Obi-run Kenobi

Member

- Joined

- Apr 27, 2015

- Posts

- 203

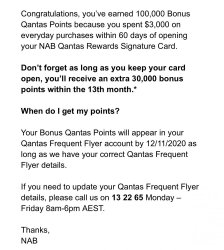

Applied yesterday and have a reference number but I haven't received any email confirming my application like with most other banks. Is this common for NAB?

I've seen that some people are waiting many weeks to get approved for this one. Is that still the case?

UPDATE

Email received and conditionally approved 24h later. Guess I'm just impatient...

I've seen that some people are waiting many weeks to get approved for this one. Is that still the case?

UPDATE

Email received and conditionally approved 24h later. Guess I'm just impatient...

Last edited: