You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Australian Housing Affordability Discussion

- Thread starter medhead

- Start date

- Status

- Not open for further replies.

CaptJCool

Established Member

- Joined

- May 31, 2012

- Posts

- 4,093

Re: The totally off-topic thread

And thus a perfect example of the capitalist democracySo various millionaires factories clip the ticket multiple times, the increased fees and charges for all utilities puts up the costs of doing business and cost of living for the community as a whole - and the pollies smile. Looking forward to their well-earned post-retirement directorships.

Forgetting climate change for a minute - Australia has the lowest cost fuel supply for power generation (when looking at sunk costs aka existing power plants) yet we pay virtually the highest price for electricity in the world.

.

Re: The totally off-topic thread

Well, unfortunately just over half the States that set this going were ALP dominated at the time.

Just like the pigs in "Animal Farm" left or right makes no difference when it comes to snouts in the public trough!

And thus a perfect example of the capitalist democracy

Well, unfortunately just over half the States that set this going were ALP dominated at the time.

Just like the pigs in "Animal Farm" left or right makes no difference when it comes to snouts in the public trough!

whatmeworry

Established Member

- Joined

- Jan 22, 2007

- Posts

- 4,623

Re: The totally off-topic thread

A major solar array can be set up in a year. Coal power takes many years to set up. A provider would need that coal power plant running for 30 years for a decent return on investment. Renewables are getting cheaper everyday. Battery storage is improving rapidly. Don't forget the pollution caused by coal mining and burning.

Mine pollution levels in Blue Mountains could be some of world's worst, insect species dying out - ABC News (Australian Broadcasting Corporation)

If it really was a capitalist democracy we would still be running with coal generation.

Of course people wouldn't like that either.

A major solar array can be set up in a year. Coal power takes many years to set up. A provider would need that coal power plant running for 30 years for a decent return on investment. Renewables are getting cheaper everyday. Battery storage is improving rapidly. Don't forget the pollution caused by coal mining and burning.

Some of the worst environmental pollution in the world has been discovered among the World Heritage-listed Blue Mountains, according to researchers from Western Sydney University.

For several years, environmental science lecturer Ian Wright and his team has been studying the effect of the Clarence Colliery on the Wollangambe River, which runs deep within the Wollemi National Park.

Since the 1980s the operators of the underground coal mine, Centennial Coal, have been allowed to discharge mine waste into the river under its environmental licence.

Mine pollution levels in Blue Mountains could be some of world's worst, insect species dying out - ABC News (Australian Broadcasting Corporation)

whatmeworry

Established Member

- Joined

- Jan 22, 2007

- Posts

- 4,623

Re: The totally off-topic thread

Australia is the number one destination for millionaires.

Foreign real estate investment jumps 75pc in a year, FIRB report reveals - ABC News (Australian Broadcasting Corporation)

Australia is the number one destination for millionaires.

An estimated 11,000 millionaires moved to Australia in 2016, compared with the 10,000 who moved to the United States.

Foreign buyers also accounted for 20,551 approvals for individuals to buy newly built properties worth a total of $14.4 billion - almost double the previous year's figures.

Foreign purchasers bought 9,236 established homes last financial year worth a total of $10.1 billion, although only those living in Australia are eligible to buy an existing property, and only to live in it themselves.

Overseas investors also received approvals to invest a further $36.2 billion in 506 commercial properties.

Foreign real estate investment jumps 75pc in a year, FIRB report reveals - ABC News (Australian Broadcasting Corporation)

Re: The totally off-topic thread

Some figures put together for an article in a, you guessed it, Sydney paper..

No Cookies | Daily Telegraph

Interesting it points out that the non-housing cost-of-living is significantly less today than it was way back when....

The monthly mortgage *repayment on a typical $687,000 unit in Sydney today is $2903 — based on borrowing 80 per cent of the cost at a 4 per cent interest rate over 25 years.

Back in 1989, an apartment buyer only had to borrow $116,800 but interest rates were 17 per cent, so monthly repayments were $1682, or $3426 today.

Home hunters today need to borrow $720,000 for a typical house in Sydney, repaying $3800 a month. In 1989 a mortgage for the average house was $124,800, with monthly repayments of $1797 — or $3661 in today’s money.

Jobs were harder to find in the recessionary 1990s, when the unemployment rate was double today’s rate of 5.8 per cent. Youth unemployment was 21 per cent, compared with 12.6 per cent now.

