You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Qantas Premier Credit Card

- Thread starter flapper

- Start date

GSP

Established Member

- Joined

- Jun 17, 2016

- Posts

- 1,429

Are points earn on this card calculated per transaction (like Amex) or per statement (like NAB)?

Per statement rounded down is my experience. That was the case on the latest statement. I'll check previous ones at some point.

GSP

Established Member

- Joined

- Jun 17, 2016

- Posts

- 1,429

I called up yesterday (pretty quick to get through tbh) - They said there was a delay in Sept bonus points, but all had been fixed in October and both month's bonus points will credit in Oct statement.

Plus, they said they'd give me 2000 bonus points "for the trouble".

Let's see what happens at the end of the month when my statement comes through...

I've just been credited with 2 sets of monthly bonus points (only one transaction), so up to date now.

teamhamsandwich

Member

- Joined

- Feb 26, 2014

- Posts

- 329

I've just been credited with 2 sets of monthly bonus points (only one transaction), so up to date now.

I also did. Now up to date.

Foreigner

Established Member

- Joined

- Mar 29, 2006

- Posts

- 4,412

- Qantas

- Platinum

Applied on Wed, two calls later and uploading supporting docs, saw approval via link given. 100k points, 75 SCs, introductory rate... expecting card in seven days

(It helped the cause by reducing my limit on Citi Prestige)

(It helped the cause by reducing my limit on Citi Prestige)

GSP

Established Member

- Joined

- Jun 17, 2016

- Posts

- 1,429

(It helped the cause by reducing my limit on Citi Prestige)

How was that quantified, was it mentioned on the calls you had? i.e Was Citi fishing around for your credit limits (which they have access too). Not sure if you have other CC's, but it would be interesting to know if you did and reduced your limit on those if the outcome would have been different.

Foreigner

Established Member

- Joined

- Mar 29, 2006

- Posts

- 4,412

- Qantas

- Platinum

How was that quantified, was it mentioned on the calls you had? i.e Was Citi fishing around for your credit limits (which they have access too). Not sure if you have other CC's, but it would be interesting to know if you did and reduced your limit on those if the outcome would have been different.

No, simpler than that.I logged to my Citi account and reduced the limit by $40k then two days later I applied for the QF Premier card. I reckon it was easier for me as both cards are issued by Citi

- Joined

- Aug 27, 2004

- Posts

- 17,611

- Qantas

- LT Gold

- Virgin

- Red

Is anyone willing to guess if the current 100K point, 75 SC and reduced first year fee will be extended beyond 30 November? I am considering this card as a replacement for my ANZ Black card which has a higher annual fee and up to $7500 1:1 points per month ($10,000 1:1 point for this card). But my ANZ annual fee is not due until April I would prefer to hold off a little if the offers are likely to extend - or get better.

- Joined

- Apr 1, 2009

- Posts

- 19,173

- Qantas

- LT Gold

- Oneworld

- Sapphire

I am in the same boat as you, waiting until March 2021 so the 75SC can go to my new membership year, along with the bonus 600SC Qantas will be providing, should make a great start to keeping Platinum.Is anyone willing to guess if the current 100K point, 75 SC and reduced first year fee will be extended beyond 30 November? I am considering this card as a replacement for my ANZ Black card which has a higher annual fee and up to $7500 1:1 points per month ($10,000 1:1 point for this card). But my ANZ annual fee is not due until April I would prefer to hold off a little if the offers are likely to extend - or get better.

My other card is a NAB Platinum at less than 1 point/$, but as a grandfathered NAB shareholder the card is free, so it's not the end of the world if I can't find something better

- Joined

- Aug 27, 2004

- Posts

- 17,611

- Qantas

- LT Gold

- Virgin

- Red

The SCs are of minor concern to me - I have LT Gold status and not perusing LT Plat and not going to get close to attaining Plat this membership year.I am in the same boat as you, waiting until March 2021 so the 75SC can go to my new membership year, along with the bonus 600SC Qantas will be providing, should make a great start to keeping Platinum.

