You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

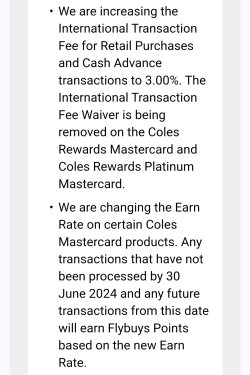

Coles Rewards MasterCard devaluation

- Thread starter twiningb

- Start date

earlyriser

Member

- Joined

- Jul 6, 2015

- Posts

- 463

HisHoliness

Newbie

- Joined

- Jun 28, 2020

- Posts

- 6

Bankwest QantasDoes anyone have a suggestion for Intl Fee Free CC that earns something?

Such a shame as we'll only just be starting our 2.5 week trip to Japan when the changes start.Yeah RIP. Will cancel this ASAP.

Does anyone have a suggestion for Intl Fee Free CC that earns something?

Ok perhaps not according to @twiningb

I applied for the CBA Smart Award Mastercard this morning. I'm a CBA Yello member so will get 90,000 points which are equivalent to 30,000 Krisflyer points I believe and as long as I spend $2,000 a month there is no monthly fee. The earn rate is definitely not as good as the Coles Rewards Mastercard.

This is a shocking series of changes. Earn rate being reduced as well.

The one that really hurts is adding the 3 per cent international fee. I've been actively using this card since mid-March while overseas on my 12-month trip RTW.

Will absolutely be giving this one the flick after 30 June.

The one that really hurts is adding the 3 per cent international fee. I've been actively using this card since mid-March while overseas on my 12-month trip RTW.

Will absolutely be giving this one the flick after 30 June.

SeaWolf

Established Member

- Joined

- Jan 24, 2007

- Posts

- 1,465

- Qantas

- Silver

- Virgin

- Platinum

- Star Alliance

- Gold

At the time I got this card it was one of a tiny number of rewards cards that didn't charge international transaction fees and I was coming to it from the ANZ Rewards Travel Adventures card deval. It also has a great earn rate at 1 Velocity point per dollar so it was my companion to my AmEx, even domestically. It's disappointing, but I think there's a few good alternatives around now.

I'm eyeing the CommBank Smart Awards card. It has no foreign currency fees, it comes with travel insurance and there's a fee waiver if you spend at least $2,000 a month. It'll be my AmEx companion card so I don't know if I'll hit that $2,000 every month, but I reckon I will often enough that it'll be no more than the Coles card each year. Downside is that it only earns 0.75 Velocity points per dollar, but it does have bonus points on your largest spend each month, so it'll actually be a little higher.

EDIT: Smart Awards does have a small trap in the fine print, you get up to 0.75 Velocity points per dollar (for certain types of purchases). For most stuff it'll be 0.5 Velocity Points per dollar. Earn more points on everyday card purchases - CommBank

I'm eyeing the CommBank Smart Awards card. It has no foreign currency fees, it comes with travel insurance and there's a fee waiver if you spend at least $2,000 a month. It'll be my AmEx companion card so I don't know if I'll hit that $2,000 every month, but I reckon I will often enough that it'll be no more than the Coles card each year. Downside is that it only earns 0.75 Velocity points per dollar, but it does have bonus points on your largest spend each month, so it'll actually be a little higher.

EDIT: Smart Awards does have a small trap in the fine print, you get up to 0.75 Velocity points per dollar (for certain types of purchases). For most stuff it'll be 0.5 Velocity Points per dollar. Earn more points on everyday card purchases - CommBank

Last edited:

Scarlett

Established Member

- Joined

- Jun 27, 2011

- Posts

- 1,257

- Qantas

- LT Gold

- Virgin

- Platinum

I note the post from @RooFlyer in this thread (post #6 - Your recommended no fee credit card)

that a NAB Signature card will have no Int’l Tx fee. May have to look at that also, but sounds like a monthly fee card.

that a NAB Signature card will have no Int’l Tx fee. May have to look at that also, but sounds like a monthly fee card.

SeaWolf

Established Member

- Joined

- Jan 24, 2007

- Posts

- 1,465

- Qantas

- Silver

- Virgin

- Platinum

- Star Alliance

- Gold

The NAB Signature will have a $24 monthly fee, though it's waived if you spend more than $5,000 a month.May have to look at that also, but sounds like a monthly fee card.

We’re changing NAB Rewards Signature

Learn about the improvements and new features that have been made to the NAB Rewards product range. Compare with the old NAB Rewards offering today.

kamchatsky

Established Member

- Joined

- Mar 8, 2006

- Posts

- 3,559

- Qantas

- Bronze

- Virgin

- Silver

I have recently signed up for NAB Rewards Signature Visa. I already got the bonus points. From mid June it will go international exchange fee free. Looks like it will be my non-churn card from now on.

kamchatsky

Established Member

- Joined

- Mar 8, 2006

- Posts

- 3,559

- Qantas

- Bronze

- Virgin

- Silver

The NAB Signature will have a $24 monthly fee, though it's waived if you spend more than $5,000 a month.

