woodyren

Active Member

- Joined

- Aug 31, 2015

- Posts

- 888

- Qantas

- Bronze

- Virgin

- Red

Yes I hear.

I have a card too. It's not fee free but it has been for recent years.

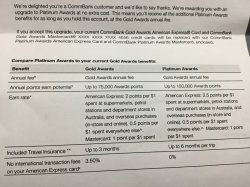

Esseinatly you get 1.2 or 1.4 can't remember exactly qff or velocity points per dollar spent on super market spend . You'd get 2 to 3 on the amex cards. So I'm not sure why anyone would use the cba card except for is purchases

No you don't. You get 3 rewards points per $ for supermarket spend which works out at 1.5 Velocity pts per $. Same for petrol. So that's about as good as anything at present.