When I was in Japan back in May I used the ING Orange Everyday Debit card, which rebated foreign ATM withdrawal fee's (up to 5) and international transaction fee's. As the foreign ATM withdrawal fee's are no longer rebated what is the best alternative product? Will it be the Macquarie Transaction Account? I will be traveling to Taiwan in a month and will need to withdraw cash there. Thanks.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ING Bank Dropping 5 ATM Operator Fee Rebate Benefit from 1/8/23

- Thread starter bdl

- Start date

- Joined

- Nov 16, 2004

- Posts

- 48,081

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

- SkyTeam

- Elite Plus

I do not believe there are any publicly available Australian banking products that rebate ATM fees currently.When I was in Japan back in May I used the ING Orange Everyday Debit card, which rebated foreign ATM withdrawal fee's (up to 5) and international transaction fee's. As the foreign ATM withdrawal fee's are no longer rebated what is the best alternative product? Will it be the Macquarie Transaction Account? I will be traveling to Taiwan in a month and will need to withdraw cash there. Thanks.

Serfty is right, no other bank rebates foreign atm fees. The best alternatives are now all pretty equal with only slight minor differences.

Bankwest, UBank, up bank and Macquarie have products for no foreign exchange fees, and none of them require the 5 transactions.

Bankwest, UBank, up bank and Macquarie have products for no foreign exchange fees, and none of them require the 5 transactions.

I do not believe there are any publicly available Australia banking products that rebate ATM fees currently.

Serfty is right, no other bank rebates foreign atm fees. The best alternatives are now all pretty equal with only slight minor differences.

Bankwest, UBank, up bank and Macquarie have products for no foreign exchange fees, and none of them require the 5 transactions.

Ok, thanks guys. I will continue to use ING then, as the 1% off utility bills (if I meet the criteria) is good enough for me to continue to use them for now.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 11,712

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

There’s also a Westpac travel wallet product that doesn’t charge ATM fees across the WBC partner network. BUT they get their 3% Int fee either upfront if you convert AUD to another currency and store that for later use OR if you just leave it loaded with AUD and withdraw foreign currency (they convert at the prevailing FX rate plus 3%).

There might be some places where that still make sense ie WBC partner ATMs are available but ATMs would otherwise charge extortionate fees and you only wanted a small amount of cash.

There might be some places where that still make sense ie WBC partner ATMs are available but ATMs would otherwise charge extortionate fees and you only wanted a small amount of cash.

Last edited:

Their PDS only mentions the prevailing FX (mastercard) rate. Nothing about "plus 3%". Where is the plus 3% mentioned?There’s also a Westpac travel wallet product that doesn’t charge ATM fees across the WBC partner network. BUT they get their 3% Int fee either upfront if you convert AUD to another currency and store that for later use OR if you just leave it loaded with AUD and withdraw foreign currency (they convert at the prevailing FX rate plus 3%).

There might be some places where that still make sense ie WBC partner ATMs are available but ATMs would otherwise charge extortionate fees and you only wanted a small amount of cash.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 11,712

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

That was our initial reading of the PDS also when I applied for one. But the guy in the local WBC branch told me that there is the 3% charge. I recall someone else here pointed out the relevant part of the PDS but there’s also another comment (not sure which thread) highlighting that WBC is the exception to all other banks involved in worldwide partner ATM access (in that they charge all customers a 3% fee).Their PDS only mentions the prevailing FX (mastercard) rate. Nothing about "plus 3%". Where is the plus 3% mentioned?

As an experiment, used my card OS this year and I was charged 3% fee using the debit function accessing loaded AUD.

mikedesign

Junior Member

- Joined

- Oct 2, 2014

- Posts

- 38

An option with Westpac/StG/BoM is to get their travel money card — prepaid card that you can transfer from your transaction account — has no Int’l fees and access to the global ATM partners.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 11,712

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

But they charge you 3% int transaction fee instead. I’ve keep mine for the situation where 3% is better than the ATM fee…An option with Westpac/StG/BoM is to get their travel money card — prepaid card that you can transfer from your transaction account — has no Int’l fees and access to the global ATM partners.

No travel card is a general good idea if you want something low fee. They all scam you on the ratesAn option with Westpac/StG/BoM is to get their travel money card — prepaid card that you can transfer from your transaction account — has no Int’l fees and access to the global ATM partners.

mikedesign

Junior Member

- Joined

- Oct 2, 2014

- Posts

- 38

No, the travel money card doesn’t, that’s why it’s an option instead of the debit card.But they charge you 3% int transaction fee instead. I’ve keep mine for the situation where 3% is better than the ATM fee…

Travel money card

Westpac’s new Worldwide Wallet is a prepaid Mastercard® that can be used to make payments and access cash in multiple currencies.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 11,712

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

The WBC has the ability to hold foreign currency amounts and yes, they get their 3% up front during the conversion (the underlying rate itself is ok). You can just leave cash in AUD but they still get their 3% on the debit/ATM transactions. So really a bit of a waste of a product…No travel card is a general good idea if you want something low fee. They all scan you on the rates

I have one and it charges 3%….No, the travel money card doesn’t, that’s why it’s an option instead of the debit card.

