If it is 3%, you're better off copping the foreign ATM operator fee and using the ING card in certain circumstances (depends on how much you're withdrawing and how much the ATM fee is).I’ve gone down the WBC / Global Wallet route but while it’s clear they won’t charge an ATM fee if you use an alliance/partner ATM, it looks like they’ll still sting you 3% if you withdraw OS from your AUD balance or sting you upfront ~2.5% if you convert AUD to one of the supported foreign currencies….

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ING Bank Dropping 5 ATM Operator Fee Rebate Benefit from 1/8/23

- Thread starter bdl

- Start date

I love to travel

Established Member

- Joined

- Jun 4, 2016

- Posts

- 3,355

- Qantas

- Silver Club

ATM withdrawals no longer counting as one of the 5 transactions per month.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 13,739

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

Yes, I think I said that here or the other thread (Citi one). In the US, ATM fees average US$3 based on my recent survey. Withdraw > $100 and your ahead.If it is 3%, you're better off copping the foreign ATM operator fee and using the ING card in certain circumstances (depends on how much you're withdrawing and how much the ATM fee is).

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 13,739

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

What do you mean? The 5x transactions is only supposed to be ATM withdrawals.ATM withdrawals no longer counting as one of the 5 transactions per month.

You should have unlimited fee free VISA debit transactions if you met the criteria in the previous month.

exceladdict

Senior Member

- Joined

- Mar 26, 2014

- Posts

- 5,119

- Qantas

- Platinum

- Virgin

- Silver

Bankwest accounts (free, or with qantas points if you're up for the 2k monthly deposit hassle) or the Macquarie account (with 4% interest on balances up to 250k) could be worth considering. There's probably a few others around the place as well. Of course you'll still be charged the atm operator fee.I’ve gone down the WBC / Global Wallet route but while it’s clear they won’t charge an ATM fee if you use an alliance/partner ATM, it looks like they’ll still sting you 3% if you withdraw OS from your AUD balance or sting you upfront ~2.5% if you convert AUD to one of the supported foreign currencies….

I’ll experiment in a few weeks time but not looking good.

Are there any other options to avoid ATM and Int TX fees to access your own money?

Ozbargain has a handy table here: Debit & Credit Cards with no international fees - OzBargain WikiBankwest accounts (free, or with qantas points if you're up for the 2k monthly deposit hassle) or the Macquarie account (with 4% interest on balances up to 250k) could be worth considering. There's probably a few others around the place as well. Of course you'll still be charged the atm operator fee.

Have to say, while I mourn the loss of ING’s unique ATM operator fee rebate, I increasingly find I’m needing less physical cash anywhere these days (obviously that will depend a lot on the destination). Tend to put most o/s spend through the Coles MC, where possible, which has no o/s transaction fees and earns Velocity points (via Flybuys).

exceladdict

Senior Member

- Joined

- Mar 26, 2014

- Posts

- 5,119

- Qantas

- Platinum

- Virgin

- Silver

Yes, agree. Across two weeks in three countries in Europe I used cash for three transactions in total, and one of those was just to get rid of change.Ozbargain has a handy table here: Debit & Credit Cards with no international fees - OzBargain Wiki

Have to say, while I mourn the loss of ING’s unique ATM operator fee rebate, I increasingly find I’m needing less physical cash anywhere these days (obviously that will depend a lot on the destination). Tend to put most o/s spend through the Coles MC, where possible, which has no o/s transaction fees and earns Velocity points (via Flybuys).

In the US and Asia this year, used a bit more cash but again mainly just because I had it and in most cases card may have been an option. Further from CBDs, I imagine cash may still be needed.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 13,739

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

Thanks. I already have UBank and of course ING will still be fee free. My NAB account was fee free but I received some cryptic letter implying it was no longer - so haven’t tried using it in an ATM.Bankwest accounts (free, or with qantas points if you're up for the 2k monthly deposit hassle) or the Macquarie account (with 4% interest on balances up to 250k) could be worth considering. There's probably a few others around the place as well. Of course you'll still be charged the atm operator fee.