My other card is a NAB Platinum at less than 1 point/$, but as a grandfathered NAB shareholder the card is free, so it's not the end of the world if I can't find something better

But with potential changes to my employment on the horizon in the near future, applying sooner rather than later may expedite approval. So the trade-off for me to to delay little, but not too long. Want to apply under current employment conditions, but want to delay paying a second annual fee as far as I think I can before potential changes take place, which may be with short notice/lead time.

got charged an int. transaction fee from a purchase made in aud online. its an international vendor.. i disputed. but QM said its legit and a mastercard charge. they either offered reversal or 500 QPs. I said it wasn't the same thing. but happy to take both given the extended gesture, they just reversed the fee no points

- Joined

- Aug 27, 2004

- Posts

- 17,611

- Qantas

- LT Gold

- Virgin

- Red

Looks like this offer (100K QFF point + 75 SC plus reduced annual fee for first year) has been extended until 24th Feb 2021. So perfect for me.Is anyone willing to guess if the current 100K point, 75 SC and reduced first year fee will be extended beyond 30 November? I am considering this card as a replacement for my ANZ Black card which has a higher annual fee and up to $7500 1:1 points per month ($10,000 1:1 point for this card). But my ANZ annual fee is not due until April I would prefer to hold off a little if the offers are likely to extend - or get better.

I have a spend of around $12k coming up this month which would have been nice and easy to make the initial spend requirement, but will not have may problems meeting it Feb/March anyway.

- Joined

- Aug 27, 2004

- Posts

- 17,611

- Qantas

- LT Gold

- Virgin

- Red

According to the published terms and conditions:I did minimum spend and received 100k bonus points but not status credit.

any Idea how long i have to wait for 75 Status credit ?

Bonus Status Credits will be credited to your Qantas Frequent Flyer Membership Account within 6 - 8 weeks of making your first eligible purchase.

Qantas Premier Platinum Credit Cards | Qantas Money

The Qantas Premier Platinum Credit Card is packed with travel benefits and much more for Qantas Frequent Flyer members. Apply today.

Thinking of applying for this one. How long are Citi typically taking to credit bonus points on this card these days? Realise terms say 6-8 weeks after meeting spend criteria which is fine, just wondering whether it will likely require follow up.

Well I did end up applying. Process was pretty painless and the card was approved and dispatched quickly. Made the min spend on the first day and have just received the 1st statement with 100k bonus points awarded and now in my QFF account.

Couldn’t be happier. Well perhaps not entirely true. Oddly, the base points for $4k I spent have not appeared on the statement or in my account. So I have 100k pts bonus but nothing else. Don’t know if I could be bothered pursuing it as I’m pretty happy to be in and out of a Citi product in less than a month

Last edited:

teamhamsandwich

Member

- Joined

- Feb 26, 2014

- Posts

- 329

And I'm due another 20K bonus points this month and....... nothing. Jeez these guys suck.I also did. Now up to date.

- Joined

- Dec 31, 2011

- Posts

- 10,877

- Qantas

- Platinum

- Virgin

- Gold

Dr Ralph

Enthusiast

- Joined

- Jan 21, 2014

- Posts

- 13,355

- Qantas

- Bronze

- Virgin

- Red

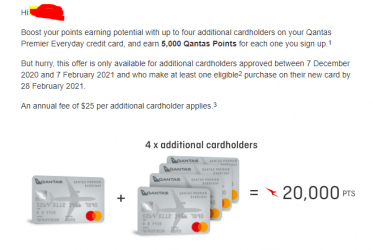

Citibank has exclusion periods?Not feeling paying an additional card holder fee despite the bonus. Just waiting for the exclusion period to pass despite having the best Qantas earn rate out there apart from Amex cards.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- AndrewCowley

- Flying Fox

- skyhigh_

- cgichard

- cjd600

- QF WP

- simmomelb

- Dudditz

- madman2020

- SYD

- Cottman

- Flyfrequently

- asterix

- Denali

- NM

- MEL_Traveller

- kearvaigskewer

- Warks

- MissJacksx

- Dmac59

- ALEX LANGTON

- axkhanna1

- p--and--t

- Fergo747

- Rayesfeg

- TheDefenestrator

- trisreed

- Bagpuss

- Lynda2475

- justinbrett

- Jay684

- mouseman99

- tassie6

- Hunter4vr

- djkelly69

- bernardblack

- GDSman

- billmurray

- timmy1234

- blackcat20

- anat0l

- Marsonline

- opusman

- KIZI

- Mattg

- accompanimince

- Rich

- smithj217

- Tiki

- jase05

Total: 255 (members: 71, guests: 184)