eastwest101

Established Member

- Joined

- Oct 26, 2010

- Posts

- 3,405

- Qantas

- Gold

- Virgin

- Gold

Agree, I still feel all these totally negative large program changes THIS year of all years, are dumber than dirt for Virgin. And many here concur very clearly.

HEAPS of folks nationally will simply fly Jetstar, use miles, or at worst, book only Lite fares when they finally wake up to the real changes. Masses of once loyal and happy Virgin flyers have not had the Penny Drop yet, that it will now cost them ~$5000 a year to keep Gold etc.

All this loses Virgin money - and all will manifest itself in a short period of time.

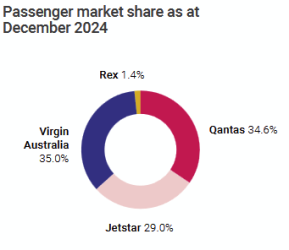

This changes will NOT make them extra money overall, that is the weird thing. Had they touched nothing at Velocity until the IPO, market share would have stayed about the same. Now it will clearly drop, weakening that juicy IPO pot of money.

All Bain want is cash, and to ride out of town carrying as much of it in their American saddlebags as they can fit in.

The SMART thing to do if anyone in there reads the wind, is the loosening of many of the crazy LG rules, and hand out a lot more LG cards than they budgeted for. FAST. That costs them zero, and will placate many, and plugs the dike a bit.

Add in Family Pooling, and remove the loopy '75% must be Virgin flights' wording, and many past very loyal flyers will make the cut. Give a lot of folks shiny LG cards, and they will not be galloping over to Jetstar/Qantas. Human nature. Carrot and Stick - right now there is just stick.

Seems like the LG scheme is not totally set in stone now, and THIS is the time to ease off, on some of the fine details to stem some inevitable bleeding of revenue and paid seats during 2025. The more loyal Virgin Elite tier flyers urge this to be loosened up, the higher the chance it will be reviewed.

Certainly seems like they weren't necessarily thinking ahead from a communication or a marketing opportunity though. If this was intended to be an awesome marketing opportunity any normal loyalty scheme would have done the calculation and the maths and announced to people how close they were to Lifetime Gold and had that information ready to roll out on the Velocity website, instead we get this rather reluctant process to email a generic address and get a generic PDF of your status history. All that does is hide the changes/info from the uninformed/disengaged members and makes the more informed/engaged customers look at their spend, look at what the airline and loyalty scheme is now compared to what it was, and then sit down and do the maths on the lower earn rate for some fares which have only been going in one direction since Covid. Add to that only one reasonable international partner and the loss of many other partner airlines, routes and frequency and many lounges, and Velocity is looking like a pretty marginal proposition even compared to the Qantas Frequent Flyer scheme! Without Singapore Airlines and Krisflyer options Velocity would be dead to me already.

Seems very much like the Bain finance revenue people have made the decision, got their bonuses and KPI's and are now sitting around asking if someone from the loyalty and customer retention teams should be brought into the room or not. A sort of ex-post-facto consideration.

I am another dual Qantas and Velocity Gold awaiting for my Velocity history to arrive by email, and will have the Amex Virgin lounge entry with BFOD Y and J fares as an option on the table once I earn/retain Qantas Gold for the year. In my particular situation it might be the best of both worlds if Qantas is gouging in the future then I have Virgin as an option with lounge access and slowly sneaking up to Lifetime Gold if close enough, and with Qantas having a much better reach internationally than Virgin as far as partners and lounge access goes, I'm still comfortable flying enough with Qantas to retain Gold annually (but probably not Platinum as its just too high a hurdle for my own circumstances). More international flying and less Family Pooling opportunities (as the kids grow up and move out) also swings the equation away from Velocity and I suspect that I'm not the only one in that position.

I've typically been in the foot in each camp when Virgin was a genuine contender with more partners and seeking my business with the added bonus of keeping Qantas honest competitively, but with Bain having their own agenda, and almost actively discouraging flying with them on certain fare types, it would seem that Qantas will be the beneficiary of my decision-making process if the maths for Velocity don't add up for me anymore.

Maybe once Bain and Qatar have exited the stage, new management at Virgin and Velocity might be reconfiguring things and give themselves a chance to win back my spend with them.

Last edited: