Fifa

Established Member

- Joined

- Sep 17, 2006

- Posts

- 2,129

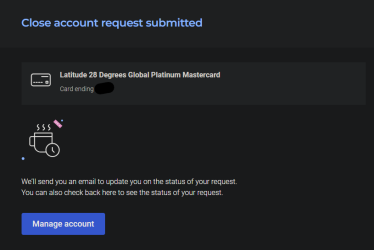

Same same.This is really annoying news...I have had the card for 18 years when it was a Wizard Clear Advantage Mastercard. You uaed to be able to load the card into a positive balance, and then withdraw cash from ATMs OS fee free. Does give 1 free flexiroam e/Sim card per card member per year, valid for 14 days with 3gb data ...I think I will need to look for the scissors!

I think every AFFer had one of these cards in the early days!