Good discussion, I for one appreciate the different viewpoints! Made me think more about about both acquisition cost and redemption value for each point together

Seems to me like what's best for each person really has to depend on the crucial comparison of how fast you can earn vs. how fast you can redeem (+ how much you want to save up for later, if you expect your earn rate to change). There can't be a one-size-fits-all answer.

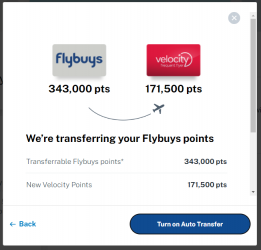

In my case, I currently have more VFF than I can reasonably redeem for my 2022 schedule, so I'm going to sit on my flybuys stash and neither spend as cash nor convert to VFF at 10% bonus — will decide in the future, since I don't think a devaluation at the flybuys end is likely.