If the changes make getting LTG much harder I would need several years before the change takes effect to be relatively unscathed. Even for LTS I’d need a fair bit of warning and rushing to get that might be hard to justify.Whatever the announcement here’s hoping we have enough time to act on the changes whether good or bad so we come out relatively unscathed

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Qantas FF announcement 20 June - "biggest overhaul" in program history

- Thread starter Doctore1003

- Start date

- Status

- Not open for further replies.

- Joined

- Mar 5, 2019

- Posts

- 3,742

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

I have it on very good authority that we'll see Lifetime Bronze

That's not a bad idea, IMHO ... something for those who are unable to qualify for LTS/G to look forward to

trippin_the_rift

Established Member

- Joined

- Apr 2, 2006

- Posts

- 4,102

... and no-one has a clue?

Let's look at the facts:

- QF has never in the history of the airline done anything "wow omg this is the best ever".

- AJ repeatedly says the board and shareholders are the priority.

- Singapore Airlines & Cathay Pacific programs (2 biggest intl airlines into AUS) have made minor changes to their respective programs over the past 18 months.

- Given that both of these programs are larger and more profitable than Qantas Loyalty (I'm assuming based on reading between the lines in their annual reports) it makes sense for QF to copy and paste the proven model.

- Qantas Loyalty has no history of copying Velocity.

- Qantas has endless presentations where they talk about "lifetime customer value"

- Qantas has more codeshare partnerships than I've had cold lunches in my entire life.

- Qantas has not made major major changes to the program since introducing status credits and joining Oneworld.

- Qantas overhypes everything.

We can condense the above historical playbook of Qantas down into a few broad themes:

- Increase Profitability

- Learn from SQ/CX

- Leverage inventory from intl carriers without needing to utilize QF a/c

- No major shift in program design/play it safe, but overhype the heck of it

With these 4 broad themes in mind:

- Loyalty program profitability is linked to redemption. More redemption = more revenue realised = profit

- On the airline side, yield drives profitability, and since QF charges a premium for biz/first seats, maybe an alignment to points costs.

- SQ/CX have both made changes to redemptions. Increased economy availability and at lower miles cost.

- Increase member engagement to drive up lifetime value. Most members have low points balances. How to get them from earning to redemption as fast as possible?

Further drilling down into the logic behind the broad themes (+basic assumptions on program changes):

- Lowering the cost of economy class flights would drive up redemption AND contribute towards lifetime customer value [2 key areas solved in one hit, plus good messaging for members and the media. Also a direct copy of other proven FFP - SQ/CX/DL/BA/MH...and others]

- Increase in points for biz/first class for increased yield on redemption tickets. QF is already fairly expensive when adding in "taxes" so increasing the points required might have to come at the cost of reducing the taxes component. The pressure on yield in biz/first is magnified because of the ultra long haul routes that QF says are driving a premium that pax are willing to pay. Thus, widening the gap between award seat recovery of points and the average revenue RASK for that seat.

- Expand on relationships with the abundance of codeshare relationships. QF has consistently rolled out online redemption for partners over the past 2-3 years. Perhaps if there are any other non-OW partners that don't have online redemption they might come online. This also drives program lifetime value AND program profitability.

Ultimately QF Loyalty is limited in the scope of the changes based on what everyone else is doing in the market. Something too expensive then people gravitate towards other programs. Go too cheap and they lose the premium on marketing revenue from banks.

My gut feeling says they need to improve:

- lifetime earning [as I mentioned in previous posts]

- platinum one [as I mentioned in previous posts]

- a qualifier of cash spend in addition to status credits [to provide revenue protection mechanism for low-frequency high spenders]

- non-air status benefits [to increase ltv within the 20-600 status credit range by profiting on ground incentives that leverage on status]

But my brain says Qantas is risk-averse, and the loyalty program has a history of business-aligned changes, rather than creative, pro-consumer changes.

As such, I doubt we'll see much in terms of creativity and the wish-list material we're reading in this thread.

My best guess based on the evolutionary history of Qantas Loyalty is what I mention in (+basic assumptions on program changes).

Add in some hype and bold statements like "biggest changes ever", and we have the hallmark signs of the Qantas PR machine.

Qantas is too predictable.

But, I'd love to be proven wrong.

