You don't need to maintain $150k balance if you just transfer $9000 in and out.Yeah, ok - so you basically need to maintain that 150K balance

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

HSBC Premier credit card - too good to be true?

- Thread starter Chicken

- Start date

dairyfloss

Established Member

- Joined

- Feb 19, 2009

- Posts

- 3,824

- Qantas

- Platinum

- Oneworld

- Emerald

- Star Alliance

- Gold

There’s two paths for eligibility; payments of >=$9K going in monthly; OR an ongoing investment of >=$150K. The question above was on the latterYou don't need to maintain $150k balance if you just transfer $9000 in and out.

I just opened up a HSBC Everyday Global Account and ticked the "I qualify for Premier status: I will deposit at least $9,000 into my account" box during the application process and got Premier status instantly. I'll be transfering my salary from my main account into the HSBC and then back out again in order to maintain the status.

Does this mean I'm eligible to apply for the Premier Credit Card? I easily meet the minimum $75,000 income requirement and last I checked my credit rating is 1,045. I just dont know if they'll check that I've had Premier status for 6 months before I can actually apply? Anyone else gone through a similar process to me in terms of getting instant Premier status upon opening an account and then applying for the CC?

Does this mean I'm eligible to apply for the Premier Credit Card? I easily meet the minimum $75,000 income requirement and last I checked my credit rating is 1,045. I just dont know if they'll check that I've had Premier status for 6 months before I can actually apply? Anyone else gone through a similar process to me in terms of getting instant Premier status upon opening an account and then applying for the CC?

WowI just opened up a HSBC Everyday Global Account and ticked the "I qualify for Premier status: I will deposit at least $9,000 into my account" box during the application process and got Premier status instantly.

Does this mean I'm eligible to apply for the Premier Credit Card?

There is no requirement to be a Premier for 6 months before applying:I just dont know if they'll check that I've had Premier status for 6 months before I can actually apply?

Are you eligible?

To apply for an HSBC Premier World Mastercard, you'll need to:

Have HSBC Premier customer status in Australia

I was going to, but then I decided it is too risky for me.Anyone else gone through a similar process

Having been involved in protests against the Hong Kong government, I don't know if any Chinese spies have taken photos of me, and whether HSBC would pass on my details and freeze my $9000 monthly deposit (which they have done to others, including a church)

HSBC had also just been fined in the UK, with the fine being the "second highest to date imposed by the regulator", for "to have incorrectly marked 99% of its eligible beneficiary deposits as "ineligible" for FSCS protection."

HSBC is too good at money laundering, but hopeless with everything else, especially with following the law. I have decided that it is not worth trying to get this HSBC credit card just to save $160 annual fee from Bankwest, and put my personal information at risk, not to mention risking the $9000 when I have to deposit every month.

Yea it does smell a bit suspicious or at least desperate that HSBC just trusts you that you'll meet the Premier criteria if you say so, but on the other hand they do appear to do an eligibility check every 6 months so guess it's really only 6 months of risk for them and the risk isnt that high

I ended up applying two days after opening my account and they had no issue at all - got approved after uploading my latest pay checkThere is no requirement to be a Premier for 6 months before applying:

Definitely understand that concern having recently visited HK myself I could definitely feel the big brother Chinese vibes much more strongly than in previous visits. But on the other hand, it's probably more of a concern if you're banking with HSBC HK or HSBC China since theyd have to follow local laws which no doubt will favour Xi Jingping. HSBC Australia is entirely separate entity that follows Australian law including any privacy and data sharing protections (admittedly which imo are still too lax but still better than HK/China). There is a risk that HSBC Australia sends some of our data to headquarters in London but since ultimately HSBC is a UK-based corporation Im not too concerned though I wouldnt be going to HSBC in HK or China anytime soon.Having been involved in protests against the Hong Kong government, I don't know if any Chinese spies have taken photos of me, and whether HSBC would pass on my details and freeze my $9000 monthly deposit (which they have done to others, including a church)

To me, a lot of the BW credit cards just arent worth it. For 0.6 QFF per $ up to $2,500 a month then only 0.3 afterwards just doesnt justify the $160 AF. Say I spend $4,000 per month. On the HSBC Qantas Premier for the first 12 months, I'd earn 72,000 QFF which is more than enough for an upgrade to business class on a Perth to London flight, or an upgraded return flight to Premium economy Perth to London. In contrast, that same $4,000 spend on the BW would only net me 23,400 QFF which is just enough for a premium economy upgrade one way from Perth to London. In subsequent years, the HSBC Qantas Premier would net me 48,000 QFF per year which again is just enough for a return upgraded flight from Perth to London in Premium Economy. And Im paying $0 with the HSBC card and I get 2x lounge entries per year. The BW card I have to pay $160 for less benefit so to me, it's worth taking the HSBC one over the BW one. Plus Im just transferring the required $9,000 into my account and transferring it out next day so Im not too concerned with HSBC freezing my funds especially since they have a reputation of not freezing funds even when they should be XDHSBC credit card just to save $160 annual fee from Bankwest, and put my personal information at risk, not to mention risking the $9000 when I have to deposit every month.

