Because they are worth more to me as flights.

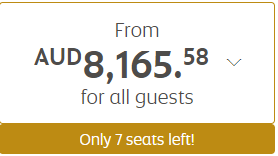

Here's an example - Singapore to Amsterdam next year in Business...

View attachment 275451

139000 velocity is 278000 flybuys.

In your view that is $1,390 of real money at Coles.

In my view this $5,841.87 of business class flights.

View attachment 275452

This is better value for me as I am going to take the flight either way.

Woolworths rewards on the other hand I always take as cash - no allegiance to Qantas in any way so their points are valueless to me.

I also do play around with credit card bonuses when I can.

Would you have otherwise really paid $5,841 if you didn't have any Velocity points?

Or is it more likely for example that you would have paid $2,000 to fly Etihad instead, in which case your points are really only worth 1.35c each.