We’re changing NAB Rewards Signature

Learn about the improvements and new features that have been made to the NAB Rewards product range. Compare with the old NAB Rewards offering today.www.nab.com.au

I signed up the card under reduced annual fee offer as existing customer. Reading the proposed change from June, I will pay equivalent new monthly fee to align with my reduced annual fee.

I love to travel

Established Member

- Joined

- Jun 4, 2016

- Posts

- 2,399

- Qantas

- Gold

But it is still no annual fee so if you want an emergency credit card for breaks between churning other cards still comes in handy as a $2000 limit is good

I love to travel

Established Member

- Joined

- Jun 4, 2016

- Posts

- 2,399

- Qantas

- Gold

I can't see where they are introducing an annual fee for the Coles No Annual Fee Platinum MastercardThey are dreaming. With an annual fee and such devaluation, I'll be looking for an alternative.

kamchatsky

Established Member

- Joined

- Mar 8, 2006

- Posts

- 3,559

- Qantas

- Bronze

- Virgin

- Silver

Reading the change again for Coles Rewards MC, looks like you still earn 1 Velocity per dollar for up to $3000 per month, and 0.5 Velocity points/dollar from $3001-$8000 per month, and nothing if spent more than that.

So really it is only good if you are not a heavy spender and don't really go overseas.

Please Note: From 1 July 2024, the following changes will apply to the Coles Rewards Mastercard.

Annual Percentage Rate on Retail Purchases and Cash Advances: The Interest rate on Retail Purchases and Cash Advances will increase to 20.74% p.a.

Points Earn Rate: Earn 2 Flybuys points for each whole Australian dollar spent on Eligible Transactions up to $3,000 and 1 Flybuys point per whole Australian dollar thereafter up to $8,000 in each Statement Period.

International Transaction Fee: The fee waiver will be removed and there will be a 3.00% charge on all Retail Purchases and Cash Advances.

So really it is only good if you are not a heavy spender and don't really go overseas.

Please Note: From 1 July 2024, the following changes will apply to the Coles Rewards Mastercard.

Annual Percentage Rate on Retail Purchases and Cash Advances: The Interest rate on Retail Purchases and Cash Advances will increase to 20.74% p.a.

Points Earn Rate: Earn 2 Flybuys points for each whole Australian dollar spent on Eligible Transactions up to $3,000 and 1 Flybuys point per whole Australian dollar thereafter up to $8,000 in each Statement Period.

International Transaction Fee: The fee waiver will be removed and there will be a 3.00% charge on all Retail Purchases and Cash Advances.

Ive been a long term user of this card, and loved that I could use overseas with no fees . Now frantically looking for new credit card before our next trip (leaving mid june), but as self funded retirees , I hate the financial hoops that we have to go through to get cards. Anyone know a senior friendly credit card provider with no OS feed please ?

- Joined

- Jan 14, 2013

- Posts

- 5,817

- Virgin

- Platinum

- Oneworld

- Emerald

Mrsandye has had this card for ages and the only reason it's not been churned is the 0% forex. Will get one last trip in but its days are numbered

Enhance your AFF viewing experience!!

From just $6 we'll remove all advertisements so that you can enjoy a cleaner and uninterupted viewing experience.And you'll be supporting us so that we can continue to provide this valuable resource :) Sample AFF with no advertisements? More..

Sample AFF with no advertisements? More..

Sample AFF with no advertisements? More..

Sample AFF with no advertisements? More..Currently Active Users

- RooFlyer

- jrfsp

- Oscarq

- aus_flyer

- flydoc

- love_the_life

- CaptJCool

- sanne

- Dr Bob

- bubblecapfish903

- big_RED

- Lynda2475

- Noel Mugavin

- NoName

- levelnine

- RichardMEL

- SYD

- Austman

- chrisbris

- mimosa1

- StayGoldPonyboy

- kpc

- JimmyJ

- AgentDCooper

- ayebee

- torks

- zig

- moa999

- LinaLee

- MEL_Traveller

- tgh

- Doug_Westcott

- tom.290290

- 33kft

- flyer89

- Economy_Gold

- Harrison_133

- http_x92

- Freq Flier 2013

- mrs.dr.ron

- tuzii

- wsthong

- baggyred

- wenglock.mok

- MattA

- Timratoo

- sudoer

- JohnM

- kgg1999

- YosemiteP

Total: 663 (members: 76, guests: 587)