I also have 28° MC. I’m contemplating applying for the Coles MC to at least get some sort points for the large amount travel expenses.

The US has improved but short of staying in one’s hotel room it’s pretty hard to get by without cash.Yes, agree. Across two weeks in three countries in Europe I used cash for three transactions in total, and one of those was just to get rid of change.

In the US and Asia this year, used a bit more cash but again mainly just because I had it and in most cases card may have been an option. Further from CBDs, I imagine cash may still be needed.

I just took out some extra cash to use in Sep when I return (after ING drop the ATM rebate).

Perhaps what we need is a thread listing countries and fee free ATMs (if any)…

exceladdict

Senior Member

- Joined

- Mar 26, 2014

- Posts

- 5,119

- Qantas

- Platinum

- Virgin

- Silver

Bankwest Qantas MCs are an option here too, though the platinum has a low cap before reducing to 0.5c/p. Current 40k promo thoughI also have 28° MC. I’m contemplating applying for the Coles MC to at least get some sort points for the large amount travel expenses.

Lynda2475

Suspended

- Joined

- May 1, 2009

- Posts

- 9,395

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

Just tried to close this account as without the ATM rebate it is zero use to me - transferred money from the linked savings maximiser account to the transaction account and did two small transfers (under $10) to savings accounts with other banks to check all was ok, then tried to transfer the remaining balance only to be told not possible as I had exceeded the daily transaction limits.

Seriously the limit is 2 OSKOs only per day? What a joke ! I cant seem to find anywhere to update the daily transfer limits (something super simple to do with Westpac, Citi or Macquarie) - looks like a huge effort t get money out and close.

Could never these guys to anyone, make it way too hard to move your own money around; and so many hurdles to get bonus interest where as all my other accounts only require that balance at the end of the month is higher than start which always happens due to the interest payment itself.

Seriously the limit is 2 OSKOs only per day? What a joke ! I cant seem to find anywhere to update the daily transfer limits (something super simple to do with Westpac, Citi or Macquarie) - looks like a huge effort t get money out and close.

Could never these guys to anyone, make it way too hard to move your own money around; and so many hurdles to get bonus interest where as all my other accounts only require that balance at the end of the month is higher than start which always happens due to the interest payment itself.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 13,739

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

A 1k per day OSKO transfer limit came in a while ago. But a scheduled transfer will still be processed pretty quickly.Just tried to close this account as without the ATM rebate it is zero use to me - transferred money from the linked savings maximiser account to the transaction account and did two small transfers (under $10) to savings accounts with other banks to check all was ok, then tried to transfer the remaining balance only to be told not possible as I had exceeded the daily transaction limits.

Seriously the limit is 2 OSKOs only per day? What a joke ! I cant seem to find anywhere to update the daily transfer limits (something super simple to do with Westpac, Citi or Macquarie) - looks like a huge effort t get money out and close.

Could never these guys to anyone, make it way too hard to move your own money around; and so many hurdles to get bonus interest where as all my other accounts only require that balance at the end of the month is higher than start which always happens due to the interest payment itself.

If you have zero balance, they’ll probably eventual close the accounts for you anyway. Probably better to wait until after the end of the FY so you can access records/statements etc.

- Joined

- Feb 25, 2020

- Posts

- 935

- Qantas

- Platinum

- Virgin

- Platinum

Lynda2475

Suspended

- Joined

- May 1, 2009

- Posts

- 9,395

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

A 1k per day OSKO transfer limit came in a while ago. But a scheduled transfer will still be processed pretty quickly.

If you have zero balance, they’ll probably eventual close the accounts for you anyway. Probably better to wait until after the end of the FY so you can access records/statements etc.

I want to get the balance to $0 before end of June so no tax issues for next year. No statements are available atm so I just screen shot the pitiful interest paid to date <$10 which was what I transferred out.

I never would have opened it if they announced the changed terms a few weeks earlier. I would have earned much more interest in any of my other accounts where not required to make deposits or purchases to qualify.