Workers also earned less. The average weekly wage in 1993 was $1124 in today’s dollars, compared with current earnings of $1533.

Some figures put together for an article in a, you guessed it, Sydney paper..

No Cookies | Daily Telegraph

Interesting it points out that the non-housing cost-of-living is significantly less today than it was way back when....

The monthly mortgage *repayment on a typical $687,000 unit in Sydney today is $2903 — based on borrowing 80 per cent of the cost at a 4 per cent interest rate over 25 years.

Back in 1989, an apartment buyer only had to borrow $116,800 but interest rates were 17 per cent, so monthly repayments were $1682, or $3426 today.

Home hunters today need to borrow $720,000 for a typical house in Sydney, repaying $3800 a month. In 1989 a mortgage for the average house was $124,800, with monthly repayments of $1797 — or $3661 in today’s money.

Jobs were harder to find in the recessionary 1990s, when the unemployment rate was double today’s rate of 5.8 per cent. Youth unemployment was 21 per cent, compared with 12.6 per cent now.

Workers also earned less. The average weekly wage in 1993 was $1124 in today’s dollars, compared with current earnings of $1533.

whatmeworry

Established Member

- Joined

- Jan 22, 2007

- Posts

- 4,623

Re: The totally off-topic thread

So many empty homes in Sydney.

Meanwhile OECD blames locals.

OECD warns of 'rout' in house prices if investors head for the doors

Daily Telegraph reckons the young are sooks.

What the youth think.

So many empty homes in Sydney.

[h=1]Sydney's ghost homes: How 200,000 homes sit VACANT in Australia's most expensive city - because foreign investors buy them and leave them to gather dust[/h]

Meanwhile OECD blames locals.

The OECD report argues that it is mainly local investors and owner-occupiers, rather than foreign buyers, that are pushing prices high. It says the markets are vulnerable to a sudden rush for the doors should prices start to falter and investors believe capital gains are no longer to be certain.

OECD warns of 'rout' in house prices if investors head for the doors

Daily Telegraph reckons the young are sooks.

What the youth think.

Moody

Active Member

- Joined

- Oct 17, 2008

- Posts

- 859

Re: The totally off-topic thread

Why do you persist with the Lies, Damn Lies, Statistics and RAM "facts"?

The 17% interest rate didn't even last a year. By the end of 1990 it was 15%, then 12% by the end of 1991 and 10% by the end of 1992. By contrast the only way is up for interest rates right now, and every 25 basis points that the RBA puts on now will see many investors going into mortgage stress (along with those already there).

Some figures put together for an article in a, you guessed it, Sydney paper..

No Cookies | Daily Telegraph

Interesting it points out that the non-housing cost-of-living is significantly less today than it was way back when....

The monthly mortgage *repayment on a typical $687,000 unit in Sydney today is $2903 — based on borrowing 80 per cent of the cost at a 4 per cent interest rate over 25 years.

Back in 1989, an apartment buyer only had to borrow $116,800 but interest rates were 17 per cent, so monthly repayments were $1682, or $3426 today.

Home hunters today need to borrow $720,000 for a typical house in Sydney, repaying $3800 a month. In 1989 a mortgage for the average house was $124,800, with monthly repayments of $1797 — or $3661 in today’s money.

Jobs were harder to find in the recessionary 1990s, when the unemployment rate was double today’s rate of 5.8 per cent. Youth unemployment was 21 per cent, compared with 12.6 per cent now.

Workers also earned less. The average weekly wage in 1993 was $1124 in today’s dollars, compared with current earnings of $1533.

Why do you persist with the Lies, Damn Lies, Statistics and RAM "facts"?

The 17% interest rate didn't even last a year. By the end of 1990 it was 15%, then 12% by the end of 1991 and 10% by the end of 1992. By contrast the only way is up for interest rates right now, and every 25 basis points that the RBA puts on now will see many investors going into mortgage stress (along with those already there).

- Joined

- Jan 26, 2011

- Posts

- 29,430

- Qantas

- Platinum

- Virgin

- Red

Why do you persist with the Lies, Damn Lies, Statistics and RAM "facts"?

The 17% interest rate didn't even last a year. By the end of 1990 it was 15%, then 12% by the end of 1991 and 10% by the end of 1992. By contrast the only way is up for interest rates right now, and every 25 basis points that the RBA puts on now will see many investors going into mortgage stress (along with those already there).