Last edited:

Kiwi_Flyer

Established Member

- Joined

- Feb 6, 2018

- Posts

- 1,104

Except that, there is no full-service carrier anywhere in the world that has become more profitable by moving to full dynamic pricing.

Air NZ did.

Kiwi_Flyer

Established Member

- Joined

- Feb 6, 2018

- Posts

- 1,104

I thought DPS was a "once in a lifetime" trip

... depending on luggage, it might also be one-way.

Kiwi_Flyer

Established Member

- Joined

- Feb 6, 2018

- Posts

- 1,104

One would hope if they make changes that bookings made before the changes are announced would be grandfathered, but we will see.

Unlikely to be the case. Some tickets are valid for almost two years (first flight has to depart within a year of ticketing and last flight within a year of first flight). I'm not aware of any significant FF changes that have had a two year period after announcement before they become effective.

- Joined

- Jan 26, 2011

- Posts

- 30,164

- Qantas

- Platinum

- Virgin

- Red

That’s called not doing due diligence. Their issue entirely. What they did to Ansett was retribution.And that’s because apparently Murdoch sold it to them for a princely sum when apparentyl hadn’t maintained the assets and they paid fulsomely for distressed assets. I can’t blame em for ripping out the pearls

trippin_the_rift

Established Member

- Joined

- Apr 2, 2006

- Posts

- 4,102

Air NZ did.

Airline profitability versus Loyalty Program profitability.

NZ loyalty is increasing deferred liability by ~10% annually. It's barely over $150M.

Approx 3M members put it about the same size as Singapore Airlines/Krisflyer, and Krisflyer has around $700M deferred liability.

Air NZ = 16M pax annually.

SQ = 30M pax annually.

To me, that suggests there is either low FFP penetration or that members are being under-rewarded by fewer points being issued compared to what other airlines offer. Essentially, with fewer points being issued (cost saving for the airline), that value of points is transferred into additional profitability on airline ticket sales.

Thus, the loyalty program takes a hit to help the airline increase yield.

Also, keep in mind that Air NZ has a monopoly or JV on all basically every route. Heck, even my 3-year-old nephew could run a profitable business under those circumstances.

williamsf1

Established Member

- Joined

- Jun 1, 2010

- Posts

- 1,257

Here is one for you playing along at home .....

Looks like you can now use your QF points for Domestic Air NZ flights

Looks like you can now use your QF points for Domestic Air NZ flights

Another speculation.

Qantas will seek to make it easier to attain lounge access for one-off trips (at a substantial cash/points cost).

While the actual frequent flyers will hate it as it will mean more lounge overcrowding, the bean counters at Qantas will love it because the marginal increase in serving more people in the lounge is tiny and there are plenty of people champing at the bit to access the lounge (ie the one-overseas-trip-per-year Instagram/Facebook crowd absolutely love posting photos of them sipping sparkling wine in the lounge to the envy of their friends).

Qantas will seek to make it easier to attain lounge access for one-off trips (at a substantial cash/points cost).

While the actual frequent flyers will hate it as it will mean more lounge overcrowding, the bean counters at Qantas will love it because the marginal increase in serving more people in the lounge is tiny and there are plenty of people champing at the bit to access the lounge (ie the one-overseas-trip-per-year Instagram/Facebook crowd absolutely love posting photos of them sipping sparkling wine in the lounge to the envy of their friends).

Read our AFF credit card guides and start earning more points now.

AFF Supporters can remove this and all advertisements

Kiwi_Flyer

Established Member

- Joined

- Feb 6, 2018

- Posts

- 1,104

Airline profitability versus Loyalty Program profitability.

NZ loyalty is increasing deferred liability by ~10% annually. It's barely over $150M.

Approx 3M members put it about the same size as Singapore Airlines/Krisflyer, and Krisflyer has around $700M deferred liability.

Air NZ = 16M pax annually.

SQ = 30M pax annually.

To me, that suggests there is either low FFP penetration or that members are being under-rewarded by fewer points being issued compared to what other airlines offer. Essentially, with fewer points being issued (cost saving for the airline), that value of points is transferred into additional profitability on airline ticket sales.

Thus, the loyalty program takes a hit to help the airline increase yield.

Also, keep in mind that Air NZ has a monopoly or JV on all basically every route. Heck, even my 3-year-old nephew could run a profitable business under those circumstances.

