SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 11,169

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

Good question. I believe it’s still in play to 30 June 2023. But now on my To Do list to check.When does instant asset writeoff end?

Good question. I believe it’s still in play to 30 June 2023. But now on my To Do list to check.When does instant asset writeoff end?

I recently used CBA award points to buy something from Myer and claimed it without any issues. The receipt showed the value of the item in dollars. In payment type it said Commbank Awards.Hmmm.. I haven't seen the receipt yet but I'm planning on buying a macbook air $2469 with $2500 worth of gift cards.

Or do you think I should use $2000 gift card and put the rest on CC just incase?

Awesome thank youProbably not. The GCs ought to get processed the same as cash. So you would expect the bottom line to show the total.

Cool that's reassuringI recently used CBA award points to buy something from Myer and claimed it without any issues. The receipt showed the value of the item in dollars. In payment type it said Commbank Awards.

Probably not. The GCs ought to get processed the same as cash. So you would expect the bottom line to show the total.

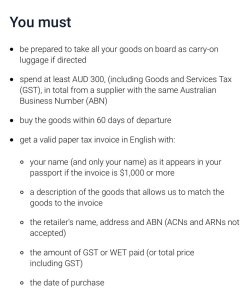

You can buy that way, however, the TRS as stated by others require the original (not copy) full tax invoice showing the description of goods, the value of the goods and the price paid, the ABN of supplier and for expensive items your name. The Gift cards will just be treated as cash.I haven't seen the receipt yet but I'm planning on buying a macbook air $2469 with $2500 worth of gift cards.

Printout invoice is Okprint out

I'll be buying online, I think they will give me an invoice for me to print out right?

Or is this not accepted and will need an instore receipt?

There is no requirement for addressaddress

My invoices have never included my middle name so you should be fine.Do I need to have my middle name on the invoice, or is first and last name sufficient? I have my middle name in my passport

AFF Supporters can remove this and all advertisements

I’m about to provide another data point to share on this one. When I departed MEL last night, I claimed clothing/footwear (which in addition to other items) put me well over the $900 concession. Dealt with a lovely ABF officer at the TRS counter, who asked if I was travelling alone or pooling and when I confirmed I was flying solo, she advised that I would likely be stung on my way back into the country. I suggested clothing/footwear was exempt so I’d be fine, to which she queried where I’d seen/heard that? Told her it was indicated on the ABF website and showed her the relevant detail -:So it seems everything (including personal goods) claimed in Aus is not "excluded" from your limit on the way back in.

So really claim at your own risk.

She agreed that the wording is very ambiguous as it can be interpreted as personal items being different to personal goods. Basically, you can read it as personal items being clothing etc that are quite simply exempt, whereas personal goods (e.g. Phone/iPad/etc) aren’t exempt unless you’ve had them for 12 months or are importing them temporarily.Most personal items such as new clothing, footwear, and articles for personal hygiene and grooming (excluding fur and perfume concentrates) may be brought into Australia in your accompanied baggage, free from duty and tax.

Personal goods are free from duty and tax if they are:

- owned and used by you overseas for 12 months or more

- imported temporarily (a security may be required by the Department).

I’m about to provide another data point to share on this one. When I departed MEL last night, I claimed clothing/footwear (which in addition to other items) put me well over the $900 concession…

Well, I dutifully indicated I did not have >$900 to declare and was promptly ushered straight out the green door.…my intent is to not declare as without the clothing/footwear, I’m well under the limit. ABF officer agreed I’d likely be fine given the ambiguity of the text. Otherwise, to use an extreme example, bringing back a deodorant or shampoo/conditioner purchased overseas (i.e. personal hygiene articles) would count towards your duty free concessions unless you’d owned them for 12 months (which would be utterly ridiculous)!!

Welcome to AFFwhat happens if you gift an item to a family member or friend and they bring in said item into the country within 12 months? surely you won't be telling your friend that you claimed the GST refund and give it to the friend?

Not if your total purchases in Oz and OS are under your DF allowance.OK I'm confused. I'm going overseas for a week soon and have bought some perfume locally thinking I could claim GST back. I have the correct paperwork. If the perfume is new and unopened on departure but I bring it back with me opened and used, I need to declare it and repay GST?

OK I'm confused. I'm going overseas for a week soon and have bought some perfume locally thinking I could claim GST back. I have the correct paperwork. If the perfume is new and unopened on departure but I bring it back with me opened and used, I need to declare it and repay GST?

And don’t forget if you’re travelling with family, you can pool your duty free allowances.Not if your total purchases in Oz and OS are under your DF allowance.