I have recently applied for this ultimate card - as I wanted to have a cc in my own name (not hubby's name). We have been long standing customers of commbank with many loans / mortgages over the years and commsec as online broker (I have had an account with them for over 30 years). It took them many weeks to approve - today I called and they said so. Since I have no regular income (retired, not in paid employment - most income are from interest, dividends and rental income), I know it is (nearly) impossible to get a cc for a retiree.

However, I think the reasons for them to approve a cc for me were: I am an existing commbank client (not a new client), we have repaid all our mortgages (sold all the properties), I have had a large share portfolio in my name with commsec for years, we have a smsf share portfolio with commsec as online broker etc.

During the approval process they asked for verification of all income sources (and statements from brokers). My tax accountant said just sent them my recent tax return (prepared by the tax accountan) but they said they wanted the 'real' one from the ato via mygov. So, I had to log in and emailed it to them. They said interest income did not count (! - I said but we have a lot of cash in bank accounts, they said not count) - only dividends and rental income, which must have taken me over the line for minimum income requirement. Also, I think when they saw my tax return, hubby's income was there and it was big because of the cgt he had to pay for selling down our investment properties.

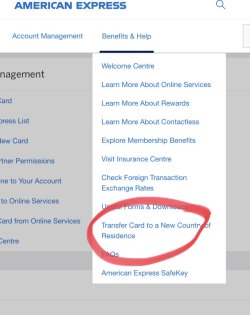

We were pondering about applying for an amex plat charge card (as I had one in the UK for over 8 years) but amex au would not approve one for me as I had no regular income from paid employment. So i gave up on amex.

Will wait and see how long before my ultimate card arrives, so I can start the spending

to get the bonus points. But from what I read here, the bonus points take a long time to post