I haven't done detailed analysis on NZ airpoints recently, but bear in mind most members are NZ-based and any-seat redemptions means points can and are spent before balances significantly accumulate. I.e. turnover of points is high compared with other programmes. In NZ you can collect airpoints for almost everything (it seems). Plus the last several years Air NZ has been aggressively pushing their online mall for redemptions, which is another way to keep balances relatively low.

Agree with you about the monopoly. Almost complete in NZ (Jetstar is limited competition), and internationally they tend to have joint ventures or other partnerships with the biggest other airline on most routes in which they don't have a monopoly. I'm continually amazed they get away with it with competition regulators.

Serious question as I've never looked at New Zealand redemptions before: this is new?Here is one for you playing along at home .....

Looks like you can now use your QF points for Domestic Air NZ flights

williamsf1

Established Member

- Joined

- Jun 1, 2010

- Posts

- 1,257

Serious question as I've never looked at New Zealand redemptions before: this is new?

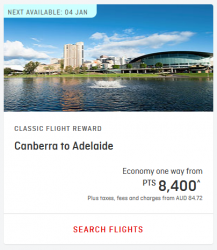

Apparently so ... you now get JQ and NZ options when searching a domestic NZ route ... eg 10000pt +$8.40 for a AKL CHC on NZ

- Joined

- Apr 16, 2018

- Posts

- 95

- Qantas

- Platinum

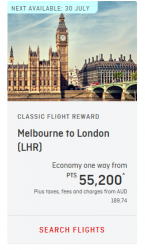

This interersting shows a lower number of pints and copayment

View attachment 171188

Usually 60000 points and $274.39 in copayment

Good find mate. Looks like we might get some of the picture before tomorrow. I wonder how the premium cabins stack up

Wanderlust_tim

Member

- Joined

- Jan 30, 2016

- Posts

- 468

This interersting shows a lower number of pints and copayment

View attachment 171188

Usually 60000 points and $274.39 in copayment

That's Interesting, where did you see this? I am curious about some other routes.

This interersting shows a lower number of pints and copayment

View attachment 171188

Usually 60000 points and $274.39 in copayment

The cat is already out of the bag. Dynamic pricing here we come.

- Joined

- Apr 16, 2018

- Posts

- 95

- Qantas

- Platinum

Usually 12000 QFFP

In fact, ADL is *annoyingly* just outside of 600 miles whereas you can fly to BNE, SYD or MEL for 8000 QFFP.

The fact that it is slightly over at 8400 QFFP makes me wonder if they are fattening the number of zones so that you pay for a distance closer to what you actually travel, rather than a more broader target of, say, 35000 QFFP for anywhere between 4801 and 5800 miles (all in Y of course).

I can't seem to get any premium fares to come up. I'll keep searching

In fact, ADL is *annoyingly* just outside of 600 miles whereas you can fly to BNE, SYD or MEL for 8000 QFFP.

The fact that it is slightly over at 8400 QFFP makes me wonder if they are fattening the number of zones so that you pay for a distance closer to what you actually travel, rather than a more broader target of, say, 35000 QFFP for anywhere between 4801 and 5800 miles (all in Y of course).

I can't seem to get any premium fares to come up. I'll keep searching

Attachments

I love to travel

Established Member

- Joined

- Jun 4, 2016

- Posts

- 3,358

- Qantas

- Silver Club

Their website looks ver different for me tonight

- Status

- Not open for further replies.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- RB001

- burmans

- Aeryn

- mccaffd

- TomVexille

- Noah Count

- ox power

- flightsonpoints

- Pete98765432

- bernardblack

- swellington

- MELso

- OZDUCK

- burneracc

- Black Duck

- GrahamBRI

- markis10

- nthd_nthd

- dajop

- ShelleyB

- ThomasIsaksson

- (Mike)

- Basaka

- ThatMrBlake

- JessicaTam

- WilsonM

- adsta

- Warks

- jrfsp

- daft009

- Human

- jase05

- vhojm

- There'sOnlyOneJimmy

- Pvcmenace

- GarrettM

- moa999

- Harrison_133

- somebol

- Zinger

- tgh

- MEL_Traveller

- Daver6

- nige_perth

- Saramartin123

Total: 1,231 (members: 61, guests: 1,170)