Yes, so dodgy LOLYea it does smell a bit suspicious or at least desperate that HSBC just trusts you that you'll meet the Premier criteria if you say so, but on the other hand they do appear to do an eligibility check every 6 months so guess it's really only 6 months of risk for them and the risk isnt that high

wow.I ended up applying two days after opening my account and they had no issue at all - got approved after uploading my latest pay check

The new National Security Law is applicable worldwide, which then makes me question if HSBC also has to comply here, because the law states that they have to comply. Kinda like when we signed up with Citi plus account and they would ask if we were US nationals and need to pay tax.HSBC Australia is entirely separate entity that follows Australian law including any privacy and data sharing protections

As HSBC group apparently made 44% of their 2022 profit from China, they have to do what they are told by Chinese and Hong Kong government. They do not have a choice.

If HSBC cannot even tag people's account on whether they are eligible for FSCS, then how do we know if they could separate customer data properly? Or that they have to freeze people's accounts just because they were told by the Chinese government?

This is why I looked into getting this HSBC Premier to replace Bankwest, just because it has no fee. Having said that, this card, or Bankwest, would never be my primary card, they would only be used by me for travelling and online shopping. I churn other cards, and I use them for my 'daily' spendings until I cancel them, so for example, my daily spending card is currently Westpac because I got it during their promotion last year. I know some people would stop using their cards once they have met the minimum spend requirement for sign up bonus, but I don't do that, I think that's pushing too far, and risk having one's name placed on a blacklist within a bank.To me, a lot of the BW credit cards just arent worth it.

Great find.I just opened up a HSBC Everyday Global Account and ticked the "I qualify for Premier status: I will deposit at least $9,000 into my account" box during the application process and got Premier status instantly.

I'm currently waiting for AeroPlan Family Sharing to be re-enabled, to combine 50,000 points for two HSBC Star Alliance accounts together (as well as earned points) and make the most of two HSBC Star Alliance accounts for a year before closing at least one of them. But the bulk of my points to date have been with SQ (earned with Amex, but I've closed Amex as I can't justify the fees).

CBA Ultimate is still a good earner (and 3X points OS, with no currency fees and no cap for OS spend) is a reasonable earn rate, but this seems like the perfect local earner.

This is a great card which earns around 0.8 KFF per $ but only up to $3k a month after which it's only 0.4KFF per $ plus $0 AF is only for first year after which it's a hefty $450. My spending per month is honestly not that big, probably averaging around $3-3.5k per month occasionally maybe $4k depending on bill cycles etc so to me this card is just not worth it especially since I'm way off the $60k per annuum required to maintain Gold Status (Silver Status is horse dung so Gold is really what you want to achieve with this card).HSBC Star Alliance

The really great thing about the Premier card is that it's $0 AF and earns points at a decent rate that have value (unlike the Amex Essentials which is pretty much the only other points earning $0 AF card I know of atm) that are on par and at times better than other rewards. The effective earn rate of the Premier card is 0.75 KFF per $ which actually works out to give me about 300 more KFF with my avg monthly spend of $3-3.5k per year than the Star Alliance, and on par with the Amex Plat and without an AF to boot so it's a perfect card to keep open. I hate churning and having to update all my subscriptions and auto billings etc so I prefer to have a card that is no frills i.e. $0 AF, and that earns good rewards. Helps that it's a Mastercard too so no need to go through the sweaty process of "will my Amex be declined" everywhere I go.

Amex used to be very good too but ever since they gutted their rewards program in response to the RBA, I've found it's far more hassle than it's worth esp trying to use all the perks in order to justify the $1,450 AF my lord. Only 2 benefits with Amex imo is that (a) they do earn points on Gov charges which isnt too much of a problem for me since I have ZipPay so I just pay bills with that then pay off Zippay with my Premier card earning me points, and (b) they only charge forex transaction fee if you buy something in a different currency i.e. they dont charge for the stupid "when the merchant process it OS even if you paid in AUD" but again, this isnt too big of a deal since I dont make many big purchases online and even then, I have a BW Zero Plat which doesnt charge that fee which I use and take with me while travelling.

