You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Australian Housing Affordability Discussion

- Thread starter medhead

- Start date

- Status

- Not open for further replies.

Now Westpac doesn’t want to lend to self run super funds.

In post-Royal Commission land...

With falling house prices AND banks' own forecasters predicting prices will fall further then it opens way for class action should house/unit prices fall MUCH further...

'Bank ABC should not have lent to SMSF to buy a house in Woolahra as they predicted that prices would fall and knowingly financed Mrs DSF, a widow with severe arthritis, into a property that wiped out her entire SMSF value....'

I can see the litigation funders salivating as I type.

Couldn't happen?

In the 1980's before Bob Carr became Premier he caused the exact same result - he told people to REFUSE to pay the NSW Govt provided fixed rate mortages as interest rates had fallen and it was unjust that they should have to pay so much...So they did and they Govt fearing an electoral backlash left the bond holders (who the NSW Govt on-sold the mortgages to) lose the lot.

Result: Large superannuation and insurance funds lost close to $250m back in the days that a Commordore cost $11,990 and a typical house in say Randwick cost under $110,000

When introduced - the fixed rate was (from memory) 15% vs variable mortgages 17% and above. Variable mortgages had had the cap removed by the Hon PJ Keating in return for the banks losing a minimal amount of interest on their SRD holdings with the RBA.

penegal

Senior Member

- Joined

- May 17, 2009

- Posts

- 5,756

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

- Star Alliance

- Gold

I wouldn’t bother puting a residential property into my SMSF as the net rental return is too modest.

Those crazy prices paid for hovels in Sydney a year ago are starting to look like a very, very bad idea.

Certainly things have been a bit hot of late, but there have been some good earners in recent times.

pauly7

Senior Member

- Joined

- Dec 8, 2004

- Posts

- 5,437

I was hoping inner Melbourne stand alone housing prices would have come off the boil a bit - sadly seems not! Clearance rates are lower but there is then a stampede of buyers that rush in to negotiate post auction and the prices they are getting are still very strong, either on the day or a couple after.

travelislife

Established Member

- Joined

- Feb 9, 2011

- Posts

- 2,413

I was hoping inner Melbourne stand alone housing prices would have come off the boil a bit - sadly seems not! Clearance rates are lower but there is then a stampede of buyers that rush in to negotiate post auction and the prices they are getting are still very strong, either on the day or a couple after.

That is the one market that I don’t believe will ever come back too much. You can’t make any more of it unlike apartments and townhouses.

pauly7

Senior Member

- Joined

- Dec 8, 2004

- Posts

- 5,437

That is the one market that I don’t believe will ever come back too much. You can’t make any more of it unlike apartments and townhouses.

I guess you are right, thankfully we got into the market already in that asset bracket,

I’m now helping a friend buy in Melbourne inner north and there are lots of people looking, perhaps fired up by the headline declines, but actually generalising a market like the news does is just rubbish.

Yes I’m sure that apartments and townhouses have stagnated, perhaps even stand alone stock in the outer suburbs, but stand alone in the inner 5km, even inner 10km is still fought over with razor blades! Investors were never really buying this stock either so all the credit crunch on them hasn’t affected demand much, perhaps the only thing is the general credit crunch and threat of out of cycle interest rates has weeded a few people out of the race but it’s not enough for a decent correction in this area.

Apartments without views are never really going to perform too well if they are replaceable with a new product down the street. The advantage is you can shut the door of an apartment and go without as many issues compared with a home with gardens.

CBA has ceased lending to SMSFs so all the Big 4 banks have withdrawn from that market.

CBA has ceased lending to SMSFs so all the Big 4 banks have withdrawn from that market.

UP4014

Senior Member

- Joined

- Jul 22, 2008

- Posts

- 6,900

I wouldn’t bother puting a residential property into my SMSF as the net rental return is too modest.

Those crazy prices paid for hovels in Sydney a year ago are starting to look like a very, very bad idea.

If You're talking mainland capital cities, other places you can do quite well if you can think outside the cities.

amaroo

Enthusiast

- Joined

- Sep 22, 2011

- Posts

- 12,359

- Qantas

- Platinum 1

Will be interesting to observe how this plays out...

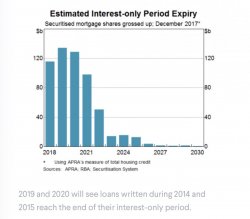

Market Downturn + Credit Crunch + Billions in loans hitting P&I = ????

View attachment 146846

Add the very real possibility of changes to negative gearing, and you have some wild ingredients for a recipe that no one has a clue how it will end up tasting.

Yes the banks are rolling folks out of interest only and the principal and interest deals take quite a bit more cash each month. It is no wonder that people are selling even in the weakened market.

Stories are out there on banks being difficult on refinancing.

Stories are out there on banks being difficult on refinancing.

Elevate your business spending to first-class rewards! Sign up today with code AFF10 and process over $10,000 in business expenses within your first 30 days to unlock 10,000 Bonus PayRewards Points.

Join 30,000+ savvy business owners who:

✅ Pay suppliers who don’t accept Amex

✅ Max out credit card rewards—even on government payments

✅ Earn & transfer PayRewards Points to 10+ airline & hotel partners

Start earning today!

- Pay suppliers who don’t take Amex

- Max out credit card rewards—even on government payments

- Earn & Transfer PayRewards Points to 8+ top airline & hotel partners

Join 30,000+ savvy business owners who:

✅ Pay suppliers who don’t accept Amex

✅ Max out credit card rewards—even on government payments

✅ Earn & transfer PayRewards Points to 10+ airline & hotel partners

Start earning today!