Looks pretty rugged to me having had a mortgage during the period. Sucked everything up.

Also, no need to call any poster here a liar. Dispute their post not the person.

earlyriser

Member

- Joined

- Jul 6, 2015

- Posts

- 469

Re: The totally off-topic thread

Plenty of empty apartments in my part of Canberra too. Can see 3 large 20 odd story apartment buildings from my balcony with maybe only 50% occupied. 6 more buildings just as tall or taller are about to start going up that will also be in my view.

So many empty homes in Sydney.

Plenty of empty apartments in my part of Canberra too. Can see 3 large 20 odd story apartment buildings from my balcony with maybe only 50% occupied. 6 more buildings just as tall or taller are about to start going up that will also be in my view.

Jeffrey O'Neill

Established Member

- Joined

- Aug 19, 2006

- Posts

- 1,500

Looks pretty rugged to me having had a mortgage during the period. Sucked everything up.

CoreLogic claims that the median capital city dwelling was valued at $605,000 as at February 2017.

According to the latest ABS Household Income Survey, the median household disposable income as at June 2014 was only $77,740 at the capital city level. If we scale this up by wages growth, this gives a current median household disposable income of $81,742.

Dividing the median dwelling value ($605,000) by the median household disposable income ($81,742) gives a dwelling price-to-income ratio of 7.4 times. Does this sound cheap to you?

What if we look at the regions only?? CoreLogic claims that the median ‘rest-of-state’ dwelling was valued at $380,000 as at February 2017.

According to the latest ABS Household Income Survey, the median household disposable income as at June 2014 was only $59,332 at the ‘rest-of-state’ level. Scaling this up by wages growth, this gives a current median household disposable income of $62,386.

Dividing the median dwelling value ($380,000) by the median household disposable income ($62,386) gives a dwelling price-to-income ratio of 6.1 times. Leaving the big smoke for affordable housing doesn't seem much of an option.

Melbourne's population rose by 832K over the last decade. They're forecasting this to increase at 970K for the coming decade.

If you factor in inflation (CPI), which was 1.5% in the 2016 calendar year, then the average Australian worker’s income went backwards.

Real NDI growth after the early 90s recession at the 8 year mark was 3 times higher than what we've had since the 2008 GFC slow down.

I'd take buying a property at 17% interest rate with a low income multiple purchase price, than the current low interest, low income growth environment. Real NDI per capita is still below the level reach on Dec 2011. Supporting a mega mortgage when average nominal compensation per employee collapsed to the lowest level on record in December 2016, recording just 0.1% growth over the 2016 calendar year wont be fun for those staring a the minksy abyss.

- Joined

- Jan 26, 2011

- Posts

- 29,430

- Qantas

- Platinum

- Virgin

- Red

Have you factored in the full cost of child care in those days (no subsidy at all); very few Centrelink benefits to families; no baby bonus and so on?

Jeffrey O'Neill

Established Member

- Joined

- Aug 19, 2006

- Posts

- 1,500

Have you factored in the full cost of child care in those days (no subsidy at all); very few Centrelink benefits to families; no baby bonus and so on?

If housing is cheap and supportable via a single income is child care such an issue?

Strategic Aviation

Established Member

- Joined

- Jan 1, 2017

- Posts

- 1,385

I'd take buying a property at 17% interest rate with a low income multiple purchase price, than the current low interest, low income growth environment.

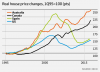

Money editor Caitlin Fitzsimmons wrote about that recently - Today's housing crisis is worse than the 17pc home loans of the 1980s

CaptJCool

Established Member

- Joined

- May 31, 2012

- Posts

- 4,093

Re: The totally off-topic thread

we do the real time electricity generation shows it

Live Australian Electricity Generation Statistics - Energy Matters

If it really was a capitalist democracy we would still be running with coal generation.

Of course people wouldn't like that either.

we do the real time electricity generation shows it

Live Australian Electricity Generation Statistics - Energy Matters

Moody

Active Member

- Joined

- Oct 17, 2008

- Posts

- 859

Looks pretty rugged to me having had a mortgage during the period. Sucked everything up.

View attachment 92792

Also, no need to call any poster here a liar. Dispute their post not the person.