Qudos Bonus Saver pays 4.25% only criteria is no withdrawals. Qantas Life pays 4.7% provided your balance at end of month is higher than start of month.

Lynda2475

Suspended

- Joined

- May 1, 2009

- Posts

- 9,395

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

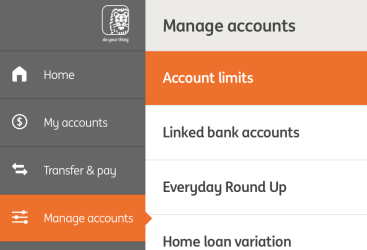

It sounds like your daily payment limit (in dollars) is too low, you can easily raise it online or in the app

View attachment 332257

Thanks, went in there and says limit is $5k, I was trying to transfer $2k on top of the $10 already transferred and it wont allow it.

Ive never heard of a $1k OSKO limit - it certainly isnt a thing at Westpac - I just finished paying my strata fees which are well over $1k with no issue.

oz_mark

Enthusiast

- Joined

- Jun 30, 2002

- Posts

- 22,058

ING have a hard limit of $1,000 for OSKO. In Westpac's case, it is included as part of your daily transfer limit.Thanks, went in there and says limit is $5k, I was trying to transfer $2k on top of the $10 already transferred and it wont allow it.

Ive never heard of a $1k OSKO limit - it certainly isnt a thing at Westpac - I just finished paying my strata fees which are well over $1k with no issue.

Lynda2475

Suspended

- Joined

- May 1, 2009

- Posts

- 9,395

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

ING have a hard limit of $1,000 for OSKO. In Westpac's case, it is included as part of your daily transfer limit.

So annoying - I transferred $1k today, will have to do $1k tomorrow then final $10 day after. What is the point of having a $5k limit if in reality you can only transfer $1k.

Doubles standards as they had no issue with me depositing the $2k to open the account.

- Joined

- Feb 25, 2020

- Posts

- 935

- Qantas

- Platinum

- Virgin

- Platinum

Are you paying to a PayID instead of a BSB and Account number?

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 13,739

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

No, you can just schedule a payment of $1010. It won’t go through immediately but it ought to be in the receiving bank by COB. Next day at the latest.So annoying - I transferred $1k today, will have to do $1k tomorrow then final $10 day after. What is the point of having a $5k limit if in reality you can only transfer $1k.

Doubles standards as they had no issue with me depositing the $2k to open the account.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 13,739

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

@Lynda2475 i recall you said you have MacBank, so that’s probably an alternative but otherwise, if your Citi Plus morphs into a regular NAB account, it will most likely be worthless for OS travel. ING will still be better for ATMs and Debit purchases (despite the hoops and jumps). So maybe leave it in limbo as a wait and see? There’s no cost.

Lynda2475

Suspended

- Joined

- May 1, 2009

- Posts

- 9,395

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

Are you paying to a PayID instead of a BSB and Account number?

Nope always BSB and Account number - i don't use payID because i have more accounts than I have mobiles or email addresses.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Hawk529

- RB001

- Fridge

- Wanderlust_tim

- larry40

- Colin Millington

- rovingrabbit

- GrahamBRI

- k3nnis

- dairyfloss

- Rayesfeg

- am0985

- AndrewCowley

- YoungTraveller

- PineappleSkip

- Daveller

- LynZ

- calib

- jkbaus

- Melka

- accompanimince

- JB001

- Lat34

- offshore171

- shamatam

- mrsterryn

- burneracc

- cheesebiscuits

- ShelleyB

- torks

- DejaBrew

- NoName

- jase05

- There'sOnlyOneJimmy

- mjt57

- bnebased

- Jthommo

- Dvg

- Rug

- flyingfan

- roshea

- daa98

- duffyd

- jakob

- #flying

- adenda

- exceladdict

- wentworthmeister

- grapes

- ahpratt

Total: 1,220 (members: 92, guests: 1,128)