- Pay suppliers who don’t take Amex

- Max out credit card rewards—even on government payments

- Earn & Transfer PayRewards Points to 8+ top airline & hotel partners

AFF Supporters can remove this and all advertisements

marki

Suspended

- Joined

- Feb 11, 2010

- Posts

- 3,529

- Qantas

- Platinum 1

- Virgin

- Gold

- Oneworld

- Emerald

- SkyTeam

- Elite

- Star Alliance

- Silver

Most Livable City Melbourne hard to see that coming off the boil.I was hoping inner Melbourne stand alone housing prices would have come off the boil a bit - sadly seems not! Clearance rates are lower but there is then a stampede of buyers that rush in to negotiate post auction and the prices they are getting are still very strong, either on the day or a couple after.

pauly7

Senior Member

- Joined

- Dec 8, 2004

- Posts

- 5,437

Most Livable City Melbourne hard to see that coming off the boil.

Quality stock has def not come off the boil in the inner ring

Which is basically what everyone said about just about every bubble ever!Most Livable City Melbourne hard to see that coming off the boil.

Happy Dude

Established Member

- Joined

- Oct 13, 2006

- Posts

- 3,230

APRA is easing restrictions on lending

Banks will soon be able to issue interest-only loans without restriction

Although the article claims that it won't stop sliding house prices, it may be significant news for those refinancing from expiring IO loans .

Banks will soon be able to issue interest-only loans without restriction

Although the article claims that it won't stop sliding house prices, it may be significant news for those refinancing from expiring IO loans .

APRA is easing restrictions on lending

Banks will soon be able to issue interest-only loans without restriction

Although the article claims that it won't stop sliding house prices, it may be significant news for those refinancing from expiring IO loans .

Given the current environment with all the banks recording 'strikes' at their AGMs over their remuneration (which can lead to Board being spilled if it happens at their next AGM) - I suspect although they can lend more freely on IO - they won't.

Since we haven't had a recession since PK's 'had to have' - there are many zombie companies ready to fail with rising interest rates wiping out their margins. Whilst the RBA is not pushing up the cash rate - anything longer than 6 mths is more tied tpo bond rates and what is happening to bond rates overseas.

As I discovered today there are a number of Super (& Pension) industry funds that have been just as 'misleading, deceptive etc etc' as the banks.

One so called 'Balanced fund' has 77% in growth assets and 23 non-growth of the 23% - 6% is cash and 13% is 'alternative assets' - aka unlisted risky assets with no guaranteed market resale ability.

Worth checking to see what your money is really invested in - this all came about when a friend mentioned he lost 45% in his balanced super from late 2007 to mid 2009 - something NO true balanced fund did - but a deceptively labelled one that has more growth assets than most labelled growth funds - sure did.

So banks are not going to risk higher write-offs by increasing the IO share of their mortgage book much, if at all. After all in Sydney for example - anyone who took out a mortgage in the last 14 months is close to zero equity in their property and shortly going to have a mortgage larger than the market value of their property.

Throw in a potential recession and we have seller no buyer.

Very good time to payback some debt....

The rent vs buy equation has swung very much to 'rent' from 'buy'.

Just like no Central Banks nor Dept of Treasury or Finance has ever predicted a recession (NEVER believe it or not in the OECD) - no Australian bank has correctly positioned themselves for a residential or commercial property downturn - not one.

In the 89-93 debacle - a brand new Collins St high rise was finally sold for 40% of previous land value - you got the 40+ storey Prime office tower for free. 4 foreign banks exited Austraia due to their loan losses on commercial property wiping out their capital several times over and required bailing out by their offshore parent.

Given the revelations from the Banking Royal Commission - the Fed Govt will not stand in the way of a residential property crash either before or after the May election.

Or I could be wrong...

Now that investors are getting land tax bills for their multiple holdings this may produce more sellers than buyers in Victoria. A family member has a beach house where the land tax has risen to $400 a week. Add on shire rates,water rates, insurance and maintenance and the cost is over $650 a week.

Now that investors are getting land tax bills for their multiple holdings this may produce more sellers than buyers in Victoria. A family member has a beach house where the land tax has risen to $400 a week. Add on shire rates,water rates, insurance and maintenance and the cost is over $650 a week.

$400 a week? The last time I had a land tax bill it was ~$400 a year.

Must be a fabulous piece of real estate!

- Status

- Not open for further replies.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Recent Posts

-

-

-

Card payment sucharges banned in Australia from 2026

- Latest: transpactraveller

-

Currently Active Users

- pjm99au

- Austman

- MELso

- Himeno

- Bbjai

- Doug_Westcott

- Beer_budget

- kerfuffle

- JimmyJ

- hotpaws

- jkbaus

- Lux

- somebol

- SomeRando

- utaussiefan

- FF98

- Forg

- jswong

- Denali

- Chick3nric3

- luxury-lizard

- Kangol

- points

- offshore171

- Nickor

- Harrison_133

- pauldab

- servicerequired

- Tlee

- VPS

- Amanda V

- Franky

- lilkid28

- Wingco

- Doctore1003

- fletty

- JohnM

- element0

- There'sOnlyOneJimmy

- jase05

- AIRwin

- Mutilla2

- PeterA

- onemorejohndoe007

- bPeteb

- anchew

- Material16

Total: 1,845 (members: 58, guests: 1,787)