This is a great card if and only if you can consistently meet the min monthly spend. I used to hold this when the min spend was only $2.5k per month but after they jacked it up to $4k I shut it down since I only occasionally hit $4k per month so it wasnt justified. I hate bank products that force you to jump through 500 circus hoops while avoiding lava on the floor just to get good value so this is why imo the Premier card is the best for me because it's no frills and gives great value. Only "hoops" really is having my pay paid into my HSBC account to maintain Premier status which is basically nothing.CBA Ultimate

Just remember that you don't get points when paying bpay using this cardPremier card

Yeah, that's a lot of money to maintain a card. I've never spent money on an annual fee (for no other benefits other than holding the card), and, up until now, I've not really considered it.HSBC Star Alliance...

plus $0 AF is only for first year after which it's a hefty $450.

Yes, I did have an Amex Platinum for a couple of years, but I made sure I got >> $1450 back in benefits every year (and not just frivolous things that I didn't need) and when I wasn't certain that I could, I closed it. Travel, cash back on things that I was going to spend money on anyway (fuel, groceries, flights, hotels). And I got pretty much $1450 in the last year without paying the last year's membership fee, because the benefits dropped (travel, Accor membership, plus 50,000 membership rewards retention offer after the anniversary date but before the fee), which I all used, then closed my account online before the fee was due anyway.

However, on my first read of the HSBC Star Alliance travel insurance policy, it looks very good.

I haven't read it side by side against a paid policy, but I will before my fee is due. If it is as good as I think it is, it potentially represents an alternative to paid travel insurance. At $450 per annum, provided that you put $500 of pre-paid travel expenses on the card, it is a lot cheaper than travel insurance, so may be worth holding. Not for the status but for the insurance.

so to me this card is just not worth it especially since I'm way off the $60k per annuum required to maintain Gold Status

Yeah, especially with the points discount after $3k per month.

Fortunately (unfortunately) we spend more than $4k per month consistently, so it's no big deal.CBA Ultimate...

This is a great card if and only if you can consistently meet the min monthly spend. I used to hold this when the min spend was only $2.5k per month but after they jacked it up to $4k

In fact, I didn't get notified (but knew from these forums) about the increase from $2.5k so as a test, only spent $2.6k last month to see if I had been grandfathered in on a lower threshold, or they'd just F$&*ed up the notification. They charged me the fee, but refunded after I asked them to prove when the notified me. They're now running around like blue-coughd flies trying to work out what to do about a) notifying me, and b) working out how many other cardholders they haven't notified.

This is another card with very good travel insurance (even now with the new conditions). I've used it (as backup to paid insurance) for things that paid insurance didn't cover, or when paid insurance cover ran out. and it was good, effective, quick enough and easy enough to claim on. For $420 per year (if you paid the fee every month), the travel insurance is possibly worth the fee.

Supersonic Swinger

Active Member

- Joined

- Aug 15, 2006

- Posts

- 974

- Oneworld

- Sapphire

- SkyTeam

- Elite Plus

However, on my first read of the HSBC Star Alliance travel insurance policy, it looks very good.

I haven't read it side by side against a paid policy, but I will before my fee is due. If it is as good as I think it is, it potentially represents an alternative to paid travel insurance. At $450 per annum, provided that you put $500 of pre-paid travel expenses on the card, it is a lot cheaper than travel insurance, so may be worth holding. Not for the status but for the insurance.

It looks like these are the same travel insurance policy terms which apply to the other HSBC cards with travel insurance (Premier, Platinum and Platinum Qantas) which have lower or no annual fee?

bullerdude

Established Member

- Joined

- Dec 26, 2011

- Posts

- 1,382

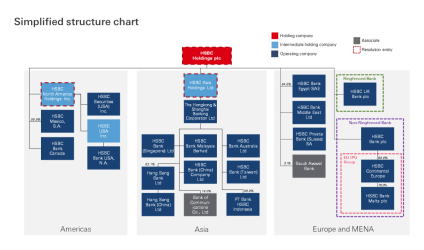

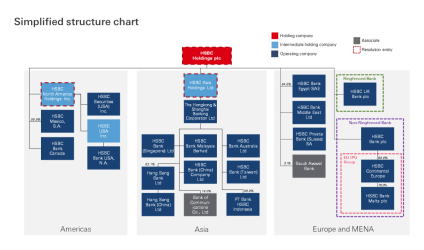

Looks like HSBC Australia is nested within their Asia group and legal structure, within the HSBC Asia Holdings Ltd entity, which is registered in Hong Kong. The diagram also doesn't show HSBC Australia to be ring-fenced, but I would expect there to be pretty tough requirements in-place to protect Australia customers given our foreign ownership laws and APRA regulations.

