kangarooflyer88

Established Member

- Joined

- May 29, 2021

- Posts

- 4,404

- Qantas

- Gold

- Virgin

- Silver

- Oneworld

- Sapphire

- Star Alliance

- Gold

An interesting report was just released from market research firm Idea Works Company which investigated ancillary revenue made by airlines globally. For those unaware ancillary revenue means revenue generated for services aside from that base ticket purchase. For instance, seat selection or baggage fees are classic examples of such sources of ancillary revenue. Ancillary revenue is the bread and butter of so called low cost carriers (LCCs) like Spirit Airways or EasyJet who charge a low base fee to lure passengers into booking the flight with them (i.e. LHR to Europe for £10 one way is not uncommon) but then charge for literally anything else you could want such as carry on bags, seat selection, drinks and meals, etc.

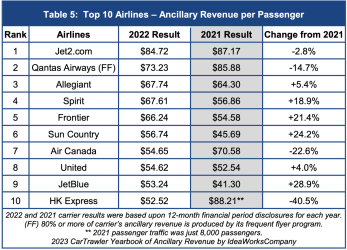

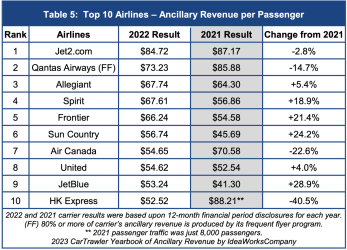

Although the report provides a fascinating look at airline revenues and how they performed and recovered before/during/after the pandemic, there are a couple of gems in this report that I think are very pertinent to Qantas specifically. In particular, Table 5 of the report investigates how much ancillary revenue airlines make on a per passenger basis, and could you believe it Qantas is number 2, just behind the legendary luxury leisure provider Jet2:

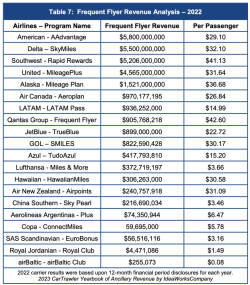

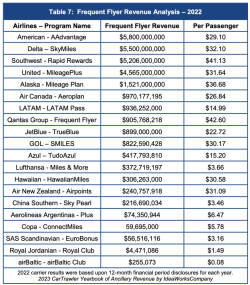

There were also a couple of gems reported about their frequent flyer program, namely that QFF is amongst the top frequent flyer programs in the world in terms of revenue generated. In particular, their frequent flyer program generates the most revenue on a per passenger basis, which suggests that Qantas could benefit in expanding eligibility to join QFF to people outside Australia. Note: I know people on this forum will rightly say that you can join QFF anywhere in the world. Whilst that is absolutely true, I would challenge them to tell me how one could actually earn QFF points if you are not based in Oceania, particularly from shopping activities.

Some more data points from the report related to QFF that might be worthy of discussion:

Although the report provides a fascinating look at airline revenues and how they performed and recovered before/during/after the pandemic, there are a couple of gems in this report that I think are very pertinent to Qantas specifically. In particular, Table 5 of the report investigates how much ancillary revenue airlines make on a per passenger basis, and could you believe it Qantas is number 2, just behind the legendary luxury leisure provider Jet2:

There were also a couple of gems reported about their frequent flyer program, namely that QFF is amongst the top frequent flyer programs in the world in terms of revenue generated. In particular, their frequent flyer program generates the most revenue on a per passenger basis, which suggests that Qantas could benefit in expanding eligibility to join QFF to people outside Australia. Note: I know people on this forum will rightly say that you can join QFF anywhere in the world. Whilst that is absolutely true, I would challenge them to tell me how one could actually earn QFF points if you are not based in Oceania, particularly from shopping activities.

Some more data points from the report related to QFF that might be worthy of discussion:

- 6% of QFF members hold elite status with the airline (likely substantially smaller than anyone on this forum would predict)

- Last year 66% of members accrued miles from flying (with it being the top category for accrual) whereas credit cards, financial services and insurance only accounting for 44% of members and 44% of members accruing points through loyalty partners (i.e. EveryDayRewards)