Hey - cherry pick data points to misrepresent reality and I will respectfully (kinda) correct you. Do it again and all bets are off. I also had a mortgage in the late '80s and can assure you that not only would the same property be at the limit of my borrowing today, it would likely send me bankrupt if interest rates returned to anything like normality.

With these super low mortgage rates running right now it would be wise to pay the mortgage down more quickly rather than take on more debt. When the current cycle ends and we have interest rate increases many folks with high debt will be likely to have trouble with their repayments. This could apply to about a million families.

No one rings a bell to tell you to increase your mortgage repayments but it could be a very smart thing to be doing.

No one rings a bell to tell you to increase your mortgage repayments but it could be a very smart thing to be doing.

whatmeworry

Established Member

- Joined

- Jan 22, 2007

- Posts

- 4,623

One million at risk of mortgage stress.

Exclusive analysis performed for AFR Weekend has revealed that more than a million Australian home owners will struggle with mortgage stress if interest rates were to rise just three percentage points.

Data from research house Digital Finance Analytics shows that close to one in three households from Victoria, Tasmania and Western Australia will experience mortgage stress ranging from mild to severe in the event of just three rises of 25 basis points. A rise of 300 basis points, back to more normal levels, would be much more severe.

Digital Financial Analytics principal Martin North says that a shake out in the property market would not be restricted to lower income areas and would include households in the trophy suburbs of Bondi and Lane Cove in Sydney as well as homes in the leafy green streets of Toorak and Prahran in Melbourne.

"The common theme here is affluent households paying top dollar for apartments with big mortgages and the potential to be caught out by rising interest rates and flat or falling incomes. Even places like the lower north shore are being hit" he said.

If rates were to rise 150 basis points the number of Australians in mortgage stress would rise to approximately 930,000 and if rates rose 300 basis points the number would rise to 1.1 million – or more than a third of all mortgages. A 300 basis point rise would take the cash rate to 4.5 per cent, still lower than the 4.75 per cent for most of 2011.

Stephen Fitzsimon, head of business development for Melbourne Real Estate, which rents more than 1000 apartments in Melbourne's central business district, said the price of a small apartment purchased eight to 10 years ago had fallen about 10 per cent to $210,000.

In the 2008 to 2010 period in Los Angeles we saw many properties forced onto the market and prices for forced sales got well and truly crunched.

Perth prices haven't crashed but they are falling on a monthly basis as there is now a surplus of homes that are available for rent.Rents have fallen due to so many project workers being let go as projects cut staff and contractors. Many have gone back east as there are very few new jobs now in Perth after the mining and gas boom.

Melbourne is now racing to release building blocks and blocks have been selling very quickly even in outer suburbs.

I am expecting a saturation to occur in Melbourne once developers catch up to market demand but no one knows how soon that will be.

Perth prices haven't crashed but they are falling on a monthly basis as there is now a surplus of homes that are available for rent.Rents have fallen due to so many project workers being let go as projects cut staff and contractors. Many have gone back east as there are very few new jobs now in Perth after the mining and gas boom.

Melbourne is now racing to release building blocks and blocks have been selling very quickly even in outer suburbs.

I am expecting a saturation to occur in Melbourne once developers catch up to market demand but no one knows how soon that will be.

Australia's highest-earning Velocity Frequent Flyer credit card: Offer expires: 30 Apr 2025

- Earn 100,000 bonus Velocity Points

- Get unlimited Virgin Australia Lounge access

- Enjoy a complimentary return Virgin Australia domestic flight each year

- Earn 100,000 bonus Velocity Points

- Get unlimited Virgin Australia Lounge access

- Enjoy a complimentary return Virgin Australia domestic flight each year

AFF Supporters can remove this and all advertisements

- Status

- Not open for further replies.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- MarkD

- Doug_Westcott

- thebmw

- snooze

- dxwell

- 747sp

- MH_fan

- flyingfan

- WilsonM

- jrfsp

- Bighead

- JessicaTam

- MKnynenburg

- TheRealTMA

- justinbrett

- petroslakis

- CaptJCool

- Austman

- WrenchHammerMcTool

- SydneySwan

- asterix

- Harrison_133

- There'sOnlyOneJimmy

- kreuky

- jc123

- tgh

- Ko0l

- meljfk

- bluelink279

- http_x92

- jase05

- tlam

- Lemon_Party

- Aeryn

- jbmarshall90

- Gudetama

- TDC

- flydoc

- RooFlyer

- Hawk529

Total: 655 (members: 51, guests: 604)