Lynda2475

Suspended

- Joined

- May 1, 2009

- Posts

- 9,395

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

So id almost forgotten about this account which I opened a few weeks before they announced the were removing all the benefits that made the account worth opening. I never bothered jumping through the deposit/transaction hoops nor ever using it (apart form initial deposit).

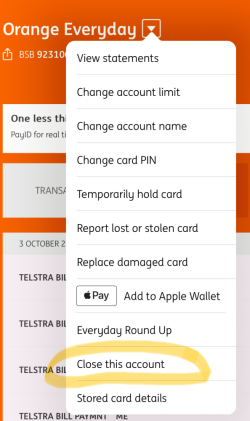

Transferred all the $ out but it wont let you close the account online. Have been on hold for over 2 hours as can only close over the phone. What terrible service.

Id hate to be calling about a lots or stolen card. They will never get me back as a customer; make it easy to open online and accept deposits but so difficult to close.

Transferred all the $ out but it wont let you close the account online. Have been on hold for over 2 hours as can only close over the phone. What terrible service.

Id hate to be calling about a lots or stolen card. They will never get me back as a customer; make it easy to open online and accept deposits but so difficult to close.