You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ATO (tax office) payments by credit card

- Thread starter js

- Start date

JohnM

Enthusiast

- Joined

- Jun 7, 2006

- Posts

- 11,804

- Qantas

- LT Gold

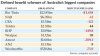

There are some big hitters that could heed that advice...the big red one is a worry.

View attachment 51462

Whoa! They still have DB schemes in private companies? Or is this just a legacy component?

LOTFAP is nuts with DB schemes. The case that blows me is the NYPD - it pays out more in pensions to retired officers than in salaries to serving officers! I know of university staff there who (claim to) retire on 100% of their final salary :shock:.

quokka77

Active Member

- Joined

- Feb 21, 2013

- Posts

- 656

Yes, the officially stated purpose of super is to "fund retirement" but i am worried by moves to push the retirement age higher, as well as talk of pushing super earnings tax rates higher / taxing withdrawals. So if they give me the option to pull my extra super tax obligation from the fund rather than my own pocket, at the age of 37, with my own mortgage to pay, I'm not inclined to leave it in super.

And thanks also for confirming my inclination NOT to dabble in smsf!

And thanks also for confirming my inclination NOT to dabble in smsf!

JohnM

Enthusiast

- Joined

- Jun 7, 2006

- Posts

- 11,804

- Qantas

- LT Gold

The City of Bell scandal in Los Angeles allowed some pensions to be revoked or reduced Google that one if you want an amazing read about LOTFAP.

Wow - that's all very nasty.

JohnM

Enthusiast

- Joined

- Jun 7, 2006

- Posts

- 11,804

- Qantas

- LT Gold

Latest thinking is you need around $2 million to retire at 65 in a major Australian city. Most folks who use only the employer contributions and no salary sacrificed funds will not be warm to this number after 45 years of contributions.

Nowhere near it. It's easy to set up a simple spreadsheet to show that.

For the middle-level of income earners, 20% of your income into super is a more realistic target than 9.5%, I would suggest. IIRC, the original intention of the Hawke/Keating super guarantee was that it would eventually rise to 15% of income. Of course, in the absence of an ongoing inflation-breaking Accord with its trade-offs, and a changed government, that got put on the never-never.

It is no wonder that 80% of people are still expected to be on at least a part age pension well into the future. And with average life longevity from birth increased by at least 10 years just in our lifetime, Cove, with no commensurate increase in the working lifetime, there is bound to be problems. And that's not adjusting for the declining proportion of the population in work and paying taxes.

quokka77

Active Member

- Joined

- Feb 21, 2013

- Posts

- 656

$2 million will take some accumulating. I'm not a low income earner by any means, and am maximising tax effective super contributions, as well as accumulating managed funds. Barring inheritance (hopefully not anytime soon) by my calculations I may not hit that figure. Still, if I can't do it, i can't see there will be (m)any others who will manage it.

JohnM

Enthusiast

- Joined

- Jun 7, 2006

- Posts

- 11,804

- Qantas

- LT Gold

$2 million will take some accumulating. I'm not a low income earner by any means, and am maximising tax effective super contributions, as well as accumulating managed funds. Barring inheritance (hopefully not anytime soon) by my calculations I may not hit that figure. Still, if I can't do it, i can't see there will be (m)any others who will manage it.

The vast majority simply will not. And that's recognised in the inter-generational reports.

However, offsetting that is the advertising bombardment from super funds that glosses over the brutal reality to paint a glowing picture.

JohnM

Enthusiast

- Joined

- Jun 7, 2006

- Posts

- 11,804

- Qantas

- LT Gold

I told my sons to go to 20% contribution rate.

And they are still quite young guys - so they have a chance of capturing the magic of compound interest, to boot.

lovetravellingoz

Enthusiast

- Joined

- Jul 13, 2006

- Posts

- 12,743

Latest thinking is you need around $2 million to retire at 65 in a major Australian city. Most folks who use only the employer contributions and no salary sacrificed funds will not be warm to this number after 45 years of contributions.

I think the Superfunds are in hyper marketing drive to attract funds.

$2 million would be a lot more than most would need, and particularly if they own their own home.

If a couple that would be $4 million.

I will be more than comfortable myself. But I think the numbers being bandied about by the super industry are not required by most even after allowing for continued puning of the aged pension (which I have no intention of every receiving).

I think $2million for a couple would probably work. I have been getting hit up with 30% contribution rate to the ATO under the additional surcharge rules so that hurts a bit.

We have Advanced Health Directives in place to tell the health authorities how we wish to be treated should we suffer a catastrophic health event. This will allow for pain relief and stopping life extending treatments. I had thought each State Government had promoted this but apparently it is a Western Australian Health Department initiative.

We have Advanced Health Directives in place to tell the health authorities how we wish to be treated should we suffer a catastrophic health event. This will allow for pain relief and stopping life extending treatments. I had thought each State Government had promoted this but apparently it is a Western Australian Health Department initiative.

JohnM

Enthusiast

- Joined

- Jun 7, 2006

- Posts

- 11,804

- Qantas

- LT Gold

We have Advanced Health Directives in place to tell the health authorities how we wish to be treated should we suffer a catastrophic health event. This will allow for pain relief and stopping life extending treatments. I had thought each State Government had promoted this but apparently it is a Western Australian Health Department initiative.

Not so, cove. If you go onto the NSW and Qld Health Dept's websites you'll see AHD forms there (I haven't looked at any other states).

In fact, I thought the NSW supporting information was more informative than the WA version which I thought was quite sketchy. So when I thought about doing mine (following your revelation to me about AHDs, BTW), I referred to the NSW one to get a better idea of the concept before I sat down with my GP and did mine.

Needless to say, perhaps, but my GP embraced me with open arms when I initiated the subject of an AHD - and I'm still as healthy and fit as a mallee bull.

- Joined

- Nov 12, 2012

- Posts

- 31,153

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

<snip>

Needless to say, perhaps, but my GP embraced me with open arms when I initiated the subject of an AHD - and I'm still as healthy and fit as a mallee bull.

Yeah, hence your goading me up Hyanu Picchu

JohnM

Enthusiast

- Joined

- Jun 7, 2006

- Posts

- 11,804

- Qantas

- LT Gold

Yeah, hence your goading me up Hyanu Picchu. I swear you were trying to get me to have a coronary. Fit as a mallee bull I am not (the wine drinkers forum, refers)!

Hang on, mate, I do both - and I'm twice your age

Eggsbenedict

Member

- Joined

- Nov 28, 2013

- Posts

- 405

Hi guys, I'm pretty sure this has been answered in this Thread but I am hoping someone can save me the time  Hoping to get some feedback on prepaying (going into credit) for ATO payments with ANZ Black Rewards and CBA Diamond. Any issues with the points?

Hoping to get some feedback on prepaying (going into credit) for ATO payments with ANZ Black Rewards and CBA Diamond. Any issues with the points?

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

Total: 459 (members: 9, guests: 450)