Travel money card

Westpac’s new Worldwide Wallet is a prepaid Mastercard® that can be used to make payments and access cash in multiple currencies.www.westpac.com.au

See here comment here.

Best card with no forex fees

Last edited:

It’s true they don’t charge a transaction fee on top, because when you use this sort of product they do the conversion for you, meaning they stiff you on the rate.

Other products have visa or MC do the conversion in real-time, and most add 3% except the various products we discuss here, like ING, Citi, Bankwest etc.

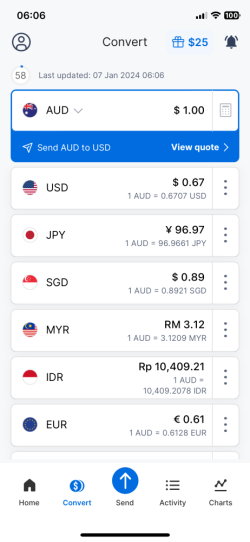

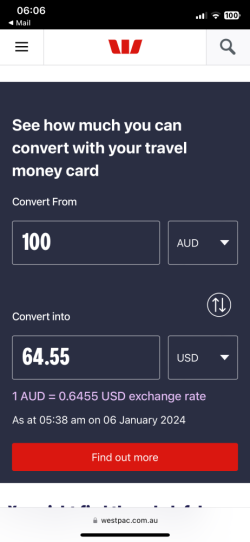

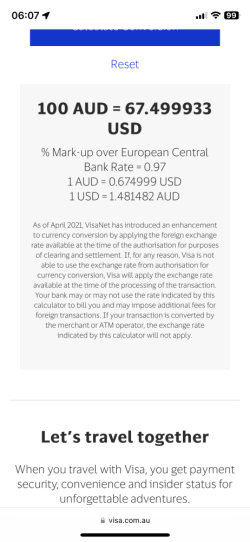

Eg right now-

XE rates are 0.6707USD.

Westpac gives me 0.6455USD

Visa (on my new Nab, ex Citi) gives me 0.674999

Other products have visa or MC do the conversion in real-time, and most add 3% except the various products we discuss here, like ING, Citi, Bankwest etc.

Eg right now-

XE rates are 0.6707USD.

Westpac gives me 0.6455USD

Visa (on my new Nab, ex Citi) gives me 0.674999

Attachments

I love to travel

Established Member

- Joined

- Jun 4, 2016

- Posts

- 3,038

- Qantas

- Gold

This card has just been hacked - middle east food delivery at 4am Australian time. Very dissapointed that this got through their security system.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 11,712

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

any idea how?This card has just been hacked - middle east food delivery at 4am Australian time. Very dissapointed that this got through their security system.

Fortunately, I only keep a very small amount in the Everyday Day acc. The rest is in the Savings Max acc. And then only use it in ATMs and occasionally for the 5x monthly taps.

If you don’t use the card often, there’s a Temporary Hold function in the app.

Last edited:

I love to travel

Established Member

- Joined

- Jun 4, 2016

- Posts

- 3,038

- Qantas

- Gold

No idea how, certainly never gave password nor used at ATM, So can only glean someone I purchased from either took the details and used it or there system was comprimised. The three people I have spoken to all have a similar story. Very annoying but took my money out of Savings Maximiser as a precuation and will close account when/if money is refunded (ING give you a hard time apparently)any idea how?

Fortunately, I only keep a very small amount in the Everyday Day acc. The rest is in the Savings Max acc. And then only use it in ATMs and occasionally for the 5x monthly taps.

If you don’t use the card often, there’s a Temporary Hold function in the app.

More likely they used a card number generator and your card number came up.No idea how, certainly never gave password nor used at ATM, So can only glean someone I purchased from either took the details and used it or there system was comprimised. The three people I have spoken to all have a similar story. Very annoying but took my money out of Savings Maximiser as a precuation and will close account when/if money is refunded (ING give you a hard time apparently)

I love to travel

Established Member

- Joined

- Jun 4, 2016

- Posts

- 3,038

- Qantas

- Gold

Would love to know how they match to expiry date and CVC. I wish ING had 2FA for online transactions.More likely they used a card number generator and your card number came up.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 11,712

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

I’ve never used ING online. In fact, rarely if ever use a Debit Card online.Would love to know how they match to expiry date and CVC. I wish ING had 2FA for online transactions.

- Joined

- Jan 26, 2011

- Posts

- 29,590

- Qantas

- Platinum

- Virgin

- Red

Did they let you know or did you find out?This card has just been hacked - middle east food delivery at 4am Australian time. Very dissapointed that this got through their security system.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.