Last edited:

playbargain

Intern

- Joined

- Aug 8, 2010

- Posts

- 62

- Qantas

- Silver

- Virgin

- Platinum

One thing to note is that the Premier card gives 0 point to any government payment, unlike others where you at least get 0.5 point.

Pretty sure Amex is the only card provider in the Australian market at the time of writing that offers any points on Government spending? All other banks/institutions grant 0 points for Gov spending (happy to be corrected since I too would love to earn points on my council and water bills!).One thing to note is that the Premier card gives 0 point to any government payment, unlike others where you at least get 0.5 point.

Pretty sure Amex is the only card provider in the Australian market at the time of writing that offers any points on Government spending? All other banks/institutions grant 0 points for Gov spending (happy to be corrected since I too would love to earn points on my council and water bills!).

This is just one example I know off my head:

Altitude Business Platinum

Mastercard (overseas merchants): 2

Mastercard (Australian merchants): 1

Government payments: 0.5

Ahh OK that's a business card - I was referring to personal cards which the HSBC Premier Card is. Are there any personal cards that offer points on Gov Charges aside from Amex?This is just one example I know off my head:

Altitude Business Platinum

Mastercard (overseas merchants): 2

Mastercard (Australian merchants): 1

Government payments: 0.5

nthd_nthd

Active Member

- Joined

- Oct 29, 2023

- Posts

- 686

I checked HSBC Star Alliance CC Insurance and it's spending $500 to receive the cover insurance with Allianz and the insurance policy is on par with Citibank premierIt looks like these are the same travel insurance policy terms which apply to the other HSBC cards with travel insurance (Premier, Platinum and Platinum Qantas) which have lower or no annual fee?

nthd_nthd

Active Member

- Joined

- Oct 29, 2023

- Posts

- 686

I have been using CBA Ultimate for all my OS (3x points) spend as well - saved a lot of OS transaction fees plus they do decent Cashback offer - I got back quite a lot from it. If not for OS spend and min 4K spend domestically requirements I would have already closed it.Great find.

I'm currently waiting for AeroPlan Family Sharing to be re-enabled, to combine 50,000 points for two HSBC Star Alliance accounts together (as well as earned points) and make the most of two HSBC Star Alliance accounts for a year before closing at least one of them. But the bulk of my points to date have been with SQ (earned with Amex, but I've closed Amex as I can't justify the fees).

CBA Ultimate is still a good earner (and 3X points OS, with no currency fees and no cap for OS spend) is a reasonable earn rate, but this seems like the perfect local earner.

- Joined

- Nov 16, 2004

- Posts

- 49,211

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

This thread reactivation is timely as we are eying off a pending renewal for our ANZ Qantas Platinum Visa and it's (all up) $360 fee. We have had this account since last century and the days of 4 pts per dollar (6 on Qantas spend) ... approaching 3 decades.

I have a couple of months leeway. With the HSBC Premier, if starting from scratch, how long do you need to be putting $9K through the "Global Account" before being able to apply for the Premier Mastercard? Earlier posts indicate no time requirement, but HSBC seems to imply 6 months.

I have a couple of months leeway. With the HSBC Premier, if starting from scratch, how long do you need to be putting $9K through the "Global Account" before being able to apply for the Premier Mastercard? Earlier posts indicate no time requirement, but HSBC seems to imply 6 months.

I believe its 6 monthsWith the HSBC Premier, if starting from scratch, how long do you need to be putting $9K through the "Global Account" before being able to apply for the Premier Mastercard? Earlier posts indicate no time requirement, but HSBC seems to imply 6 months.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Recent Posts

-

Qantas Upgrades - Successes or Failures (post results)

- Latest: Flyfrequently

-

-

Currently Active Users

- kpro

- Peasant

- blacksultan

- lunne

- MELso

- Noah Count

- dh3mike

- Doug_Westcott

- astrosly

- rurounimaikeru

- Brissy1

- Seat0B

- qfflyer

- Austman

- XavierP

- Arkana

- Aeryn

- Gladstone Tim

- EmBee

- Darkpulsar

- FlyandStay

- Docfritz

- Tlee

- Mr_Orange

- BrianQQ

- cityliving2

- Shubysnacks

- Pete98765432

- AIRwin

- TomVexille

- Mrmaxwell

- CyberTian

- DJTravels

- TheRealTMA

- HealthyPotato

- sjw2410

- M2002queen

- ABC

- waflyer

- points

- SJF211

Total: 1,329 (members: 49, guests: 1,280)