JL Collins Simple path to wealth. Highly recommend both of those, especially the latter.My father was a serious long-term investor so I have a general understanding. However, it is 35+ years ago since I lived at home. Where would you suggest one gains up-to-date understanding? I am keen to invest as a hobby as well as make a profit where possible, as I plan my not-too-distant retirement.

Yes @Gladstone Tim your financial advisor is registered to be able to give you financial advice.

Because I had some health issues in 1994 I fast forwarded some lifestyle assets after i prepaid my two sons education and paid out the house mortgage.

Then we had to get to those places so we got stuck into frequent flyer points and miles.

Now that we haven’t been travelling much the stock market and industrial real estate has been a good place for us.

We are planning to go to the Finbar AGM as the directors need some questions to answer. They have been underperforming Profit wise.

Because I had some health issues in 1994 I fast forwarded some lifestyle assets after i prepaid my two sons education and paid out the house mortgage.

Then we had to get to those places so we got stuck into frequent flyer points and miles.

Now that we haven’t been travelling much the stock market and industrial real estate has been a good place for us.

We are planning to go to the Finbar AGM as the directors need some questions to answer. They have been underperforming Profit wise.

- Joined

- Apr 6, 2018

- Posts

- 2,886

I use an online platform with the yellow bank - which is all I need.Investing hasn't really changed except for the availability of internet-based broking platofrms meaning you don't need a broker that buys and sells on your behalf, unless of course you want that.

I do all my own research/ trading on my phone - for the long term (Always reinvest dividends when I can) and about 5% I play with for speculations/fun.

….. Its very easy to sign up as I only want a portal not all the rest.

As I do more than a certain number trades per month brokerage becomes free.

I like reading Warren Buffet. Re: newsletters and other spruikers - they only have a business model by taking your money and if riches were that simple to make - why give it away?

e.g I do get access to info re broker recommendations/valuations etc because of my trading volume

…invariably I read about stock X - expert a - strong buy b- strong hold and c- strong sell…

So - the above is just my experience and - as everyone says this is not financial advice - do your research including whose research you will listen to.

Warren Buffet says only invest what you could tolerate losing 50% in a day (given Black Monday was 25-40% drop depending where you were) I like that..

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.